Scottish Mortgage is one of the most popular investment trusts and regularly features on best-buy lists, but its tech-heavy portfolio of growth stocks has been hit savagely by the recent market sell-off.

Stifel research analysts Iain Scouller and William Crighton said on 8 April that the trust’s share price had fallen 30% from its recent peak of £11.32 in mid-February.

“We would continue to be cautious around the funds with high growth/tech weightings such as JPMorgan Global Growth & Income and Scottish Mortgage,” they added.

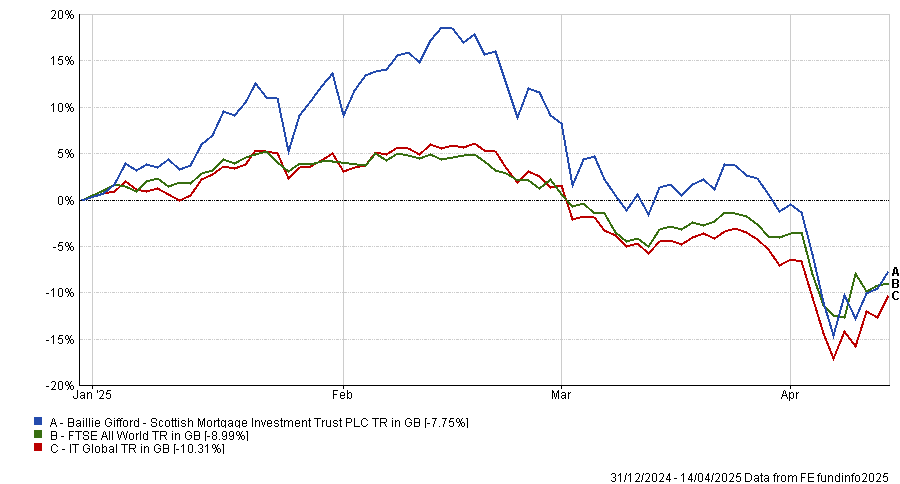

Investors in Scottish Mortgage would have made a 7.8% year-to-date loss as of 14 April 2025, although that is less than the FTSE All World index and the IT Global sector’s losses of 9% and 10.3%, respectively, as the chart below shows.

Performance of trust vs sector and benchmark, year to date

Source: FE Analytics

Yet the stock market downturn is a double-edged sword because it has caused the discounts of many investment trusts to widen to attractive levels.

Scottish Mortgage’s discount has come in a long way since its nadir of 22.8% in 2023, not least due to a £1bn share buyback programme, but it still stood at 9.6% as of 14 April 2025. This could represent a buying opportunity for investors with a high risk appetite and long time horizon, experts said.

Why is Scottish Mortgage so popular?

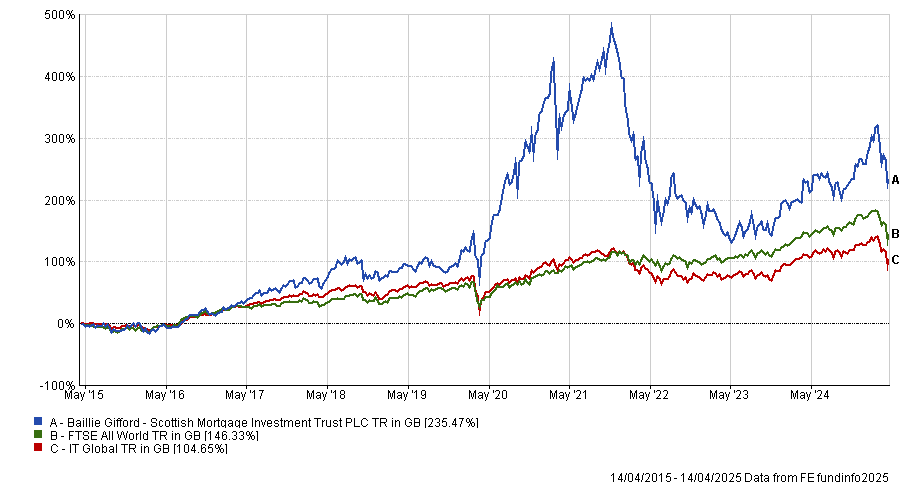

The trust has an impressive long-term track record and is the best performer in the IT Growth sector over 10 years, which goes part way to explaining its enduring popularity.

It is middle of the road within its sector over five years, however, and the third-worst trust over three years – a difficult period for Baillie Gifford’s growth style of investing. Yet it has bounced back to become the third-best trust in its sector over 12 months to 11 April 2025.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Josef Licsauer, investment trust research analyst at Kepler Partners, said: “Given performance challenges in recent years, Scottish Mortgage continues to divide opinion, but there could be good reasons for long-term investors to take a closer look.

“The trust offers exposure to some of the world’s most innovative, high-growth and disruptive companies along with low-cost access to private businesses that are otherwise difficult for most investors to reach. Scottish Mortgage’s high-conviction, benchmark-agnostic portfolio distinguishes it from others in the sector, offering genuine diversification potential.”

A perfect fit for a Junior ISA

Given its mix of tech stocks, growth companies and unquoted investments, the trust is viewed by several fund selectors as more appropriate for investors with a high risk tolerance and/or a long time horizon, such as children’s Junior ISAs.

Rob Morgan, chief investment analyst at Charles Stanley, said: “An aggressive growth strategy can be appropriate for at least part of a JISA portfolio. Scottish Mortgage stands out for this, especially following recent turbulence, which has seen a setback in the share price. It offers investors a portfolio of the most exciting technology and growth companies worldwide.”

Victoria Clapham, investment manager at Manorbridge Investment Management, also suggested Scottish Mortgage for JISAs. “Whilst it contains the large US technology names, its tech exposure is not solely focused on the US, with holdings also in TSMC and ByteDance. China’s competitiveness in areas such as artificial intelligence (AI) is something I feel a young investor would benefit from having exposure to,” she said.

Scottish Mortgage is on Deutsche Numis’ recommended list for global developed equity trusts, alongside AVI Global and Caledonia. Analysts Gavin Trodd, Ewan Lovett-Turner and Ash Nandi chose Scottish Mortgage for its “unique approach to investing in transformational growth companies, outstanding long-term track record, liquidity and positive portfolio outlook”.

“In addition, the board has demonstrated its commitment to managing the discount, with buybacks exceeding £1.7bn since March 2024,” they said. “In our view, the discount of 10% offers an excellent entry point for an innovative, differentiated portfolio (88% active share) of growth companies, with the discount supported by an extensive buyback programme.”

In what environments does the trust flourish and struggle?

The trust typically thrives when interest rates are low, inflation is subdued and markets reward innovation, Licsauer said. “Think 2020, when low rates and booming tech demand saw Scottish Mortgage soar.”

Conversely, the trust’s growth bias contributed to periods of underperformance in 2021 and 2022, as more cyclically sensitive and lower-quality stocks gained traction.

“Those years favoured value-oriented sectors like financials – areas where Scottish Mortgage has limited exposure – amid a backdrop of surging inflation and rising interest rates. These macro headwinds were compounded by a slowdown in the IPO market, which weighed on the trust’s private company holdings,” the Kepler analyst explained.

“Ahead of the market pullback following ‘Liberation Day’, Scottish Mortgage’s performance had begun to improve, buoyed by contributions from several key names such as MercadoLibre, TSMC and Spotify. There have also been encouraging signs from the private portfolio, with many holdings now cashflow positive, and others – such as Tempus AI – listing successfully.”

The current backdrop, with persistently high interest rates and uncertainty around tariffs and trade wars, could continue to test the trust’s growth-focused style, Licsauer noted. Yet if there is a shift back towards growth or a rotation in market leadership, the trust could rally once more, he added.

Have the managers learned from their past mistakes?

Analysts at Deutsche Numis think the trust’s managers – Lawrence Burns and FE fundinfo Alpha Manager Tom Slater – have “learned healthy lessons” from their performance challenges during 2021 and 2022. This was evidenced by their decision to take profits in Nvidia, reducing their stake by 73% since January 2023.

“We believe that this shows strong capital discipline, with the managers locking in profits following a strong run – something that many growth investors, including Scottish Mortgage, faced criticism for not doing when investor sentiment turned in early 2022,” the analysts said.

“Nvidia remains in the portfolio (3% in January) and has been a highly profitable position given Scottish Mortgage first invested in July 2016 (the shares have risen by more than 8,000% since).”

What about the private holdings?

Trodd, Lovett-Turner and Nandi believe the trust’s private portfolio has a compelling outlook. It owns five of the top 10 unicorns globally (SpaceX, ByteDance, Stripe, Databricks and Epic Games) and 71% of the private portfolio by weight is cash generative.

The trust has a strong track record of liquidity events, they continued. “Of the trust’s 97 private investments, 47 have been subject to a transaction (39 IPOs, eight mergers and acquisitions, one liquidation), which we believe is an excellent testament to the quality of private companies held, particularly given the challenging market backdrop in recent years. We note press reports that Databricks, Stripe and Brandtech have been considering IPOs over the mid-term.”

Is the trust risky?

Scottish Mortgage is not for the faint-hearted. Some of the trust’s unquoted holdings have faced significant challenges and Northvolt went bankrupt, Licsauer said. “In our view, this trust is best suited to patient investors who can tolerate volatility and look beyond short-term noise.”

Morgan agreed. “There can be a high failure rate when backing high-growth companies and at times a good deal of optimism can be factored into the share prices. This means any disappointing news can be severely punished, especially in a market downturn,” he explained.

“In addition, there is gearing (borrowing to invest) within the trust, which serves to exacerbate the price movements of an already-adventurous portfolio. But for those happy to take a very long-term perspective and ride out significant short-term volatility, it could be a great buy and lock away investment.”