Mid-cap stocks could be an attractive destination for investors hoping to avoid the worst of the market’s volatility despite underperforming their larger peers for several years, research by Aberdeen suggests.

Analysis by the fund management house suggests a combination of historically low valuations, diversification benefits, an attractive risk/return balance and strong long-term performance has put mid-caps in a “sweet spot” during uncertain markets.

Recent years have seen investors flock to large-caps, as lacklustre economic growth dampened sentiment towards companies further down the market capitalisation spectrum. In addition, some of the strongest stocks in recent years have been larger companies, such as the Magnificent Seven tech mega-caps.

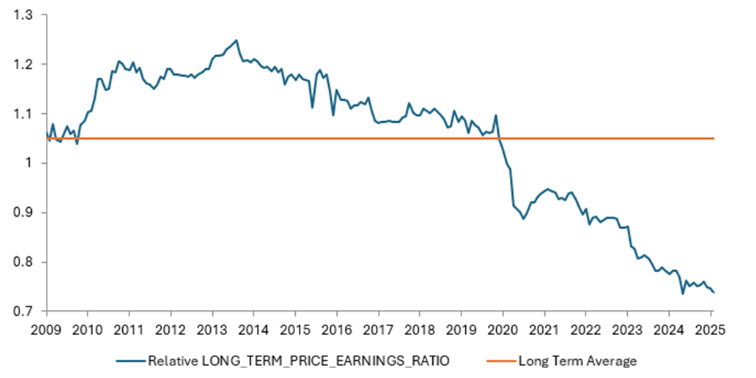

Valuations of mid-caps vs large-caps

Source: Aberdeen, Bloomberg, to 31 Mar 2025

FE Analytics shows the MSCI World Mid Cap index has made a total return of 61.8% versus a gain of 84.4% from the MSCI World Large Cap over five years to 7 May in sterling terms.

But analysts at Aberdeen used data going back to 2009 and found medium-sized companies are currently trading at their lowest valuations on record compared with large firms, as the chart above shows.

This is despite the fact that they have generated higher returns than large-caps over the past 25 years and offer diversification benefits for investors cautious about the outlook for US stocks. While 73% of the MSCI World Large Cap index is in US stocks, just 60% of the mid-cap index is allocated there.

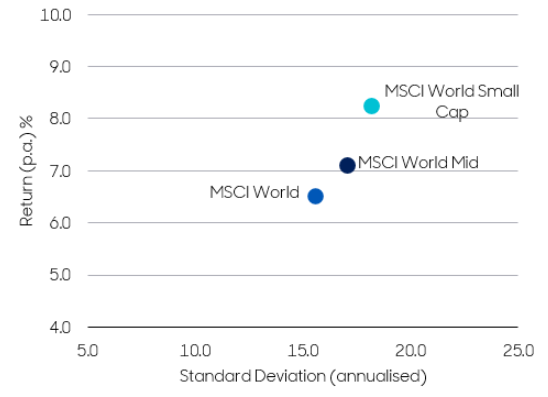

What’s more, the average volatility of the MSCI World Mid-Cap index was lower than for global small-caps, adding support to Aberdeen’s view that global mid-caps sit in a “sweet spot” in the current market uncertainty.

Risk vs return of global indices over 25yrs

Source: Aberdeen, Morningstar, 27 Apr 2025. Average over 25 years, in US dollars

Anjli Shah, manager of the abrdn SICAV I Global Mid Cap Equity fund, said: “Globally mid-caps have long been overlooked and under-loved by investors. Still today there are only a handful of global funds that focus exclusively on this part of the market. But, considering the diversification benefits they offer, now may be the time for investors to consider introducing a specific allocation to mid-caps into their portfolios.

“For companies to have made it from small to mid-cap, they tend to have established and resilient business models while remaining nimble. Thus, mid-caps can potentially offer lower levels of risk than small-caps.

“Despite these attractive characteristics, market inefficiencies still exist. Mid-caps are often under-researched and under-covered versus large-caps. These market inefficiencies present an opportunity for us to find hidden gems. Investors buying in currently would be investing at a time of record low valuations relative to large-caps – which could be an attractive entry point.”

Trustnet looked at 26 dedicated mid-cap funds in the Investment Association universe with at least five years of track record and found that none have achieved top-quartile returns over the past half-decade.

Only one is in the second quartile (Schroder UK Mid 250, which is in the IA UK All Companies sector). There are 17 in their sector’s third quartile and eight in the bottom quartile.

However, there has been an uptick in relative performance over the past month, after investors sold out of expensive US mega-caps in the wake of president Donald Trump’s Liberation Day trade tariffs.

In April, 19 of the 29 mid-cap funds with a long enough track record were in the top quartile of their respective sector, with three in the second quartile and one in the third quartile. Just six made bottom quartile returns.

Among the first-quartile funds over one month are abrdn UK Mid Cap Equity, Jupiter UK Mid Cap, Schroder UK Mid 250, iShares EURO STOXX Mid UCITS ETF and abrdn SICAV I Global Mid Cap Equity. It should be kept in mind that a month is a very short period to examine performance.

The IA UK All Companies sector is the peer group with the most dedicated mid-cap funds – 14 of the 29 we looked at reside in this sector. What’s more 13 of them are in the top quartile over the past month, while the remaining fund (Royal London UK Mid-Cap Growth) is in the second quartile.

Rebecca Maclean, co-manager of the Dunedin Income Growth Investment Trust, is among the managers who think the UK is a particularly attractive destination for mid-cap investors.

“We see numerous compelling opportunities among UK mid-caps for long-term investors. Recent market turmoil and slowing global growth have renewed investor attention on the UK mid-cap sector, which offers superior earnings growth, a stronger domestic focus and a persistent valuation gap relative to large caps,” she argued.

She added that UK mid-caps have distinct advantages over the FTSE 100. Some 50% of FTSE 250 revenues come from the UK, whereas around four-fifths of large-caps’ revenues are international, making mid-caps more closely aligned with domestic economic trends.

Meanwhile, the UK mid-cap index has historically delivered stronger long-term earnings growth than the FTSE 100, with projections suggesting this trend will continue going forward.

“Crucially for long-term investors, UK equities remain undervalued and this is particularly evident in the mid-cap segment,” Maclean finished.

“The UK market is currently trading 20% below its long-term average price-to-earnings (P/E) ratio while the FTSE 250 is at a 20-year low in P/E discount relative to the FTSE 100.”