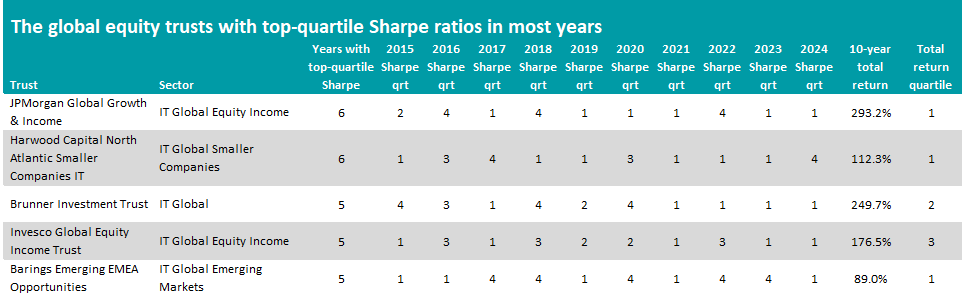

JPMorgan Global Growth & Income and Brunner Investment Trust are some of the global investment trusts with some of the highest Sharpe ratios of their sectors over the past decade, Trustnet research shows.

The Sharpe ratio – which calculates the excess return earned per unit of volatility – can be used by investors to assess whether an investment’s returns are worth the level of risk. A higher Sharpe ratio means an investment has a higher return for each unit of risk.

In this article, Trustnet examines the IT Global, IT Global Equity Income and IT Global Emerging Markets sectors for investment trusts that have made a top-quartile Sharpe ratio in at least five of the full calendar years of the past decade.

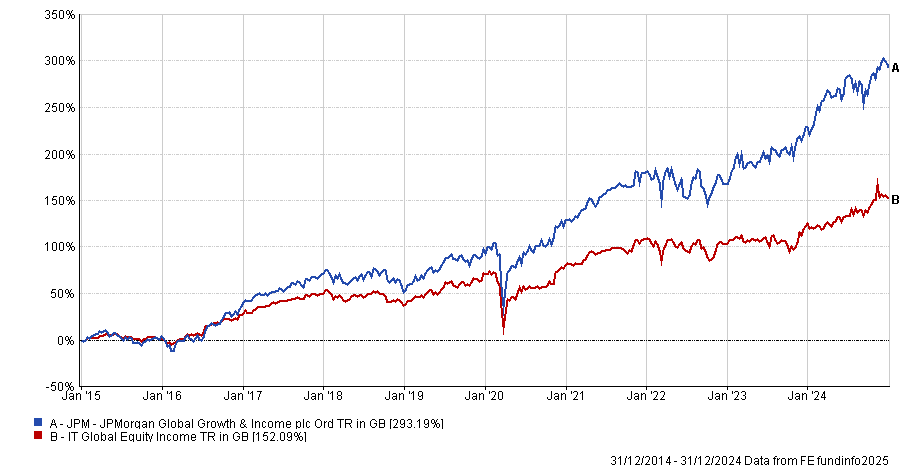

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024.

JPMorgan Global Growth & Income is at the top of the table as it has generated a first-quartile Sharpe ratio in six of the past 10 full calendar years. It also made a 293.2% total return over this time, putting it in the top quartile of the IT Global Equity Income sector.

Managed by Helge Skibeli, Timothy Woodhouse and James Cook, the trust is designed to be a core holding that provides exposure to companies with superior quality of earnings and faster growth, without being expensive.

At present, the portfolio is split between ‘high-growth cyclicals’, such as tech stocks with exposure to the artificial intelligence theme, and ‘low-growth defensives’, which includes overlooked areas such as defensive infrastructure, healthcare and defensive consumer.

Analysts at Kepler said: “In our view, JPMorgan Global Growth & Income’s outperformance of its benchmark, the MSCI ACWI index, in every calendar year since 2019 is particularly impressive, given the varying market environments over this period.

“We think it is worth noting that this outperformance was driven by stock selection rather than sector or country allocation, highlighting the managers’ stock-picking skills.”

Performance of JPMorgan Global Growth & Income vs sector over 10yrs to end of 2024

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024.

JPMorgan Global Growth & Income has absorbed three investment trusts since 2022 and is expected to combine with Henderson International Income Trust in July 2025. The managers and strategy will remain unchanged.

Harwood Capital's North Atlantic Smaller Companies is the only other trust to make a top-quartile Sharpe ratio in six of the past 10 full calendar years. This came with a total return of 112.3% over the decade in question.

It resides in the IT Global Smaller Companies sector but, as its name suggests, invests in businesses based in countries bordering the North Atlantic Ocean.

Manager Christopher Mills can invest in both quoted and unquoted companies, with the sustainability and growth of long-term cash flow being key considerations for any investment.

Last month, Mills said: “The trust has for a number of years maintained substantial cash balances. However, given the collapse in the value of UK equities due to mass redemptions and the panic that is spreading across equity markets courtesy of president Trump, I believe now is the right time to start to deploy our liquidity into companies where we either understand the financial impact of a potential global trade war or where there is little or no impact.

“Obviously, calling a bottom in markets is never easy and we will cautiously deploy our liquid reserves.”

Brunner Investment Trust is in third place with a top-quartile Sharpe ratio in five of the 10 years and a first-quartile total return of 249.7%. Residing in the IT Global sector, it is managed by Allianz’s Christian Schneider.

The trust aims to “thrive in all market conditions” by balancing quality, value and growth when seeking best-in-class businesses. Key to the approach is buying and selling at the right valuations; the management team try to invest before a stock reaches its full potential but sell before it looks overdone.

Kepler said: “Brunner looks well placed to navigate varying market environments, thanks to its strategy of balancing quality, growth and value factors, resulting in a versatile portfolio.

“This adaptability is underpinned by a strong track record, with Brunner being one of the best-performing strategies in the AIC Global sector over the past five years.”

Analysts added that this strong performance is not solely down to the diversification across factors, as stocks added in the past 12 months have been strong contributors and also demonstrate successful stock selection.

Invesco Global Equity Income is the only other trust on the shortlist to make a return of more than 150% over the 10 years examined in this research.

Managers Stephen Anness and Joe Dowling invest in high-quality companies trading at attractive valuations and often buy them following a period of weakness.

They also divide the portfolio into three buckets: companies that can grow their dividend over time, those with low yields but strong growth potential and those with short-term challenges but a chance to restore their dividend.

In a recent update, the managers highlighted how they attempt to build an ‘all-weather’ portfolio, rather than one that bets on specific economic or market outcomes.

“We choose not to second guess these outcomes, rather focusing our time and energy on building a diversified portfolio of high-quality businesses, trading at attractive valuations from the bottom-up,” they said.

“Diversification is key in this market as we can’t rely on one definitive economic outcome. We will continue to work through the economic implications at an individual business level, but with the focus entirely on building a robust portfolio that can perform through different environments.”