A truly innovative company is not necessarily the one making the most noise or sending shockwaves through markets.

Dr Ian Mortimer, co-manager of Guinness Global Innovators, believes tomorrow’s winners can be found at the margins – not in the headlines – in quality companies that are quietly and sustainably compounding returns.

The $1.5bn fund comprises a high conviction 30-stock portfolio which Mortimer said “is a cumulation of our best ideas”.

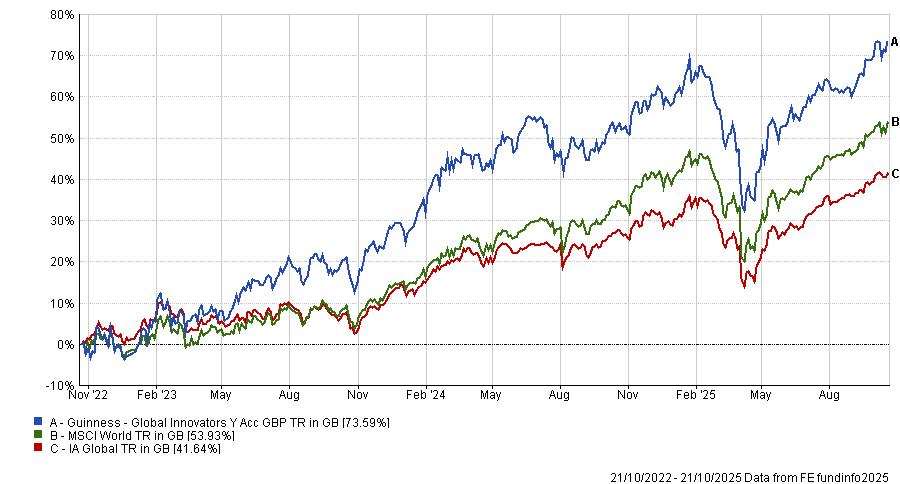

Performance of the fund vs sector and benchmark over 3yrs

Source: FE Analytics

It is in the second quartile in its sector for returns over one year, gaining 13.1%, but first quartile over three, five and 10 years – delivering a 335.8% return over the decade.

Below, Mortimer explains how they look to capture innovation and how using historical growth to find future growth does not work.

What is your process for the fund?

There is no magic formula that will tell you with a high probability that a company will grow its earnings faster than the market – using historical growth to find future growth does not work.

We first look at a selection of secular growth themes. In 2025, that might be something like artificial intelligence or advanced healthcare. We then identify companies that have exposures to those themes.

The risk of taking a purely thematic approach, however, is that you don’t necessarily buy good companies.

This means that we apply a quality cut-off, only looking at companies that have a demonstrable return on capital, good balance sheets and strong earnings. For this reason, we prefer more mature companies over early stage.

But you also don’t want to pay too much for future growth, given that the future is uncertain. We try to have some valuation discipline to minimise the risk of buying a company where growth disappoints and there is a big de-rating you can’t get back.

The key is to find good businesses that have shown ability to allocate capital well and have exposure to some of these expected high-growth areas. If it does well, then that will benefit the portfolio’s performance, but if it doesn’t, then there is still a backstop based on what the rest of the business looks like and how it is working.

How do you define an innovative company?

For us, looking for innovation is about applying more of a quasi-quality lens. Being innovative doesn’t necessarily mean that a company has designed a game-changing widget or is highly disruptive in the market.

But the market at large can be quite focused on, and distracted by, the big winners that completely change the landscape and take all the market share in those early stages of innovation.

You could take an approach where you buy 10 companies that fit this profile – some might go bust, some might languish in the middle and one or two might shoot the lights out. In that scenario, the overall return on investment probably looks good, but this is a volatile way of going about it.

We want to improve our chances of a good return while decreasing the chances of a bad return, so we are not picking the most obvious company.

Where are you finding opportunities?

Looking for innovation doesn’t mean the fund has to be purely invested in tech companies, although there are undeniably a lot of opportunities within the information technology (IT) sector.

We have historically had around 40% to 50% in the IT sector, with the remainder in non-IT companies. But we also find good opportunities in financials, industrials and consumer discretionary stocks. We generally have low exposure to commodity-focused companies like materials, energy, regulated utilities and REITs.

Within the IT sector, the semiconductor space especially looks much more attractive as there has been a change in the dynamic of the sector – moving away from being cyclical as we see more drivers for demand, such as data centres and chips.

What was your best call over the past 12 months?

It has been pleasing to see that our best-performing company isn’t necessarily the one you might have heard of, which encapsulates what the portfolio is all about.

Our best performer was Amphenol – a US-based company that makes interconnects and fibre optic cables. The company is especially benefiting from the build out of data centres.

We bought it in June 2021 at 3.3% of the portfolio. It is currently 3.6% of the portfolio as of 30 September, with the share price increasing by 260% (in dollar terms) during ownership.

In the 12 months from 22 October 2024, Amphenol contributed 3% in dollar terms to the portfolio.

What was your worst call over the past 12 months?

Danish pharmaceutical business Novo Nordisk was the biggest detractor. The fund purchased the company in Aug 2023, initiated at 3.3%. The share price fell by 41% in dollar terms during ownership.

At the end of last year, Novo Nordisk had a disappointing drugs trial for a weight loss drug which was going to compete with Eli Lilly. The market was expecting an efficacy of 25% weight loss plus but it came out nearer 23% – less than Eli Lilly’s offering. The market took this extremely negatively.

We felt this was a bit overdone, frankly, because we still felt the pie was quite big – even if Novo Nordisk was going to end up with a slightly smaller slice.

As we went through the rest of 2025, we saw a more negative share price performance, which continued when it changed CEO and pre-announced second quarter results. We decided to sell in July.

What do you do outside of fund management?

I have a young family, with a son and a daughter both under the age of six, which keeps me busy. Otherwise, I like sport and try to play tennis when I can – or do some sea swimming when it is not too cold, although my wife is a much hardier sea swimmer than I am.