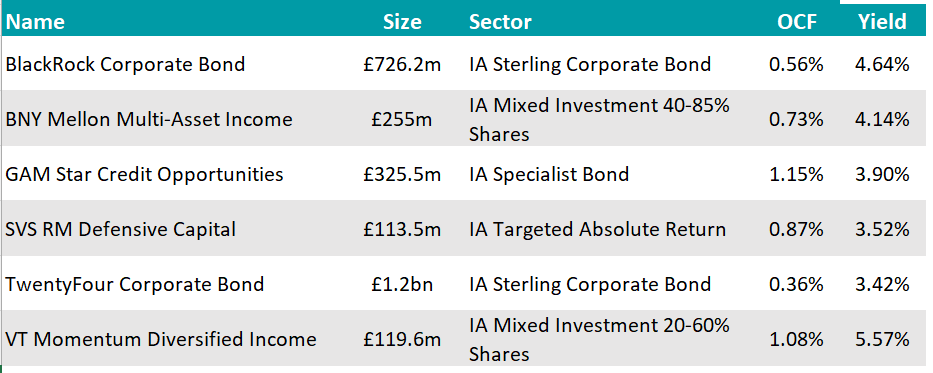

Excitement has its place in investing but perhaps not when markets are as unpredictable as they are today. With wars ongoing, chaotic tariff policies and artificial intelligence (AI) upending industries, many investors are ditching risk in favour of reliability.

“Appetite is growing for boring, predictable funds that can weather the storm,” said Darius McDermott, managing director at Chelsea Financial Services. “They are not built to shoot the lights out – their goal is to deliver consistent, incremental returns.”

For defensive investors and for those that have an investment horizon of five years or less, McDermott believes a carefully constructed, lower-volatility portfolio is the answer. Below, he put one together that can serve as an example, focusing on multi-asset, absolute return and fixed income strategies designed to smooth the ride through market turmoil.

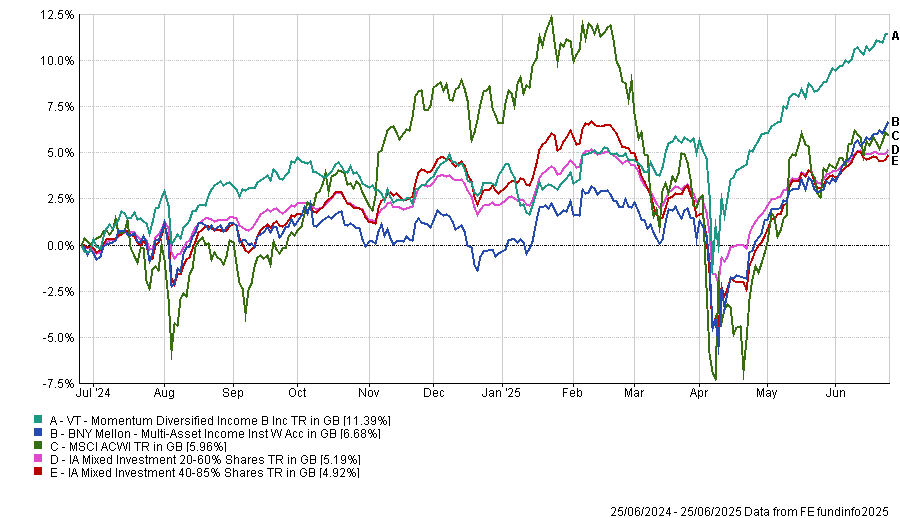

His first port of call was multi-asset funds that “bring genuine diversification”, such as BNY Mellon Multi-Asset Income and VT Momentum Diversified Income – a split of the two should make up 40% of the portfolio.

Performance of fund against index and sector over 1yr

Source: FE Analytics

The BNY Mellon strategy draws on Newton’s global research to deliver “a stable and growing income” alongside long-term capital growth.

The managing team (with Paul Flood as lead manager and Bhavin Shah as deputy) invests without any benchmark restrictions and are rated by RSMR and Square Mile analysts.

McDermott highlighted the fund’s strong performance record since its launch in 2015 – to today, the fund has outperformed the IA Mixed Investment 40-85% Shares sector average by 24 percentage points.

VT Momentum Diversified Income is also a “well-diversified” global fund focussing on income though a “common-sense approach that has helped it deliver better returns and lower volatility relative to peers”, according to the fund picker.

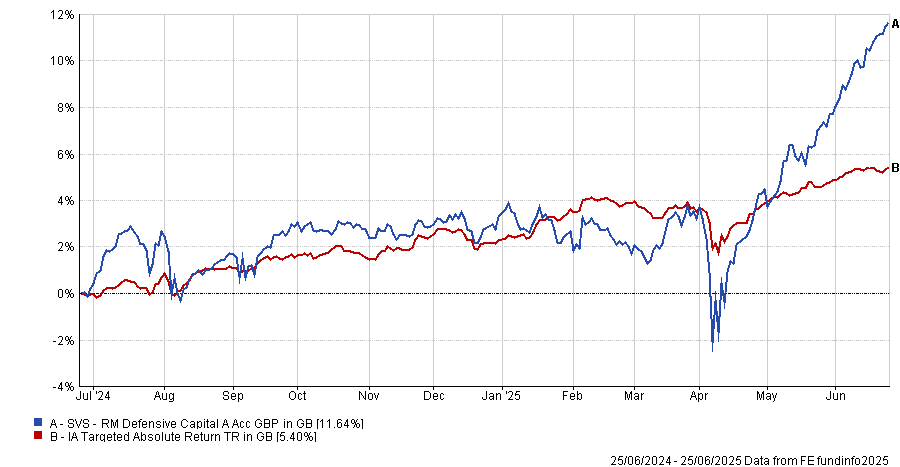

Next up was absolute return, which was given 15% of the overall allocation. Here, the choice was SVS RM Defensive Capital, an all-weather strategy with a focus on lower volatility and minimising downside risk.

Performance of fund against index and sector over 1yr

Source: FE Analytics

Managed by Niall O’Connor, the portfolio combines bonds, equities and commodities and tends to have a value bias by avoiding expensive areas of the market, which makes it “another dull but more predictable option,” according to McDermott.

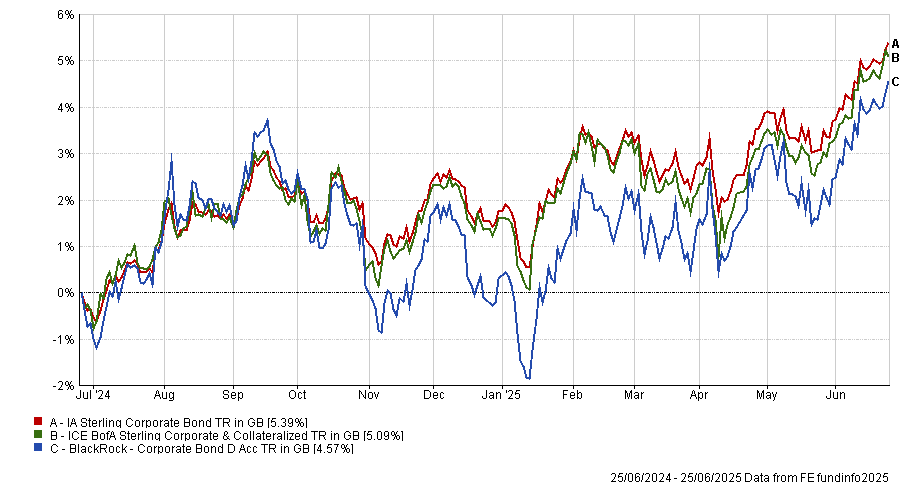

The rest of the portfolio was dedicated to fixed income, with the managing director first including a corporate-bond fund, BlackRock Corporate Bond, which should make up 15% of the overall portfolio.

He praised its flexibility and “proven ability to exploit inefficiencies in fixed income”.

Since Ben Edwards has been in charge from 2015, the strategy has delivered “excellent returns”, with its 30% upside over the past 10 years putting it in the first quartile of performance against the IA Sterling Corporate Bond average of 27.5% – all the while taking “significantly less risk than the rest of the sector”, McDermott noted.

This result hasn’t been achieved over more recent times frames, however, with the vehicle dropping to the third quartile of performance over the past five and three years, and to the last over the past 12 months, as shown in the chart below.

Performance of fund against index and sector over 1yr

Source: FE Analytics

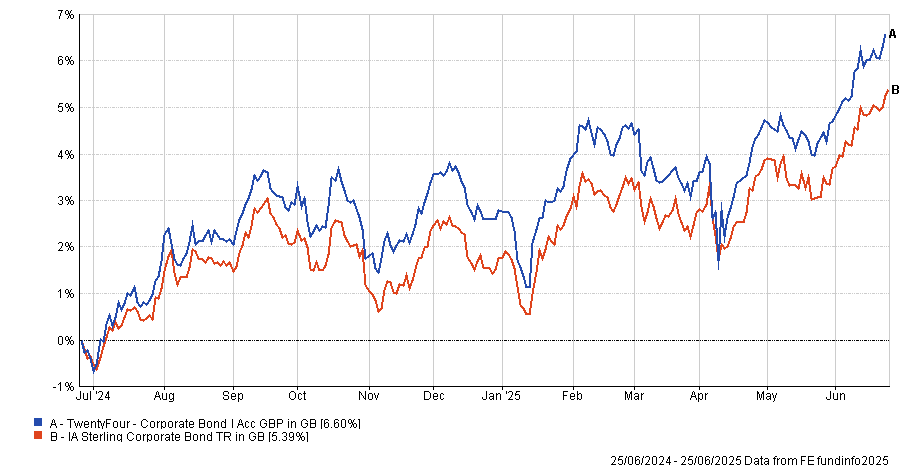

To continue in the same area, TwentyFour Corporate Bond also deserved a place and another 15% of the budget.

For McDermott, manager Chris Bowie has built “one of the most dependable funds in the space”, aiming to deliver high income with minimal volatility. It is currently in the IA Sterling Corporate Bond's first or second quartile over one, three, five and 10 years, making a top-quartile 31% total return over the past decade.

Square Mile analysts appreciate its approach of mixing “a healthy degree of interest rate risk, which could prove to be an attractive diversifier in a balanced portfolio, as well as exposing investors to credit risk and the extra returns above government bonds which this should generate over time”.

Performance of fund against index and sector over 1yr

Source: FE Analytics

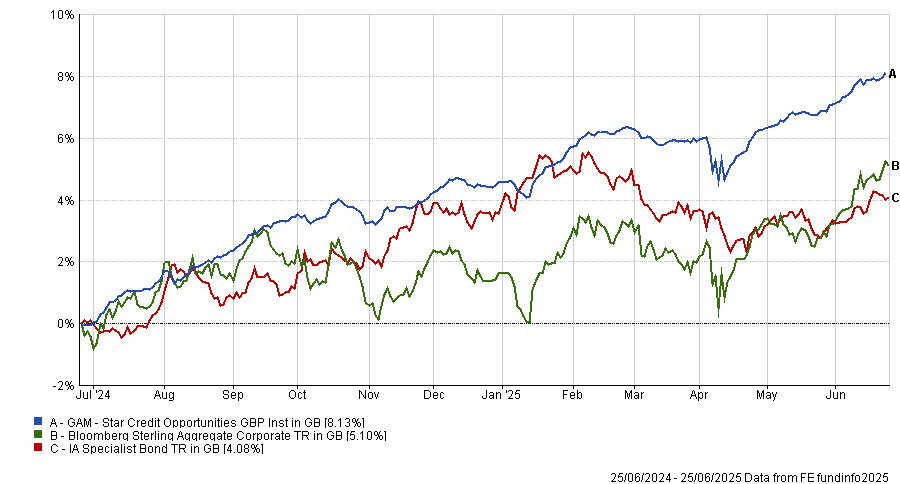

Finally, while it carries slightly more risk, GAM Star Credit Opportunities was McDermott’s last pick, which offers “an attractive option for income seekers” and accounts for the final 15% the portfolio.

“By focusing on the strongest companies further down the capital structure, the fund generates a high yield while maintaining quality,” he said.

It is co-run by FE fundinfo Alpha Manager Anthony Smouha, who follows the philosophy that investment-grade companies rarely default and by extension their higher-yielding junior debt rarely defaults.

Performance of fund against index and sector over 1yr

Source: FE Analytics

The fund has a strong bias towards financials such as banks and insurers. For RSMR analysts, its low sensitivity to changing interest rates is compelling.

They said: “The simple approach of investing in quality companies via junior credit and using the capital structure to derive higher returns has been a cornerstone of the investment approach for a long time and has led to attractive returns for investors willing to tolerate some volatility at times of market stress.”

Despite the slightly higher volatility, the fund achieved a first-quartile performance against its IA Specialist Bond peers across all main timeframes.

Source: FE Analytics