The US has been a hard place to be, but investors should not be too quick in writing the market off entirely – although they might have to look outside of current darlings like tech stocks.

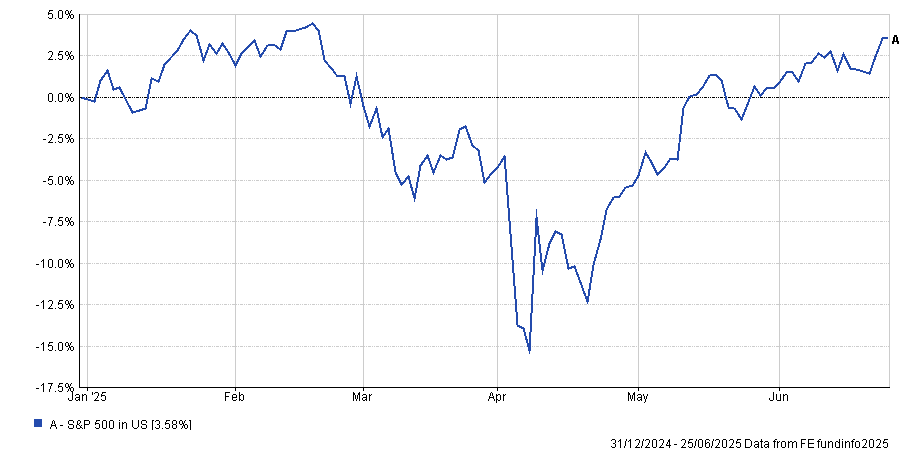

The extreme policy volatility has caused the S&P 500 to fall by as much as 15.3% in dollar terms during April, with some investors beginning to reconsider their allocations in favour of other regions, such as Europe and the UK.

Nevertheless, letting recent volatility distract them from the long-term potential of the US market is a mistake, according to Katie Magee, US equity specialist at JP Morgan Asset Management.

The US can generally rally from a downturn, and while April’s volatility was dramatic, the S&P 500 recovered most of the ‘Liberation Day’ losses within a month, as demonstrated by the chart below.

Performance of the S&P 500 year to date

Source: FE Analytics. Data in US dollars.

As analysts from Brewin Dolphin noted earlier this week, underperformance does not mean the US is no longer attractive.

However, recent volatility does mean the opportunity set is changing, according to Magee.

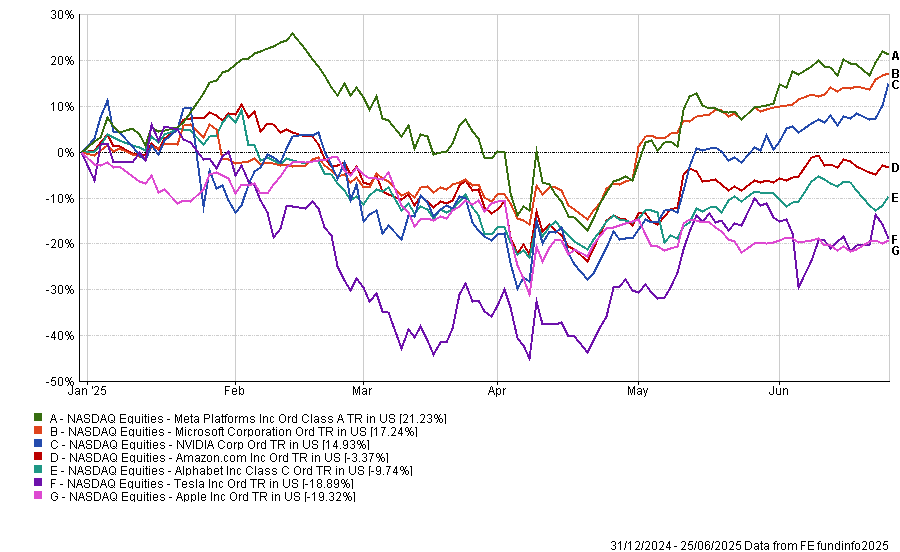

While artificial intelligence (AI) is still a transformational development, AI companies will struggle to generate the returns they used to. This trend is already starting, with four of the ‘Magnificent Seven’ (Apple, Nvidia, Microsoft, Tesla, Meta, Alphabet and Amazon), down so far this year.

Performance of the Magnificent Seven year to date

Source: FE Analytics. Data in US dollars

“I don’t think the dynamics we’ve seen over the last couple of years are going to repeat themselves.”

Instead of these handful of mega-cap tech stocks being the main driver of performance, investors should expect the market to broaden out and earnings growth to moderate, she said.

For example, Magee is a strategist on the JPM America Equity and JPM US Select Equity Plus funds, which posted top-quartile returns in the IA North America sector over the past five years due to stock selection across multiple sectors, including technology. However, the funds have struggled to maintain these strong returns this year as market have been volatile, with both sliding into the bottom quartile of the peer group.

Magee explained that as part of their active approach, they have been gradually reducing their tech allocation taking profits from stocks that have performed well, and redistributing this capital to other areas within the portfolio, such as financials.

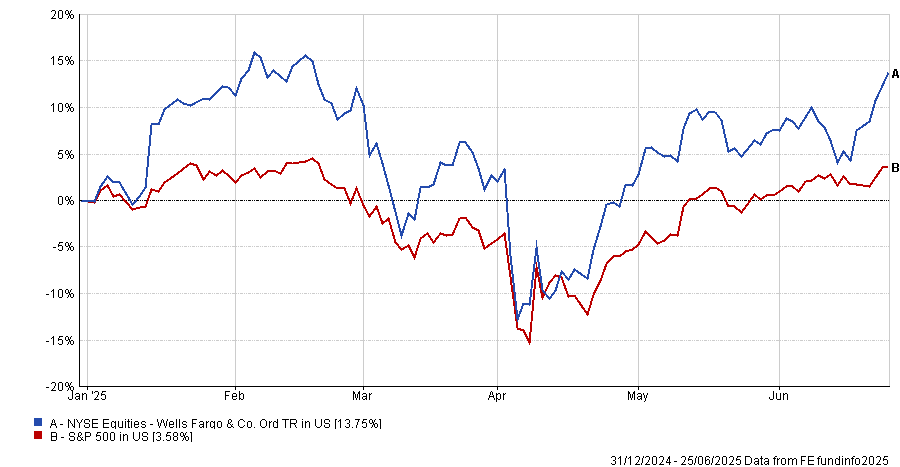

JPM US Select Equity Plus has US bank Wells Fargo as the ninth largest position and it is performing well. So far this year, Wells Fargo is up 13.8%, a 10-percentage-point outperformance compared to the S&P 500. This follows earnings reports coming in above expectations and the Federal Reserve ending a cap on its assets, which has been in place since 2018.

Performance of stock vs the S&P 500 YTD

Source: FE Analytics. Data in US dollars

However, banks in general are looking more appealing, Magee said. Larger banks are benefitting from a wave of structural change, including the push for deregulation and an interest rate environment that, while still unclear, looked more broadly supportive.

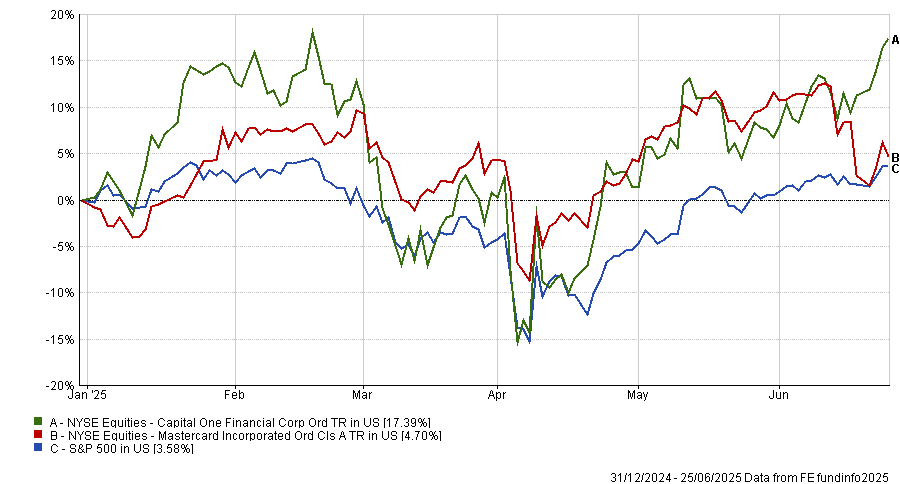

Elsewhere in financials, “as payments move away from being cash-based,” insurance and digital payment companies looked appealing. MasterCard and Capital One are good examples, which are already in their portfolios and have outperformed the S&P 500 so far this year.

Performance of stocks vs the S&P 500

Source: FE Analytics. Data in US dollars

Other recent opportunities that have caught the team's eye include the consumer space, with “off-price retailers and affordable restaurants” standing out.

She argued that these will be “less affected by tariffs” than some other US businesses and consumers have more emphasis on value for money, which is broadly supportive of higher spending.

Additionally, the US consumer was in a strong position and still drove most of the US gross domestic product (GDP), she argued. “We’d seen real wage growth be pretty reasonable for the US, consumer inflation had dropped from its peaks and unemployment rates were low. From our perspective, those themes remain in place,” she concluded.

“It’s not just been mega-cap tech driving performance this year and that’s been good. There are opportunities to be found across the board.”