The UK is home to many attractive value opportunities including the likes of Jet2 and NatWest, according to Ninety One’s Alessandro Dicorrado.

After years of underperformance, value investing appears to be experiencing a resurgence. Over the past year, the MSCI ACWI Value index is up 5.8% in sterling terms, outpacing its MSCI ACWI Growth counterpart, which climbed 5.4%.

On a geographic basis, value-driven markets such as the FTSE All Share (up 9.8%) are outperforming traditional growth markets such as the S&P 500 (up 4.2%).

For Alessandro Dicorrado, manager of the Ninety One UK Special Situations fund, this has made it “particularly interesting to fish for opportunities in [the UK] pond”. UK businesses are cheaper than “almost anywhere else” and, when markets seem more uncertain, he thinks value stocks in the UK have much further to run.

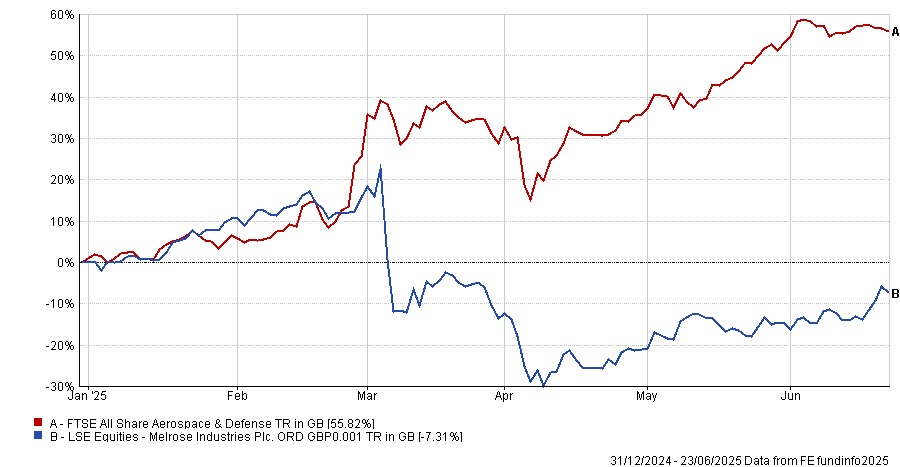

For example, he is bullish on aerospace manufacturer Melrose, which is down 7.3% this year, despite the FTSE All Share Aerospace and Defence index surging following widespread commitments from governments to increase defence spending.

Performance of Melrose year to date

Source: FE Analytics

Melrose has been investing internally to refresh its supply of jet engines, which has been a headwind on performance since the UK market “does not appear to like it when you invest a lot internally”.

However, Dicorrado explained: “The essence of our value approach is to move towards where there is uncertainty, where people are doing things because of emotion rather than rationality.”

Companies may only need to purchase a few jet engines each year, but they demand constant upkeep. As very few companies are able to maintain them, customers will go to Melrose for engine maintenance, meaning the company will continue to grow its earnings long term, he said.

Despite this, Melrose trades on a price-to-earnings ratio (P/E) of just 10x, whereas competitor businesses in the same field trade closer to 20x. “We think that is worth it,” Dicorrado said.

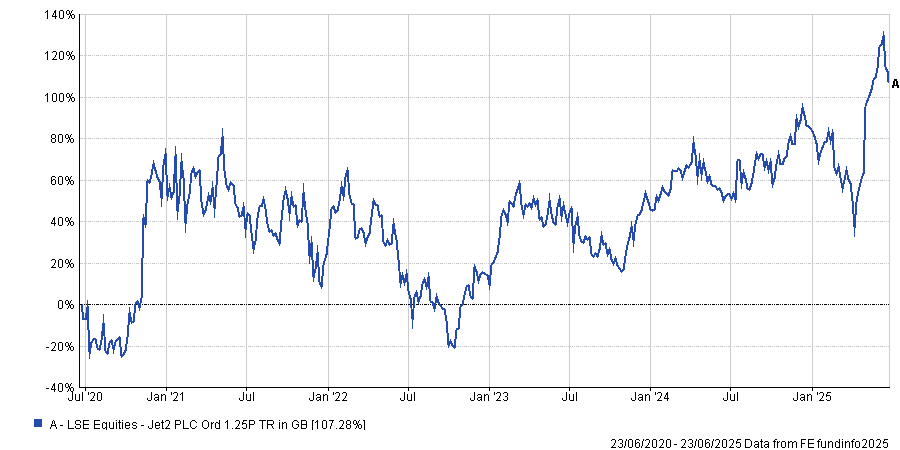

Jet2 is another favourite value stock, which was initially purchased when airline shares slid during the pandemic. This led to the market heavily underestimating the company’s solid fundamentals and long-term growth potential, Dicorrado explained.

“Every time there's an airline involved, this is a company that needs to be well run. It's not an easy business to run, but it's been run extraordinarily well run largely by the same team for the last 15 years,” he said.

“We bought this during Covid when the revenues elapsed but the company always had a good balance sheet and was conservatively financed, so we knew it would survive. We just didn't know when the recovery would come.”

Although airline stocks were hit hard by the pandemic’s travel restrictions, Jet2 was able to benefit from the fact it “owns the entire client experience”: customers can book their flight and accommodation through the firm.

This meant travellers felt more comfortable booking with Jet2, as they could cancel flights and hotels in one go if necessary, receive a refund and get a discount on their next trip. The result was Jet2 gaining market share during the pandemic and the share price has reflected that, Dicorrado explained. While other airlines have struggled since the pandemic, Jet2 has soared 107.3%.

Performance of Jet2 over the past 5 years

Source: FE Analytics

“We’re not talking about a tiddler company no one can buy. It’s a wonderful domestic business on a 9x P/E ratio, which is not an expensive price for a company of this quality.”

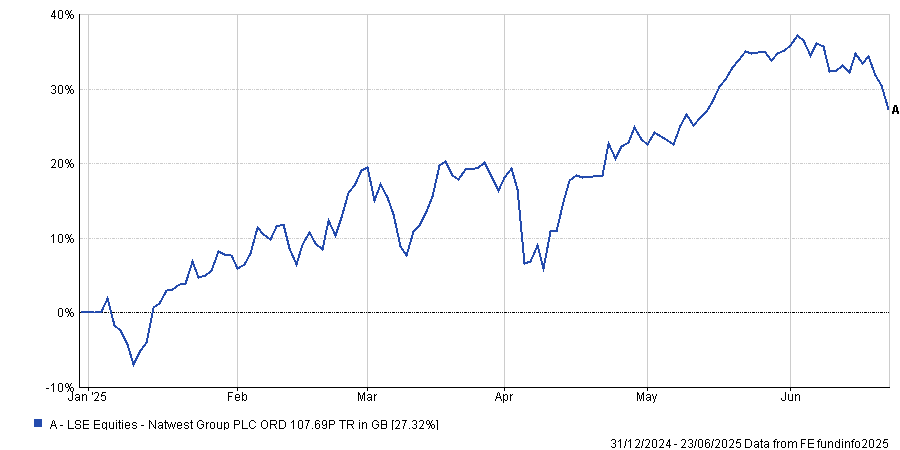

Finally, the Ninety One UK Special Situations manager pointed to NatWest. The bank is the second-largest holding in the portfolio and has returned 27.3% this year. “It trades on a 5x P/E ratio and we think that’s enough to take on a business that isn’t all that impressive,” Dicorrado said.

Performance of NatWest year to date

Source: FE Analytics

The unique advantage of holding NatWest as a value investor is its extremely high payout. The average dividend payout on the UK market is around 6%, but “NatWest pays out almost 15%” when combining its 4% dividend yield with share buyback payouts, he explained.

“With a yield that high, you don’t need anything else from NatWest; you just need it to exist. It’s not an amazing business, but it’s good enough.”

This is a great “deep value opportunity”; one of four value buckets that underpin Ninety One’s approach to value investing, alongside fallen angels, cyclical leaders and special situations.

Fallen angels are former high-quality businesses that have suffered a blow but remain strong and “quite stable companies” that can compound over time. Because they are so out of favour, they can often be bought at “panic levels” of distressed valuations.

Cyclical leaders are one of the most common types of businesses in the UK economy, which vary depending on the economic cycle. Special situations refer to businesses that the market misunderstands, whether because a key element has been spun-off or they have assets that investors are unaware of.

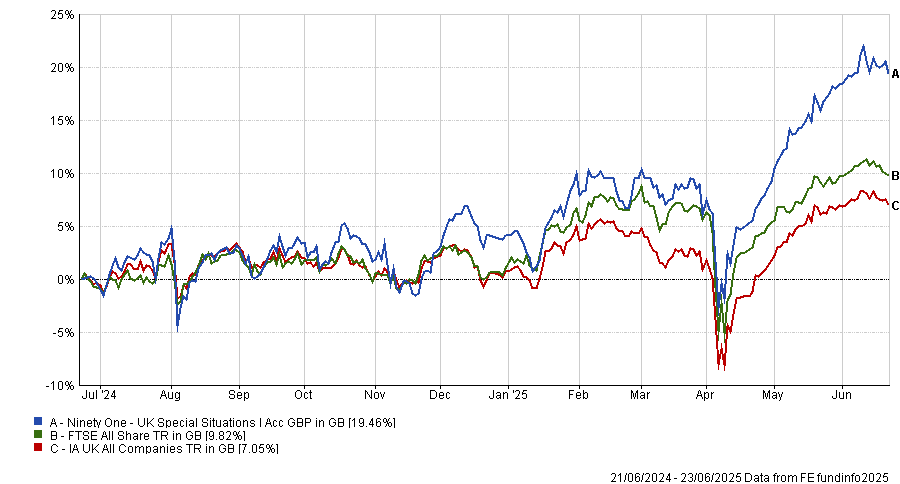

The data suggests that this approach to value investing has paid off. Over the past year, the Ninety One UK Special Situations fund is up 19.5%, the fourth-best return in the IA UK All Companies peer group. It has also posted top quartile results over the past three, five and 10 years.

Performance of the fund vs the sector and benchmark over the past year

Source: FE Analytics