The number of investment trusts on the market has dropped by almost a fifth over the past three years, according to AJ Bell.

The platform’s analysis of data from the Association of Investment Companies (AIC) found 279 trusts were listed on the London market at the end of May 2025, down from 337 in the same month of 2022. This is a fall of 17%.

Dan Coatsworth, investment analyst at AJ Bell, said: “There are now fewer trusts on the market than 10 years ago, which is quite remarkable when you consider how they’re increasingly popular with retail investors.”

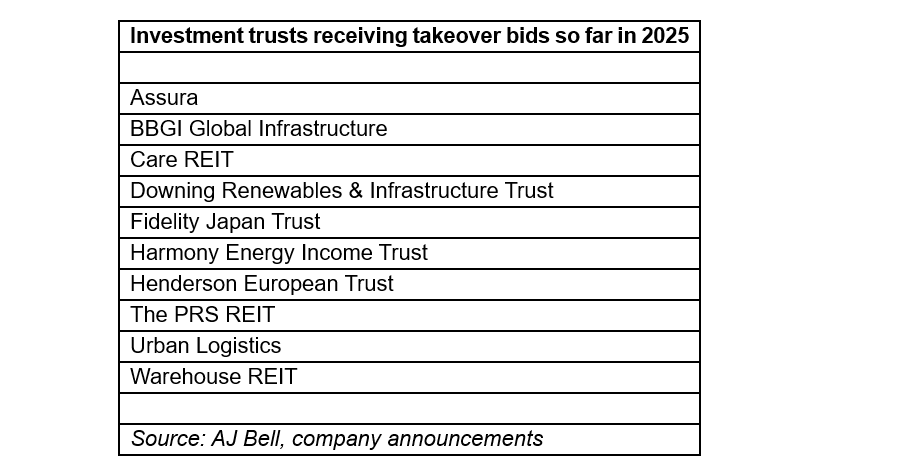

There have already been three times as many takeover bids this year as in 2024 and takeover action can be expected to continue for the rest of the year, he explained. “Sustaining a rapid pace of takeovers would exacerbate a worrying trend that’s already in motion, namely the shrinking pool of investment trust opportunities on the market.”

But why is this happening if investment trusts remain popular with retail investors?

Firstly, many trusts are “trading well below the underlying value of their portfolio”, creating attractive bargains for international investors. The average investment trust currently trades at a 14% discount to net asset value (NAV) but some have a discount of more than 50%, according to AIC data.

There has also been increased activity from activist investors, or shareholders who use their equity stake in a company to influence its management and strategy. This has “put pressure on trust boards to take improve performance, narrow discounts or take trusts in a new strategic direction”, Coatsworth said.

While US hedge fund Saba Capital failed in its shareholder battles last year, it provided a “wake-up call” for trusts to “think about what is best for shareholders long term”.

The investment trust market also suffers from some inefficiencies. Investors tend to avoid trusts below a certain size, so the market is full of trusts with less than £200m assets under management that failed to gain traction. “Various sub-scale investment trusts [are] realising they either need to get bigger or admit defeat and return money to shareholders”, as investors will not buy trusts below a certain size.

So far this year, most takeover bids have been in the property or renewable sectors, which have traded at significant discounts due to higher interest rates and reduced appetite for green investing.

Russ Mould, AJ Bell’s investment director, added: “The UK stock market continues to be on sale. If investors don’t recognise the good value opportunities on offer, trade buyers or private equity firms will keep swooping on targets and pick them off one by one.”

Source: AJ Bell

There have been several high-profile takeover bids recently, including the drawn-out battle for NHS property business Assura, which has been running since February.

Initially, it supported a cash bid from private equity consortium KKR/Stonepeak, but Assura now favours a larger £1.8bn offer from London real estate investment company Primary Health Properties (PHP).

Oli Creasey, head of property research at Quilter Cheviot, said: “Assura had previously faced accusations that, by promoting the lower bid, they were not seeking best value for shareholders. That accusation appears to be put to bed.”

However, with PHP’s share price down 2% in the past five days, further slides could narrow the gap between PHP and KKR’s bid, so the saga may not be over yet. “Given events to date, further twists and turns could be on the cards.”

While this was the most contested recent bid, it is not the only one. Earlier this month Downing Renewables and Infrastructure Trust (DORE) agreed to a £175M bid from Polar Nimrod Topco Limited (Bidco), a subsidiary of Bagnell Energy. It has secured the backing of 22.5% of eligible shareholders.

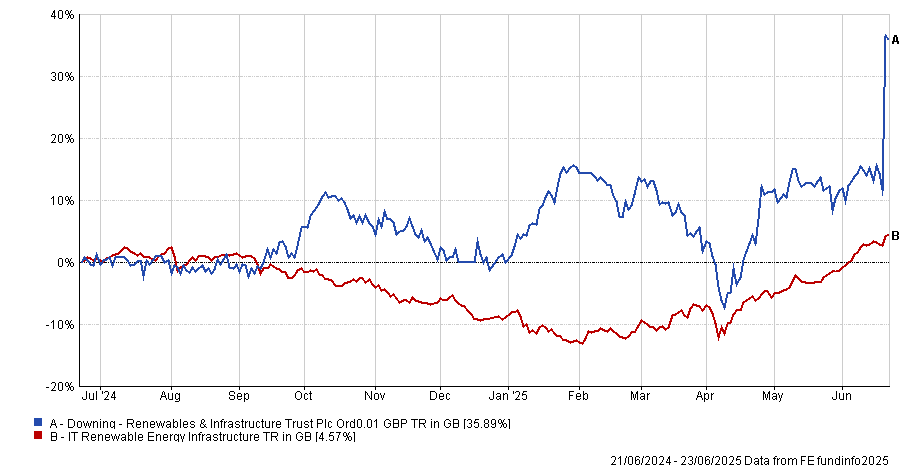

Matthew Read, senior data analyst at Quoted Data, noted that “by most objective measures, the trust has performed well”. It is up 35.9% over the past year, which is the best performance in the IT Renewable Energy Infrastructure sector.

Performance of the trust vs the sector over the past year

Source: FE Analytics

However, it has faced several headwinds, including rising interest rates, a lack of scale and limited liquidity, with a buyback programme in 2023 that failed to close the discount in any meaningful way, he explained. As a result, it has fallen out of favour with investors despite strong returns.

“This deal follows a now-familiar playbook: a subscale, well-managed renewables trust with strong NAV performance finds itself persistently undervalued by public markets and is ultimately taken private by a long-term investor that can see the potential,” Read said.

“With institutional investor support in hand and no counter-bid likely, the deal appears poised to go through, but we are sorry to see it go. It marks yet another chapter in the ongoing consolidation and privatisation of UK-listed alternatives.”

Other recent high-profile bids included the Henderson European Trust and Fidelity European Trust merger announced last week.