Stagflation, once a cautionary tale from the 1970s, is back on the radar. Most professional investors now expect the global economy to slip into this difficult mix of high inflation and low growth within a year, raising the question of how to protect portfolios.

Danni Hewson, head of financial analysis at AJ Bell, pointed to a “rather sour smelling mix of tariff concerns, geopolitical tensions and a consumer under pressure” threatening to derail economic growth and slowing inflation.

“There are concerns that this could be the sweet spot when both the US and UK economies are looking sluggish and inflation is relatively benign,” she said. “If the oil price keeps on rising and the global economy can’t kick on because of tariffs, then the spectre of stagflation might become more than just a cautionary tale.”

The latest Bank of America Global Fund Manager Survey found three-quarters of asset allocators expect the global economy to go into stagflation in the coming 12 months. Although this is down from the 81% forecasting this outcome last month, it is still the consensus prediction by fund managers and a persistent worry.

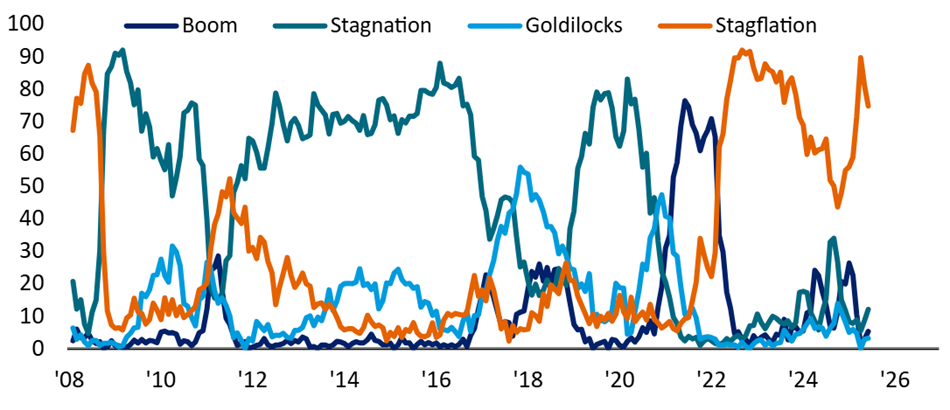

Fund manager expectations for global economy over next 12 months

Source: Bank of America Global Fund Manager Survey – Jun 2025

Stagnation – or below-trend growth and below-trend inflation – is expected by 12% of fund managers. Meanwhile, just 5% anticipate boom conditions (above-trend growth with above-trend inflation) and only 3% forecast a ‘Goldilocks scenario of above-trend growth combined with below-trend inflation.

If “the spectre of stagflation” does materialise, how should investors react?

Duncan Lamont, head of strategic research at Schroders, said stocks perform worse during stagflation than in other economic conditions but “the difference is not statistically significant”. Despite this, stocks have historically outperformed cash and kept up with inflation.

“There can be lower conviction of strong returns but predicting doom is not appropriate either,” he said.

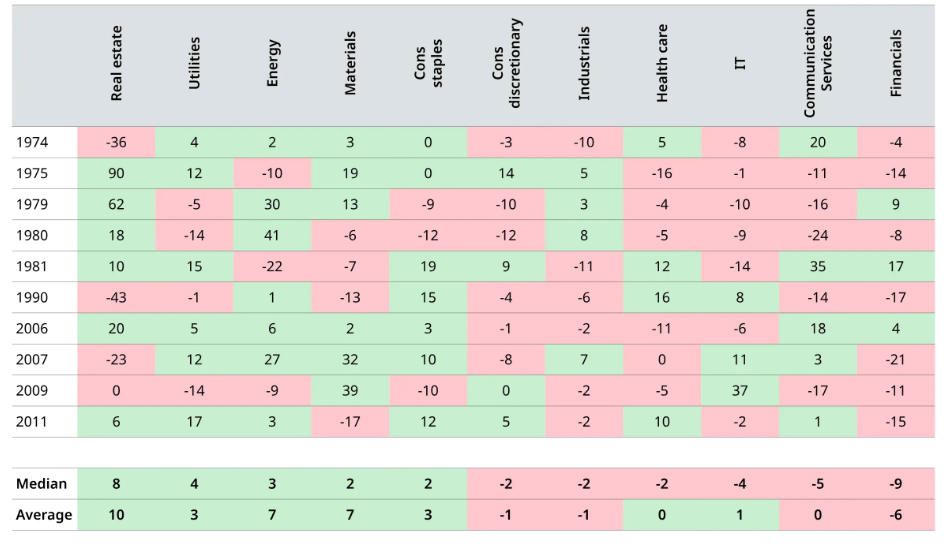

Lamont looked into how different US equity sectors performed in periods of stagflation (defined here as times when real GDP was below the previous 10-year average and CPI inflation above its 10-year average).

He caveated that historical sector data only goes back to 1974, reducing the number of years that can be analysed, while many sectors look different today than they did in the 1970s and inflation drivers now – especially tariffs – differ from the commodity shocks of earlier decades.

“Any conclusions from historical analysis must therefore come with lower conviction and be overlaid with qualitative judgement,” Lamont said, before adding that the patterns which do emerge could be useful starting points for understanding sector performance in stagflation.

US sectoral performance in stagflation years

Source: LSEG Datastream and Schroders. US sectoral real equity returns when inflation is above and growth below its 10-year average, 1974-2024, calendar year data

Schroders' analysis shows utilities and consumer staples have held up relatively well during stagflation, largely because they offer essential goods and services. Their demand is less cyclical, so revenues and earnings stay more stable even as broader economic activity slows.

Healthcare presents a more nuanced case. In shorter-term data sets, the sector has appeared lacklustre during stagflation, but a longer historical view supports a more positive outlook. Lamont pointed to academic data going back to 1927, which shows median outperformance of 4% in stagflation years, lending more confidence to the view that healthcare can be a defensive play.

Energy and materials also have a record of strong performance, typically benefitting from the commodity price shocks that often fuel inflation. While weaker demand and subdued prices challenged that assumption earlier this cycle, recent Middle East tensions have reintroduced upside risk for these sectors and their outlook now depends heavily on geopolitics.

Real estate is another area where performance can be relatively resilient, but outcomes are highly variable. Factors such as lease structure, rental inflation protection and tenant quality all become critical under stagflationary conditions.

Consumer discretionary stocks, meanwhile, tend to suffer as households cut back on non-essential purchases as prices rise and the economy weakens. This erosion in demand directly impacts companies reliant on cyclical spending and widens the gap between discretionary and staple goods.

Technology and communication services also face headwinds, with stagflation hitting both on earnings expectations and valuations. High price-to-earnings ratios make growth stocks more sensitive to rising interest rates, while slower demand and higher input costs further constrain profitability, although today’s tech giants may be more defensive than their predecessors thanks to their stronger balance sheets.

Financials have historically underperformed during stagflation, particularly due to yield curve inversion and rising credit risk. Although 2025 has seen some recovery in the sector thanks to a steepening curve and optimism around deregulation, Lamont warned that “serious growth concerns could easily lead to tumbling longer-term yields, putting this performance at risk”.

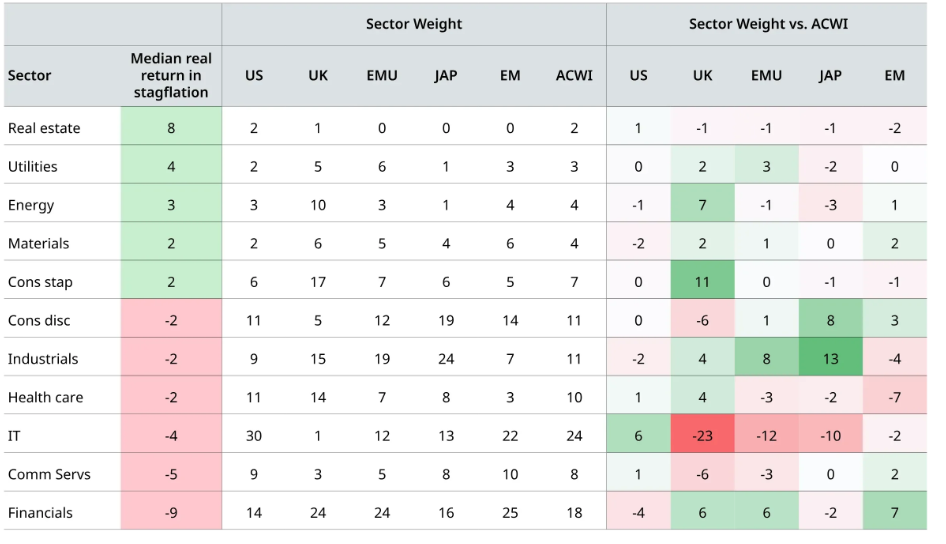

Schroders’ research also tried to find the global stock markets with more favourable allocations to the sectors that hold up better during stagflation, as well as those with less favourable weightings.

Regional market composition

Source: LSEG Datastream and Schroders

The US equity market’s vulnerability to stagflation stems from its sector composition, with outsized exposure to technology and communication services. These sectors, dominated by companies like Alphabet and Meta, tend to underperform when inflation is high and growth is weak, particularly given their elevated valuations and sensitivity to interest rates.

Adding to this fragility is the US’s limited exposure to sectors that historically weather stagflation better, such as utilities, consumer staples and energy. At just 16% combined, these allocations are relatively low, leaving the US equity market poorly hedged if stagflation risks materialise.

Europe’s heavy industrials weighting is a concern, especially under the shadow of US tariff threats, Schroders said. However, fiscal stimulus plans in Germany and modest overweights in utilities and underweights in high-valuation tech sectors provide important counterweights, improving its relative positioning.

The UK, often overlooked by global investors, may have renewed relevance in a stagflationary world. Its defensive tilt, stemming from a 17% allocation to consumer staples and minimal exposure to technology, coupled with low valuations, suggests both resilience and a compelling entry point, according to Lamont.

Japan and emerging markets face structural challenges, however. Japan’s high exposure to industrials and discretionary sectors – 43% of its index – makes it vulnerable to global demand shocks, while emerging markets are skewed toward cyclical and interest-rate sensitive sectors, offering limited stagflation protection.

“Whichever market you look in, there will be winners and losers,” Lamont finished.

“Sector allocations can provide useful insights into potential risks but it is only by analysing individual company fundamentals that investors can hope to identify those which have the potential to thrive and those which risk underperforming.”