BlackRock Throgmorton and Finsbury Growth & Income are among the UK investment trusts that have achieved some of the highest Sharpe ratios of their sectors over the past decade, Trustnet research shows.

Investors use the Sharpe ratio – which calculates the excess return earned per unit of volatility – to assess whether the returns of an investment are worth the level of risk. A higher Sharpe ratio means an investment has delivered more return for each unit of risk.

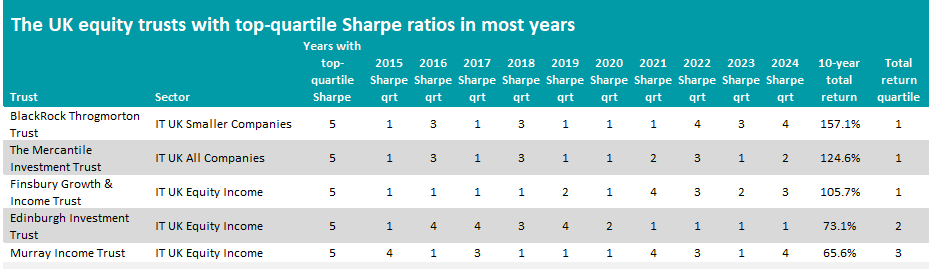

In this article, Trustnet is searching for investment trusts in the IT UK All Companies, IT UK Equity Income and IT UK Smaller Companies sectors that have made a top-quartile Sharpe ratio in at least five of the full calendar years of the past decade. Only five achieved this.

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024.

First up is BlackRock Throgmorton Trust, which is managed by Dan Whitestone. As well as being in the IT Smaller Companies sector’s top quartile for Sharpe ratio in five of the past 10 years, its 157.1% total return is the highest of the trusts shortlisted in this research.

The trust invests primarily in UK small- and mid-cap companies, concentrating on a relatively small number of companies where the manager has strong conviction. In particular, Whitestone is looking for quality companies and examines factors such as the competitiveness of a company’s position, product strength and strong management teams.

Top holdings include investment manager Tatton Asset Management, property development and investment company GPE and housebuilder Bellway. Its biggest sector weightings, by some margin, are to industrials (31.5%) and financials (24.1%).

Analysts at Kepler Trust Intelligence said: “[Whitestone’s] ability to identify quality companies that are able to capitalise on structural-growth themes and industry change has delivered superior long-term performance characteristics.”

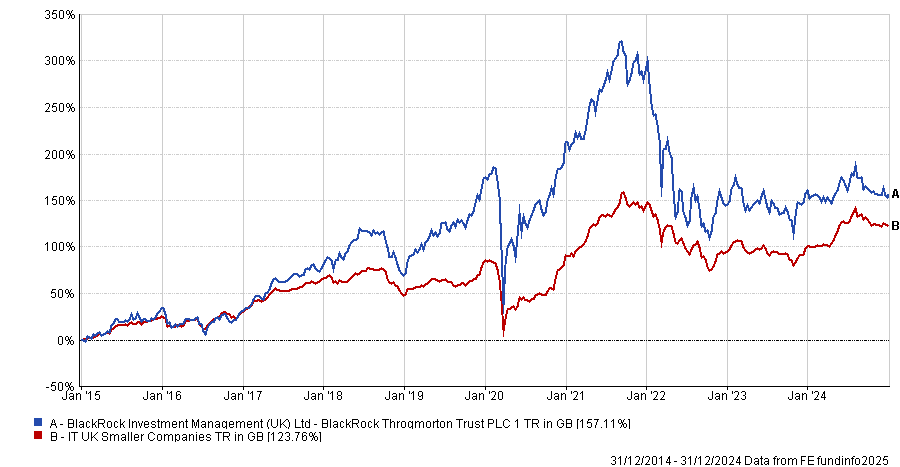

Performance of BlackRock Throgmorton vs sector over 10yrs to end of 2024

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024.

The Mercantile Investment Trust came in second place in this research, with a 10-year total return of 124.6% and five years in the top quartile for Sharpe ratio. Residing in the IT UK All Companies sector, the trust is managed by JP Morgan Asset Management’s Guy Anderson and Anthony Lynch.

This is another trust that focuses on UK medium and smaller companies, with Bellway, private equity firms 3i Group and Intermediate Capital, and food producer Cranswick among its top holdings. Its largest sector overweights versus its FTSE All Share (ex FTSE 100, ex investment companies) benchmark are financials and consumer discretionary.

Anderson and his team are looking for companies they consider to have higher quality but undervalued growth prospects. They also want firms with strong cashflows, which can generate an attractive income for shareholders (Mercantile has increased its dividend for 12 years in a row).

Analysts at Square Mile Investment Research & Consulting said: “Over a market cycle we believe that the fund has the key attributes in place in terms of an effective repeatable process propagated by an established and experienced team to facilitate long-term outperformance of its benchmark.”

Performance of Mercantile Investment Trust vs sector over 10yrs to end of 2024

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024.

In third place is Finsbury Growth & Income Trust, which is managed by Nick Train. The core principle of Train’s investment philosophy is that durable, cash-generative franchises are relatively rare and frequently undervalued by most investors.

The manager looks for companies that he considers to be ‘great businesses’ – typically from the consumer branded goods, media, pharmaceuticals and retail financial services spaces – and then holds them for as long as possible.

Finsbury Growth & Income is more biased towards larger companies than the trusts mentioned so far, with its top holdings being RELX, London Stock Exchange, Experian, Sage Group and Unilever.

Kepler’s analysts said: “As well as harnessing the strong growth of portfolio companies, and allowing compounding over the long term to work its magic, the large-cap defensive nature of many of these companies has helped give the trust defensive characteristics when markets fall.”

All three of the trusts above have made a triple-digit total return over the past decade, unlike the remaining two.

Edinburgh Investment Trust made 73.1% over the past 10 full calendar years and was in the top quartile in five of them.

Liontrust’s Imran Sattar has only run the fund since October 2023, so was not responsible for the bulk of its track record – although it was top quartile for Sharpe ratio in 2024. The trust has been run by Liontrust for five years, over which time it has been in the IT UK Equity Income sector’s top quartile for both total returns and Sharpe ratio.

Before Sattar took over, Edinburgh Investment Trust had a value bias but the manager tilted towards growth stocks (while retaining some exposure to value companies). This multi-style and flexible process “is designed to reduce the volatility of returns through the economic and market cycle”.

Murray Income, meanwhile, has been run by Charles Luke since 2006. Luke invests in high-quality companies which offer both resilient income and strong capital growth prospects. The trust has grown its dividend for the past 51 years.

Analysts at FundCalibre said it is “a dependable, diversified and differentiated trust, which has delivered consistently strong performance at a time when it has been challenging for UK equities”.