There are several reasons to sell US equities right now – the first and most obvious being they are just too expensive, according to Trevor Greetham, head of multi asset at Royal London Asset Management.

Valuations are “the best way of trying to forecast future returns” and people should sell US stocks on valuation grounds alone, he said.

If that wasn’t enough, Donald Trump’s second administration is giving investors all the more reason to take profits, while the possibility of US earnings weakening and the dollar’s demise are cherries on top.

Excessive valuations presage poor returns

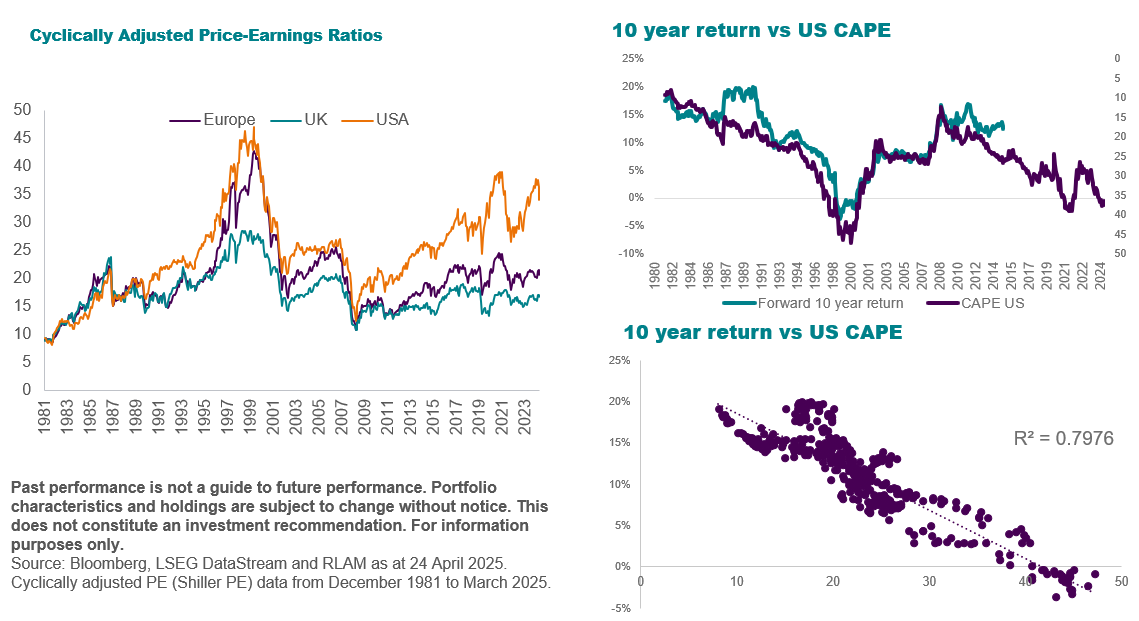

US equity valuations have been a hot topic for a while now. Prior to the recent sell-off, the US market traded at a cyclically adjusted price-to-earnings ratio (CAPE) of 36x, while the UK was at 18x.

“The US is the world's most expensive developed stock market,” he said. “It's the stock market representing the world's largest economy and the most respected economy. But when you have expensive valuations, you also have 10 years of bad returns.”

In saying that, he was referring to John Hussman’s returns model showed below, according to which investing £20k in the US now will lose investors almost £8k within a decade.

In the bottom-right chart of the picture below, 36x valuations on the horizontal axis correspond to low single-digit returns from the S&P on the vertical axis, “probably with some bear markets mixed in”.

US Valuation and prospective returns

Trump’s conduct is deterring investors

Trump’s erratic and unstatesmanlike behaviour is a big worry for Greetham, who said his conduct is akin to that of an emerging market leader. “I suppose we could call the US a submerging market,” he said.

In the first Trump administration, the story went that whenever Trump stepped out of line, the adults in the room would intervene. This mechanism has broken now, said the manager, because “there aren't any adults in the room anymore and I'm not even sure there's a room because a lot of discussion about policy is based on messages on Truth Social”.

“You don't have to have a reason to think strategically. I'll step away from the US because valuation is enough. But then you think about this four-year presidency ahead of us and I can see why a lot of investors are reviewing their strategic asset allocation.”

Earnings

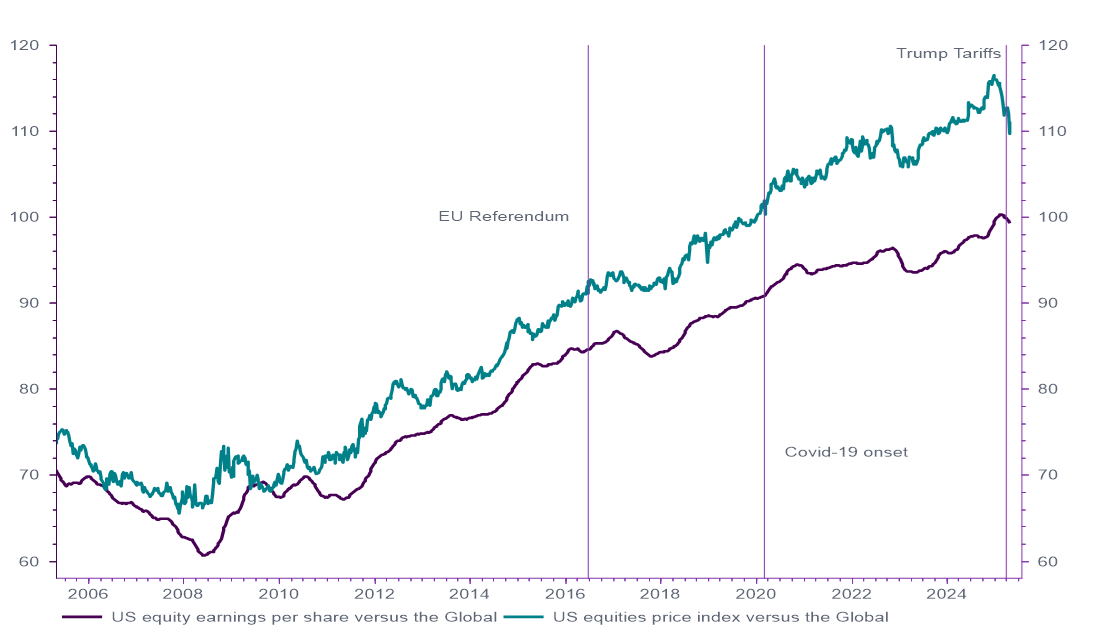

One way people justify high valuations is the phenomenal earnings of mega-tech stocks.

With a long trend of superior earnings growth, people will pay up more and more for those earnings – but crucially for Greetham, this is only the case until the earnings trend turns.

“If relative earnings per share start to turn and US earnings start to underperform the rest of the world, you get big stock market underperformance.”

While this hasn’t happened yet, Trump’s trade war could be the catalyst, the manager argued.

US equity prices and earnings versus global

Source: RLAM, LSEG Datastream

“If the trade war turns out to be more damaging for the US than the rest of the world, which is plausible, then that could hurt relative earnings. At the first signs of the S&P 500 not generating superior earnings, people will want to dump the market, because it's still more than 34x earnings,” the manager said.

“If the S&P 500 falls, there’s quite a bit of space below it that it can fall by. Then it will be too late to sell US equities.”

Dollar de-rating

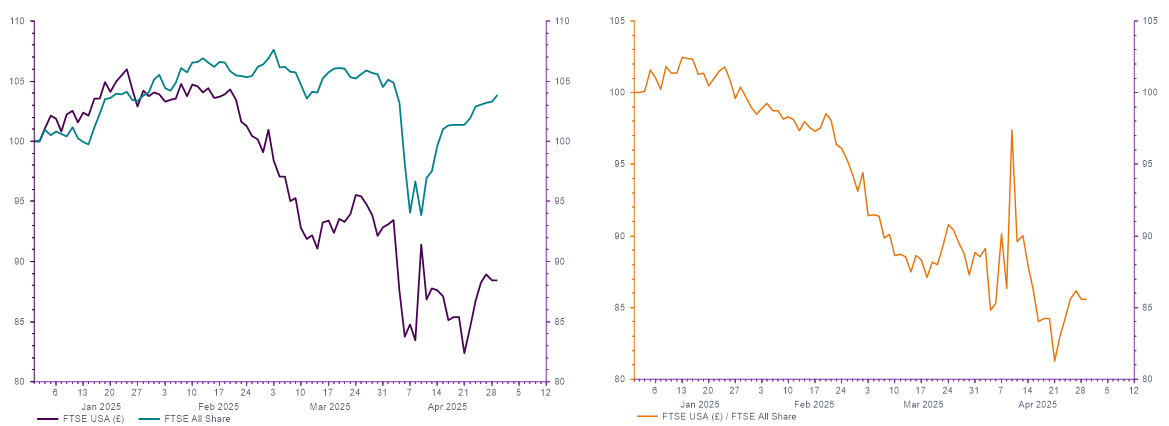

Finally, UK investors must factor in not only that the US market has been derating, but also that the dollar is weaker.

FTSE USA versus FTSE All Share in pound sterling over the year to date

Source: RLAM, LSEG Datastream

“The US stock market has bounced but the dollar hasn't,” said Greetham. “As a sterling investor in American equities, you have to account for the currency too.”

Greetham’s strategy

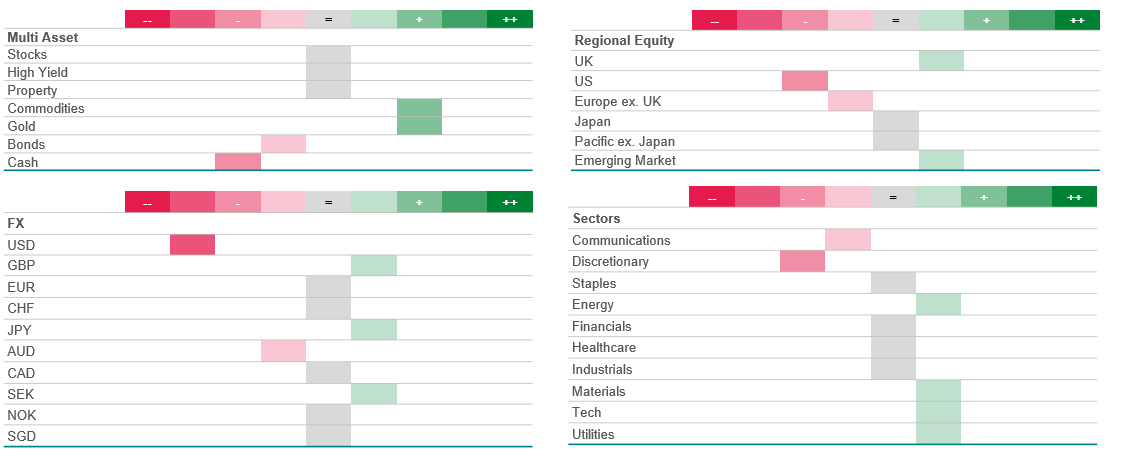

Greetham is practicing what he preaches in his portfolios, including the Fe fundinfo five Crown-rated Royal London GMAP Balanced where US stocks (especially growth sectors) and the US dollar are the only underweights.

“Rather than following the market capitalisation weights, which would have us invest 3.5% in the UK, we have about 20%, and rather than having 70% in America, we have about 50%,” the manager said.

“So we're still quite exposed to the US and we're still thinking, is that 50% too much?”

His main overweight positions are to commodities, gold, as well as UK and emerging market stocksis, as the chart below shows.

RLAM Multi Asset Strategies positioning

Source: RLAM