Views on monetary policy converge around a downward trajectory for interest rates, with yesterday’s much-anticipated decision by the Federal Reserve finally shining a light around the extent and rhythm of the easing cycle.

This leaves investors and asset allocators wondering how to position their portfolios as monetary easing gathers pace. Historically, government bonds have performed well on the back of interest rate cuts, while equities struggled when cuts coincided with recessions but rallied in more benign economic conditions. Growth stocks posted positive performance regardless of the macro backdrop, however.

With that in mind, Darius McDermott, managing director of FundCalibre, has put together a perfect portfolio for investors seeking to benefit from interest rate cuts.

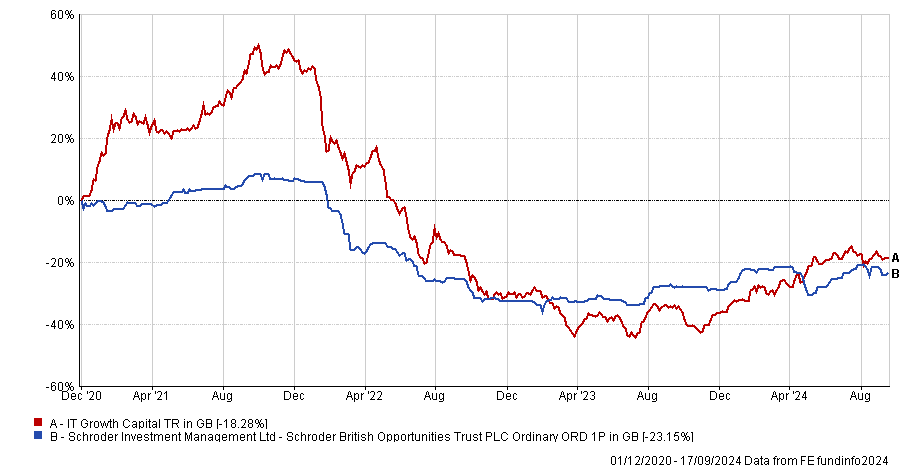

As the rates available from savings accounts fall and cash becomes less appealing, he expects investors to gravitate towards dividend-paying stocks and proposed a 30% allocation to global equity income funds.

“While not all dividend stocks are bond proxies, they can still provide reliable income,” said McDermott, who suggested using TM Redwheel Global Equity Income or Murray International Trust.

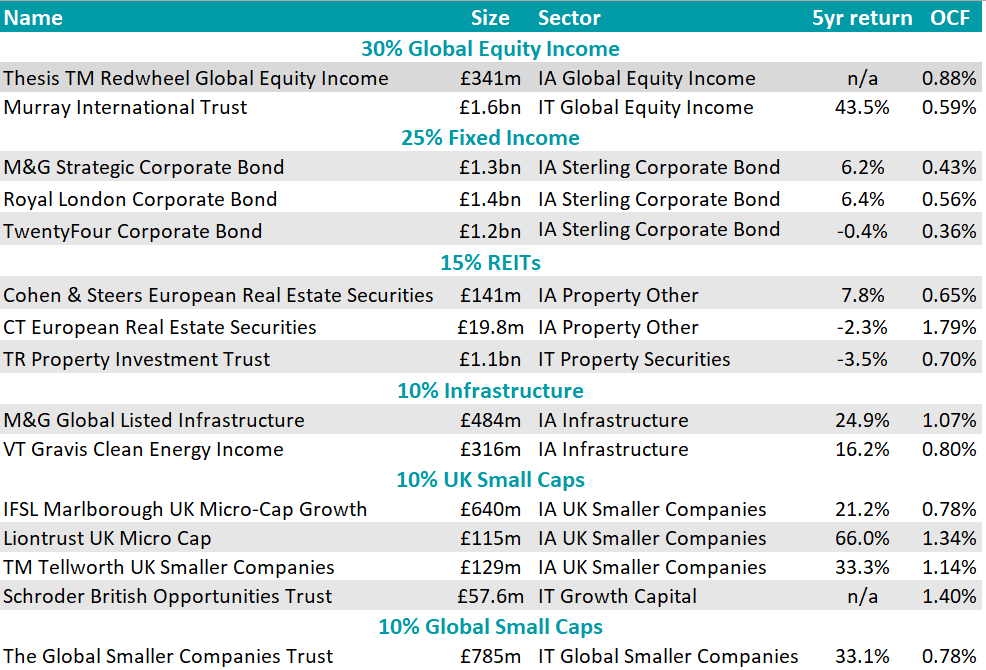

The two have had mixed luck at beating the MSCI World index, with the former coming out on top in 2021 and the latter in 2022, although they both trailed the index in 2024, as the chart below shows.

Performance of fund against sector and index over 3yrs

Source: FE Analytics

Bond prices typically rise when interest rates fall, making now “the ideal time to lock in attractive yields” on long-duration bonds. Not only do they offer “immediate income at historically high levels”, but also opportunities for “significant capital appreciation”, said McDermott.

Within the IA Sterling Corporate Bond sector, he would allocate 25% to either the TwentyFour Corporate Bond, M&G Strategic Corporate Bond or the Royal London Corporate Bond funds.

For a lower-risk option, he veered towards government bonds such as gilts or Treasuries, which can provide a steady income and act as a portfolio stabiliser during market downturns thanks to their often-negative correlation with equities.

Another addition was smaller companies, as sentiment toward them is expected to strengthen as rates fall.

“Smaller companies are typically more sensitive to rising interest rates and many saw their valuations decline during the recent rate hikes,” McDermott said.

“But anticipation of global interest rate cuts has already fuelled a broader risk asset recovery this year, and this interest rate cut by the Fed will likely embolden investors to increase their level of risk.”

Building on this year's positive momentum, the director allocated 20% to smaller companies, split between global (via the Global Smaller Companies Trust) and UK, where he sees “even greater upside potential”.

“UK small-caps are currently trading at near record-low valuations relative to historical averages. This sector boasts a wealth of talented stock pickers that we believe can tap into a market full of opportunities at depressed prices,” he said.

Examples include Liontrust UK Micro Cap, IFSL Marlborough UK Micro Cap Growth, and TM Tellworth UK Smaller Companies.

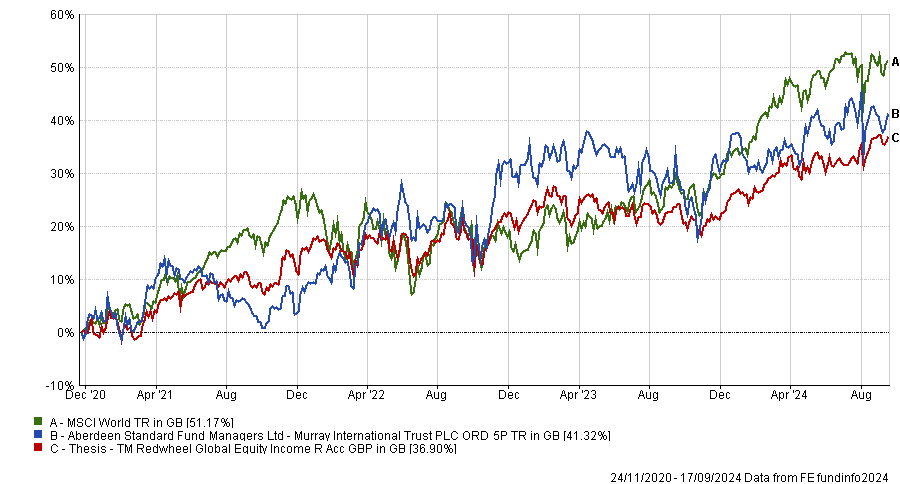

For those seeking a more adventurous investment, the Schroder British Opportunities Trust offers exposure to both listed and unlisted early-stage British companies. While early-stage firms carry higher risks, they are also “poised to benefit the most from falling interest rates”, he explained.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

Finally, “bombed-out sectors” such alternatives earned a 25% space in McDermott’s portfolio, distributed between real estate investment trusts (REITs), which take up 15%, and infrastructure (10%).

Alternatives typically struggle in a rising rate environment because when borrowing costs increase, purchasing power falls and other asset classes such as bonds and cash become more appealing, he explained.

“This has left discounts languishing at historically wide levels, despite the inherent value of the underlying assets remaining high, but share prices should recover as interest rates decline and in the interim, investors can benefit from the attractive yields these trusts offer.”

In the REITs space, investors could consider Cohen & Steers European Real Estate Securities, CT European Real Estate Securities or the Property Investment Trust.

As for the infrastructure plays, McDermott’s preference went for the M&G Global Listed Infrastructure and VT Gravis Clean Energy Income funds.