The investment trust sector has its fair share of heavyweights: from Scottish Mortgage, which usually features near the top of most-bought lists; to Pershing Square and its outspoken billionaire hedge fund manager Bill Ackman; and the UK’s largest investment company 3i Group.

Step away from the obvious names, however, and there are many skilled but lesser-known managers running trusts with stellar track records.

Below, Trustnet asked experts to highlight trusts whose managers are under the radar but merit a higher profile.

Richard Pindar at Literacy Capital

The private equity investment trust sector is dominated by well-known names such as HgCapital and Pantheon Ventures. Yet James Carthew, head of investment companies at QuotedData, believes Literacy Capital is deserving of investors’ attention and has a high opinion of its chief executive officer, Richard Pindar.

After working in corporate finance at KPMG and low- to mid-market private equity at Lonsdale Partners, Richard Pindar co-founded Literacy Capital in 2017 with his father, Paul, and listed it in 2021.

Over the past three years, it has been the best-performing trust in its sector (excluding 3i). Carthew said its stellar track record was “helped by some spectacular successes, such as investments in pet food business Butternut Box and service provider RCI Group”.

“The expectation is for more profitable exits from the portfolio, reflecting its increasing maturity,” he added.

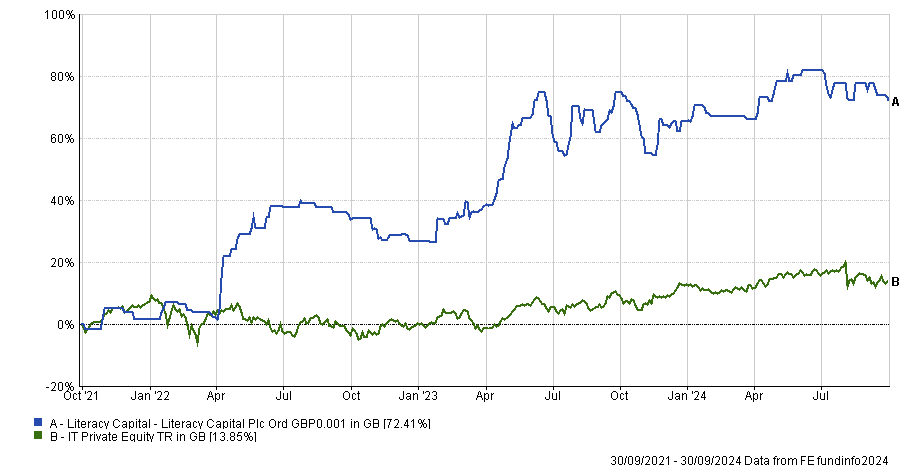

Performance of trust vs sector over 3yrs

Source: FE Analytics

Literacy Capital focuses on UK businesses with earnings before interest, tax, depreciation and amortisation (EBITDA) of between £1m and £10m. It provides a lot of support to management teams and helps businesses to grow through mergers and acquisitions.

The trust also has a benevolent mission and donates 0.9% of its net asset value (NAV) each year to education and literacy charities in the UK. It has donated almost £10m so far, Carthew said.

Imran Sattar at Edinburgh Investment Trust

Imran Sattar took over from James de Uphaugh as manager of the Edinburgh Investment Trust in February 2024. Since then, he has put clear air between the trust and its sector and benchmark, as the chart below shows.

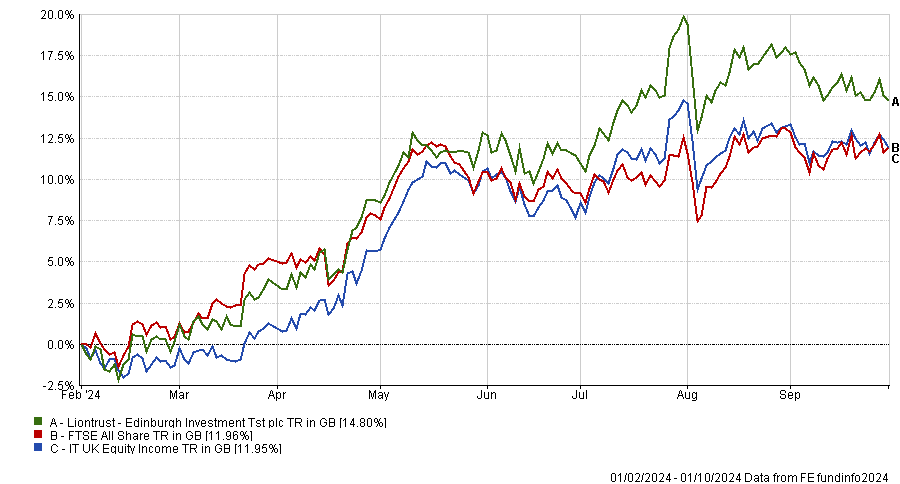

Performance of trust since February 2024 vs sector and benchmark

Source: FE Analytics

Peter Walls, fund manager of Unicorn Mastertrust, said he was surprised that Sattar doesn’t have a higher profile. “It’s particularly surprising given his 26 years of experience managing equity assets, mostly through institutional mandates at BlackRock before moving to Majedie Asset Management,” he said. Majedie was subsequently acquired by Liontrust Asset Management, which advises the trust.

Rob Crayfourd and Keith Watson at Golden Prospect Precious Metals

Gold mining used to be “an unloved and overlooked” industry, said Thomas McMahon, head of investment companies research at Kepler Partners, but it “seems to be coming back into its own”.

“While gold has been strong in recent years, the miners have been weighed under by cost inflation – of energy and labour.” This year, however, the share prices of miners have finally started to follow the yellow metal upwards.

“Gold has hit new highs and the miners are benefitting from this, low valuations and falling cost pressures. With geopolitical risk high and rates set to come down, the outlook seems promising for gold,” he observed.

Investors are taking note. BlackRock World Mining was the most-bought investment trust on interactive investor’s platform last month, knocking Scottish Mortgage off its perch.

McMahon finds a much smaller trust, Golden Prospect Precious Metals, to be equally worthy of attention. It “still sits on a 17% discount even after such a strong run”, making the trust “an interesting way to play” the gold mining story, he said.

“Managers Crayfourd and Watson take a highly active approach to the sector, concentrating on the smaller end where the potential returns are higher.”

Prashant Khemka at Ashoka Whiteoak Emerging Markets

Prashant Khemka is not an unfamiliar name but his newest trust, Ashoka WhiteOak Emerging Markets, is building its reputation having launched relatively recently in May 2023.

Josef Licsauer, an investment trust research analyst at Kepler Partners, said: “Khemka boasts a strong track record from his time at Goldman Sachs and has achieved notable success managing Ashoka India Equity, which has consistently delivered sector-leading returns since its launch.”

Ashoka WhiteOak Emerging Markets is a multi-cap portfolio with a focus on small- and mid-caps. “Khemka employs a performance-first culture, designed to maximise alpha through stock selection, whilst minimising volatility,” Licsauer explained.

“This differentiated strategy, including its unique valuation framework, has seen the team add value through stock selection in these under-researched areas.”