Investors preferred passive funds for their equity exposure so far this year, with money mainly flowing to index trackers in all the main equity sectors, data from FE Analytics shows.

The most-bought funds in the first half of 2025 were, with very few exceptions, passive vehicles – this holds true across the Global, UK All Companies, Europe ex UK, North America and Global Emerging Markets sectors.

Within the most-bought active strategies, many were value-focused, which also emerged as a key trend.

Below, we present the data sector by sector.

Source: FE Analytics

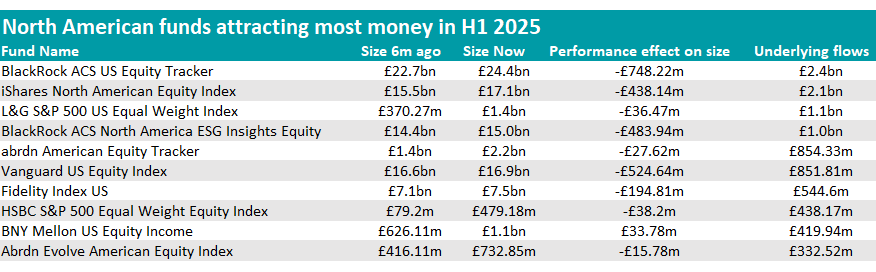

The largest positive flows went into North American funds, where two BlackRock and iShares trackers topped the list with over £2bn inflows over the past six months.

L&G and HSBC were also in the list with their respective S&P 500 equally-weighted index trackers. This index format has become popular with investors looking for a less top-heavy exposure to the American market as allocations are evenly distributed across all the 500 constituents instead of maintaining a bias to the top stocks (Nvidia, Microsoft, Apple, Amazon and Meta).

The only active strategies to feature in this market segment were Kieran Doyle’s BlackRock ACS North America ESG Insights Equity and John Bailer’s BNY Mellon US Equity Income, which respectively added £1bn and £419.9m.

The latter was also the only strategy in the list to make a positive return in the first half of the year. FE Investments analysts rate its “tried and tested process” and its value style, which provides “important diversification away from the growth-oriented US market and average peer”.

“It is a clear positive that each stock position contributes meaningfully to income, rather than an approach combining some growth stocks with some of the highest-yielding names, as the fund is therefore simultaneously a pure-play on the value style whilst avoiding businesses that are in structural decline,” they said.

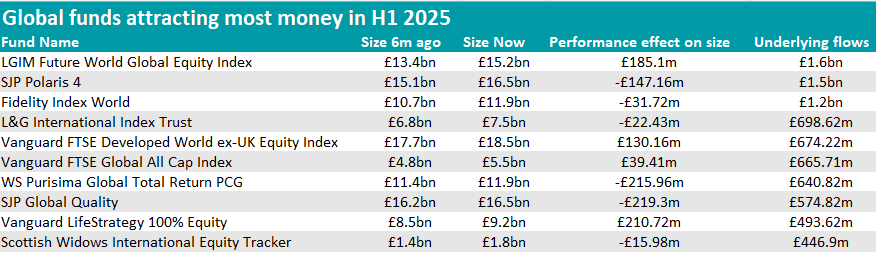

The second-largest inflows across the main equity sectors went into global funds – seven passive and three active portfolios.

Source: FE Analytics

Popular passives included Fidelity Index World and a number of Vanguard funds, including LifeStrategy 100% Equity.

St James’s Place was prevalent among active strategies, with the multi-asset SJP Global Quality as well as SJP Polaris 4 UT, a multi-manager portfolio holding a combination of active and passive investments.

Investors also added £640.8m to WS Purisima Global Total Return.

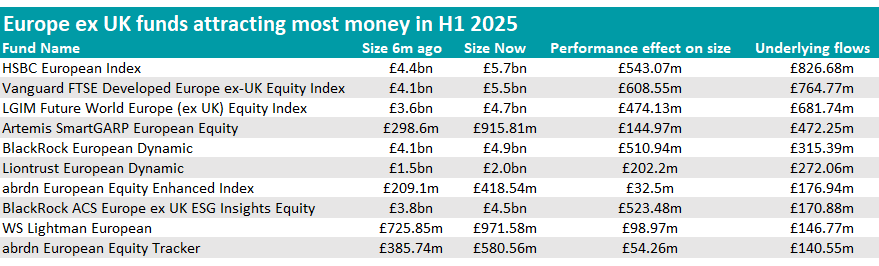

Investor interest towards Europe has grown in 2025, and so have flows to the sector. The passive/active split was six to four.

The HSBC European Index led the pack, attracting £826.7m.

Source: FE Analytics

Of the active strategies, Artemis SmartGARP European Equity stood out, with investors committing £472.25m and frequent mentions on Trustnet for its high information ratio and its decade-long consistency.

Rob Burnett's WS Lightman European is another favourite, with fund pickers having chosen it as one of the European funds to play the continents resurgence, a perfect fund to hold alongside a global tracker and a perfect way to diversify away from a US sell-off.

BlackRock European Dynamic and Liontrust European Dynamic completed the list.

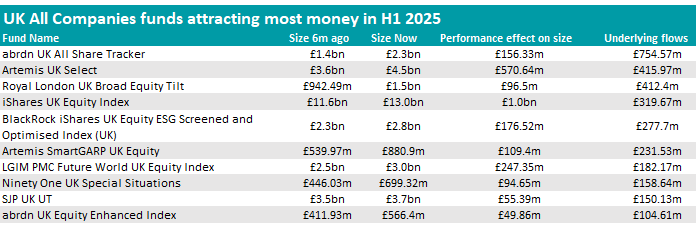

Artemis funds were also a strong choice in the UK, with both Artemis UK Select and Artemis SmartGARP UK Equity making an appearance in the region.

Source: FE Analytics

They were followed by Alessandro Dicorrado’s Ninety One UK Special Situations fund, a value strategy with a maximum FE fundinfo Crown rating of five.

RSMR analysts said they believe the fund can outperform when the value investment style is in favour and praised its “well-resourced and experienced” investment team.

Two passive strategies by Aberdeen – abrdn UK All Share Tracker and abrdn UK Equity Enhanced Index – opened and closed the top 10, with £754.6m and £104.6m added to them, respectively.

The passive Royal London UK Broad Equity Tilt added £412.4m worth of investments. Its main objective is to track the FTSE All Share index but with a carbon intensity at least 10% lower.

As Square Mile analysts noted, this means that the fund's tracking error will increase slightly, however they believed that this “is justified because of the environmental approach taken, while the tracking error will remain within a reasonable range.”

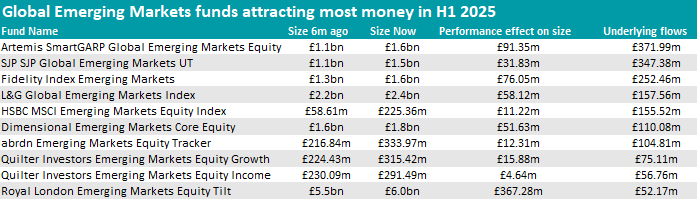

Elsewhere, Artemis, St James’s Place and Fidelity topped the UT Global Emerging Markets ranking, as shown in the table below.

Source: FE Analytics

Other stand-out names included Dimensional Emerging Markets Core Equity as well as the Quilter Investors Emerging Markets Equity Growth and Emerging Markets Equity Income funds, both managed by JP Morgan Asset Management.

The remaining best-selling funds were index trackers.