Large fund houses such as JP Morgan and Liontrust have several under-the-radar UK strategies that investors might be missing out on, according to Trustnet research.

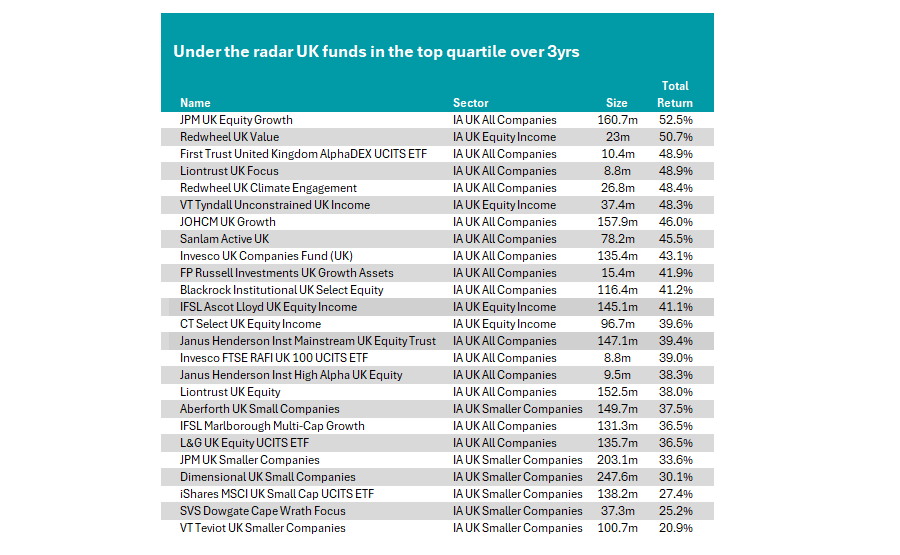

In this series, Trustnet examines the open-ended funds in each market that have delivered top-quartile returns over the past three years but are relatively unknown, with less than £250m of assets under management (AUM). Today, we look at the UK.

Across the three major Investment Association UK equity sectors (IA UK All Companies, IA UK Equity Income, IA UK Smaller Companies), 25 funds match these criteria.

Source: FE Analytics. Returns in sterling as of 30 June

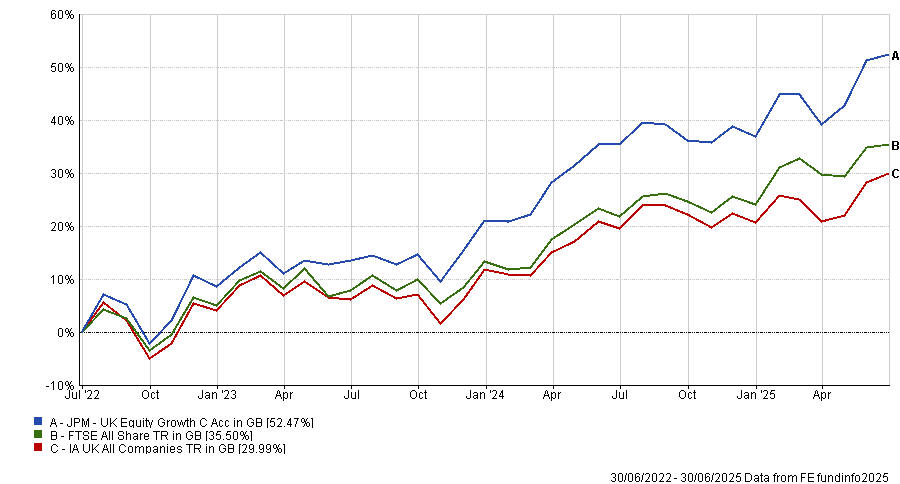

Leading the pack is the JPM UK Equity Growth fund, led by FE Fundinfo Alpha Manager Guy Anderson, who also manages the highly popular Mercantile Investment Trust.

The fund is a multi-cap mandate aiming to invest at least 80% of its assets in UK companies with “superior growth momentum”. As a result, it has major holdings in companies such as Rolls-Royce, which has surged more than 65% this year as defence spending has risen across developed economies.

The strategy is also benefitting from the more positive UK macro environment and its overweight positions in banks and financial brokers, as well as to private-equity and infrastructure trust 3i Group.

As a result of strong returns in both 2024 and 2023, the fund is up 52.5% during our period, beating the FTSE All Share by around 17 percentage points.

Performance of JPM UK Equity Growth vs sector and benchmark over the past 3yrs

Source: FE Analytics. Total return in sterling to 30 June 2025.

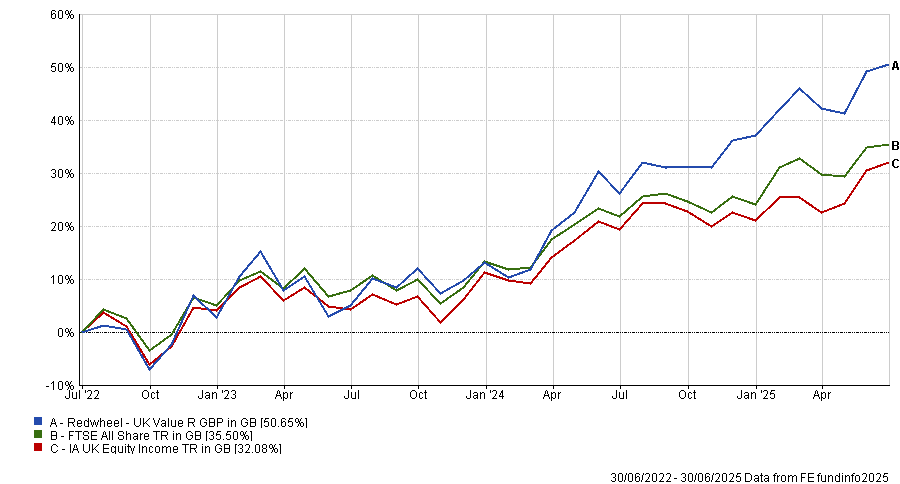

Trailing just behind is the Redwheel UK Value fund, which posted a 50.7% result during this period.

The fund is managed by the experienced Ian Lance and Nick Purves, who have worked together for close to two decades, including their previous tenure at Schroders.

The managers are convinced that value will lead to better prospective results than growth and aim to emphasise balance-sheet strength to avoid being caught by value traps.

Performance of Redwheel UK Value vs the sector and benchmark over 3yrs

Source: FE Analytics. Total return in sterling to 30 June 2025.

This approach has generally worked out, with the fund beating its benchmark, the FTSE All Share over the past one, five and 10 years. Despite these strong returns, it has just £23m in AUM.

Its stablemate, the Redwheel UK Climate Engagement fund, which is run by the same team, posted a return of 48.4% in this period, the fifth-best return in the table. This is the only sustainable-focused mandate on the list, outperforming despite disappointing returns for environmental, social and governance (ESG) funds last year.

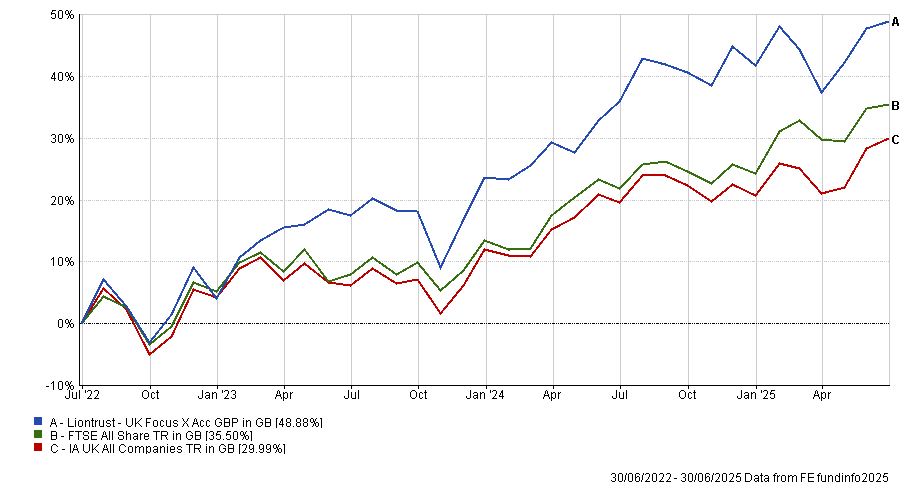

Next up is the Liontrust UK Focus fund, which is up 48.9% during this period, the 10th-best result in the sector.

However, annual performance proved volatile. While both 2023 and 2024 were top-quartile returns in the IA UK All Companies sector, the fund was down 20.6% in 2022, a bottom-quartile result.

So far this year, it has posted a positive absolute return, but failed to outperform the FTSE All Share index, which is surging as investors pivot out of the US following mixed economic data and tariff concerns.

Performance of Liontrust UK Focus vs the sector and benchmark

Source: FE Analytics

The fund’s overweight towards consumer giant Greggs was a drag on recent performance, due to a lack of demand from customers, the team explained in their review of the first quarter of 2025. With UK banks surging this year, the funds underweight towards financials has also been a headwind.

Some smaller-company mandates also performed very well, with the best of the group being Euan Macdonald’s Aberforth UK Small Companies.

Its 37.5% total return beats the average peer in the IA UK Smaller Companies sector by more than 25 percentage points and narrowly outpaced the wider Deutsche Numis Smaller Companies excluding investment trusts index.

Performance of Aberforth UK Small Companies vs the sector and benchmark

Source: FE Analytics

This strategy is the open-ended counterpart of the Aberforth Smaller Companies trust and shares its emphasis on companies priced below their intrinsic value.

Recent manager reports from the end of 2024 argued that UK smaller companies are much better businesses than valuations suggest but are being “priced for irrelevance”.

The recent surge in M&A activity was argued to be a headwind for UK smaller companies, demonstrating that there are several “rational investors, who are prepared to pay substantial premiums to own small UK quoted companies”.