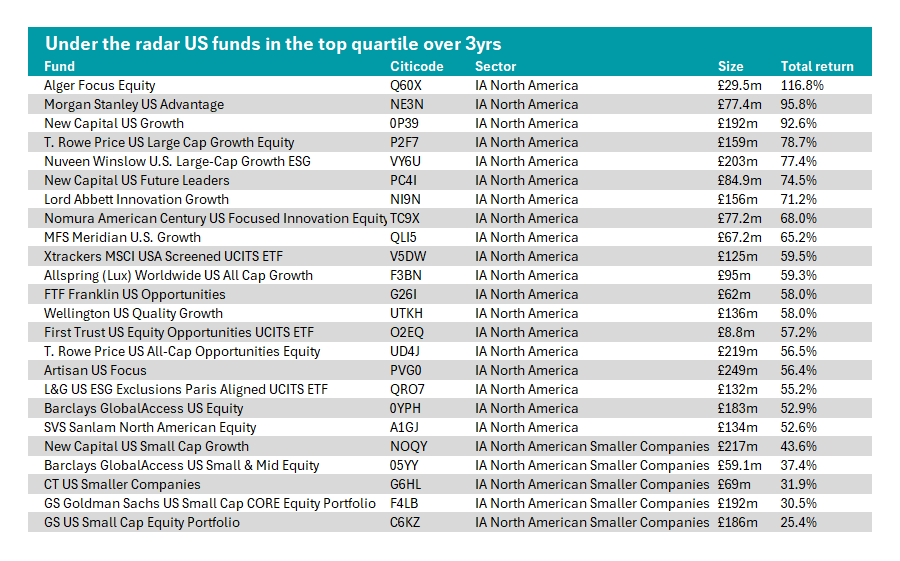

There are 24 ‘hidden gem’ funds in the US that have made top-quartile returns over the past three years yet have failed to grow to behemoth scale, based on Trustnet research.

In this latest series, we look at the top-performing funds with less than £250m in assets under management (AUM). The table below shows the 24 ‘hidden gem’ funds in the US based on these criteria.

Source: FE Analytics. Total returns in sterling.

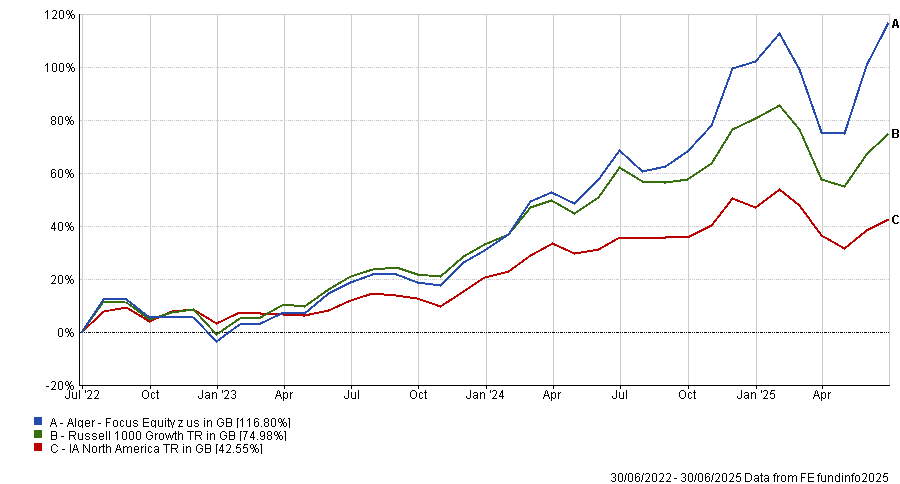

Topping the chart is the Alger Focus Equity fund. Headed up by FE fundinfo Alpha Managers Ankur Crawford and Patrick Kelly, they invest in a portfolio of around 50 companies with promising growth potential.

It targets companies taking market share in high-growth areas, or stocks where factors such as innovation or regulation changes have led to a renewal in earnings growth, following a similar process to its larger stablemate, the Alger American Asset Growth Fund.

Over the three years under consideration, Alger Focus Equity posted a 116.8% total return in the IA North America sector, the top performance in the peer group overall.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics. Data as of 30 June

Speaking to Trustnet earlier this year, Kelly attributed the strong recent results to the fund’s emphasis on innovative companies. With the advance of artificial intelligence in the US creating “big winners and losers”, companies that are not evolving their processes will struggle to compete, he explained.

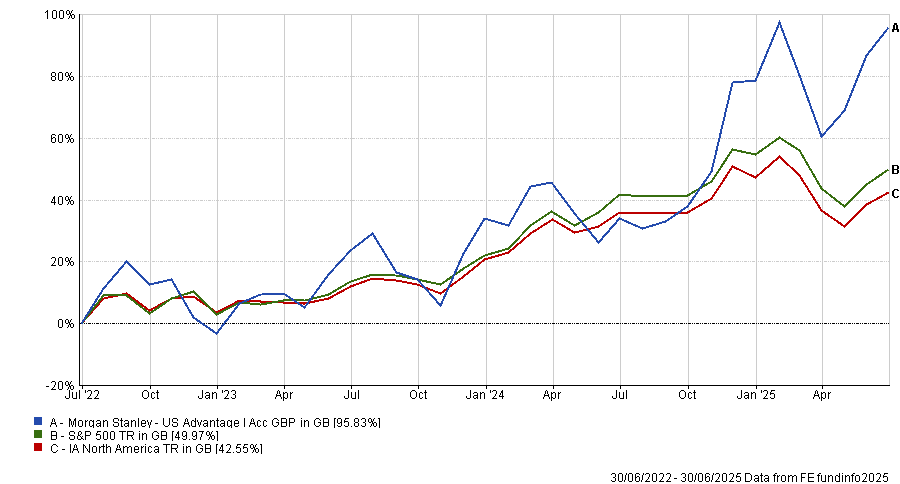

Second place in the table goes to Dennis Lynch’s Morgan Stanley US Advantage Fund. With a 95.8% total return over three years, it is the sixth best performing fund in the IA North America sector, outpacing the S&P 500 by more than 40 percentage points.

The fund targets high quality established companies with strong brand recognition, sustainable competitive advantages, strong current free-cash flow yields and favourable returns on invested capital trends.

Performance of funds vs sector over 3yrs

Source: FE Analytics. Data as of 30 June

Lynch’s strategy has achieved supranormal performance with relatively low allocation towards ‘Magnificent Seven’ (Apple, Nvidia, Microsoft, Tesla, Amazon, Alphabet, Meta) stocks. Of these, Lynch only has a major holding in Tesla, with the rest of the top 10 populated by names such as DoorDash and Mercado Libre.

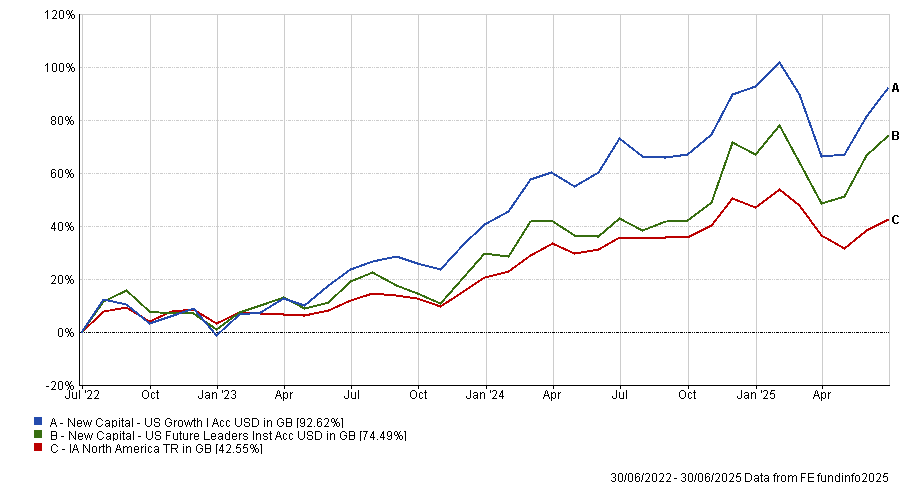

For some asset managers, multiple strategies met our criteria during this period.

For example, Chelsea Wiater and Mike Clulow’s New Capital US Growth Fund and New Capital US Future Leaders Fund both feature in the table above.

Over three years, the former performed slightly better, up by 92.6%. By contrast, the Future Leaders Fund climbed 54.4%. Both funds aim to achieve long-term capital appreciation but take slightly different approaches to their holdings.

Performance of funds vs sector over 3yrs

Source: FE Analytics. Data as of 30 June

The Future Leaders Fund invests in companies such as Cloudflare, Axon and Doordash, while the US Growth Fund holds four of the Magnificent Seven, as well as other high-growth names such as Broadcom and Visa.

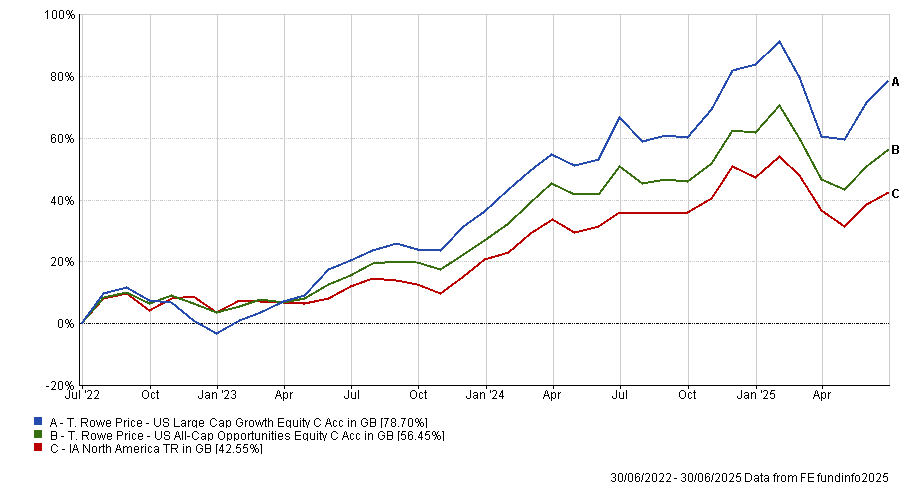

Elsewhere, T.Rowe Price’s US Large Cap Growth Equity fund may have just £159m in AUM, but it is on the radar for analysts at Rayner Spencer Mills, who drew attention to its high-conviction approach of 60-75 companies and high annual turnover of around 40%-75%.

“A key competitive advantage is the depth of the analytical resource at T.Rowe Price, whereby wider coverage allows the sector-specific analysts to focus on 30 to 40 companies each, frequently conducting on-site visits and company management meetings as part of their due diligence process,” they said.

While this has led to more volatility and greater maximum drawdown than the benchmark, it is up by 78.7% over the past three years, narrowly beating its benchmark (the Russell 1000 Growth).

Its stablemate, T.Rowe Price US All Cap Opportunities Equity, also qualified. Managed by Justin White, the fund has delivered a total return of 56.5% over the period.

Performance of funds vs sector over 3yrs

Source: FE Analytics. Data as of 30 June

Investors could also find hidden gems in the small-cap space, with five US Smaller Company strategies delivering top-quartile results with less than £250m in AUM.

New Capital’s Wiater and Clulow added their third strategy to the list with the New Capital US Small Cap Growth fund, which is up 43.6%. This is the best performance in the sector overall; however, results have slid over the past year, with the fund down by 4.2%.

Finally, two strategies from the team at Goldman Sachs qualified – the Goldman Sachs US Small Cap CORE Equity Portfolio and the GS US Small Cap Equity Portfolio, which are up 30.5% and 25.4% respectively.