Japan has proven a challenging market for investors over the decades but the rise in geopolitical uncertainty around the world paired with a swathe of domestic changes and innovations has made value opportunities in Japan more attractive than ever, according to Nicola Takada Wood, managing director of Japan for Asset Value Investors (AVI).

Global trade appears to be a mixed bag. Although a US trade deal was agreed last week with Japan – and another swiftly followed with the EU on Monday – the geopolitical outlook is still shaky with investors looking for opportunities outside of the US.

As the third biggest market in the world, Japan should be drawing more attention than it has, Takada Wood said.

“The long love affair with America looks slightly shaky now and investors are going to be looking for an alternative,” she said.

“In terms of markets that are as liquid and are as deep as the US, there aren’t many out there – especially single country type of markets. Europe is complex, the UK is not nearly as large, and people are wary of investing in China. Meanwhile, Japan is geopolitically aligned with the West and is relatively stable.”

Part of this may be because “investors typically think of Japan as an exporting economy”, but the “most exciting opportunities” are not “wrapped up” in behemoth companies such as Toyota or Hitachi, but in the smaller stocks that have “never had a foreign shareholder before”.

These stocks have been “collecting cash for a rainy day”, without much thought as to what to do with it, she said, but could finally deploy it for the betterment of shareholders.

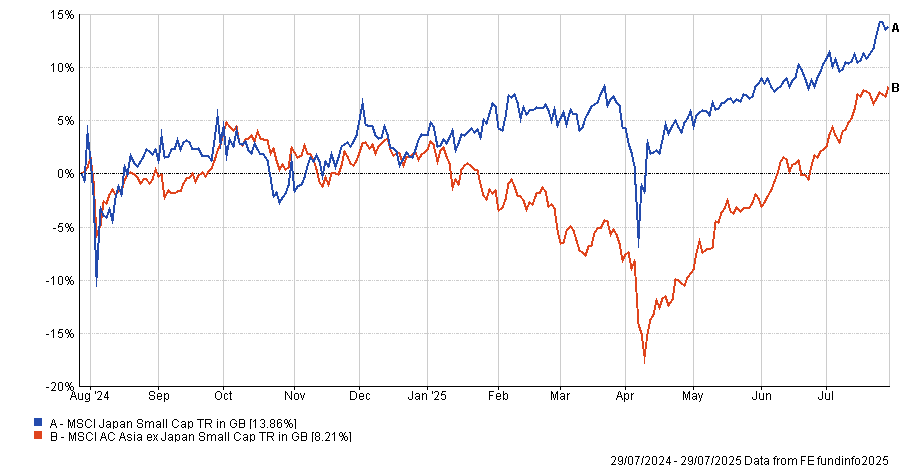

MSCI Japan Small Cap vs MSCI AC Asia ex Japan over 1yr

Source: FE Analytics

Valuations in this part of the market remain attractively low, too, Takada Wood said. Kepler research found that, of Japan’s companies with a price-to-book of less than one, 76% of them are in the small-cap universe.

In addition, around a quarter of Japanese companies have “more than 30% of their market capitalisation in cash”, she said.

There is also an increasingly attractive backdrop to the market thanks to increasing interest rates, wage growth, corporate governance reform and innovations across crucial sectors like healthcare.

One area that remains undervalued is warehousing and logistics, said Takada Wood.

“These logistics companies have prime real estate all throughout the big port cities in Japan and a lot of that real estate is underutilised, or it’s not valued at the correct pricing.”

As an example, the £230m AVI Japan Opportunity Trust holds apparel and hospitality-focused TSI Holdings in its top 10. In January the company owned a building that was worth 30% of TSI Holding’s market cap “and yet it had been on their books at around 2%”.

“It just goes to show how there is so much latent value in some of these companies,” she said.

Plenty of innovation has also been happening in response to Japan’s ageing population, too, Takada Wood said. Sharing Technology (which makes up around 6% of the AVI Japan Opportunity Trust portfolio) prioritises looking after older people.

“If someone has an issue with their home – such as a broken washing machine – then Sharing Technology will find someone locally who can help,” she explained. “It is designed to be a service to help support the elderly.”

In May, the company revised its year-end dividend per share forecast from 30 yen to 40 yen, following a record high both in sales revenue and operating profit in the second quarter of this year.

Fears of history repeating

History has nonetheless provided investors with plenty of reason to be wary, Takada Wood acknowledged.

Japan’s corporate culture has frustrated investors, with issues commonly cited including insularity and an unwillingness to engage with shareholders. As such, the region has suffered from excess cash on the balance sheet with inefficient capital allocation, as well as underutilised assets.

Work has been done over the past decade by the Japanese government and Tokyo Stock Exchange – such as the introduction of a stewardship code and corporate governance code in 2014 and 2015. This has “helped to address these inefficiencies”, she said.

For example, in 2024 the Tokyo Stock Exchange began publishing a monthly list which highlights companies with inadequate disclosures (or English disclosures), as well as those willing to speak to investors.