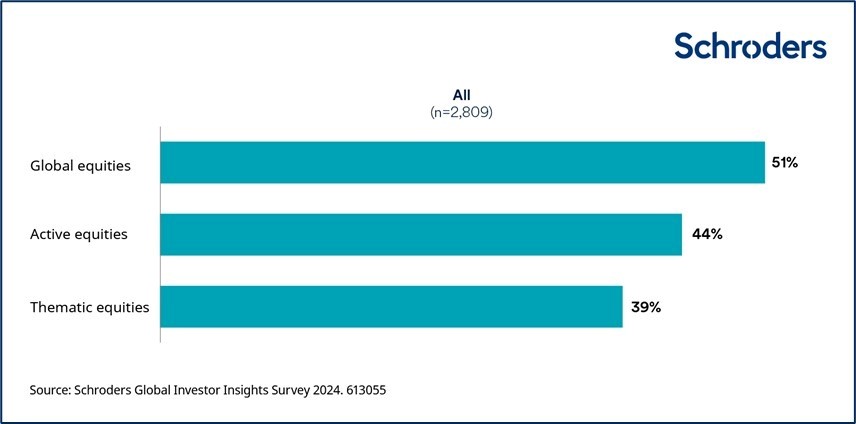

Professional investors are optimistic about global stock markets and half (51%) plan to increase their equity allocations in the next one or two years. What’s more, 44% of wealth managers, financial advisers and institutional investors intend to do so using active managers, the Schroders Global Investor Insights Survey revealed.

This echoes the risk-on sentiment of fund managers themselves, who have increased their equity exposures to 31% overweight this month from 11% overweight in September, according to the latest Bank of America survey.

Alex Tedder, co-head of equities at Schroders, said active managers have the edge when it comes to investing in out-of-favour and attractively valued sectors such as utilities, REITs, biotechnology and alternative energy, all of which could benefit from lower inflation and interest rates.

How do you expect your equity allocation to evolve in the next 1-2 yrs?

Source: Schroders

Thematic equity strategies are gaining in popularity with 39% of respondents putting more money behind them. Almost a third (30%) of professional investors expect to increase their exposure to the energy transition.

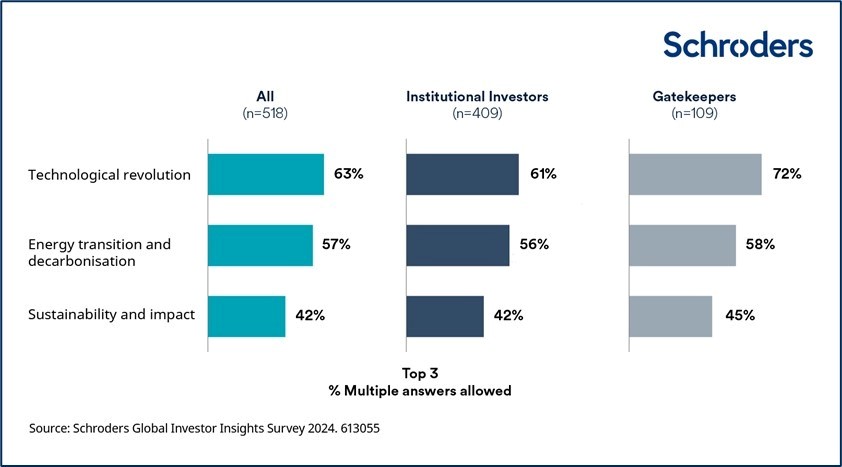

More than 80% of investors already have exposure to private markets or intend to dip their toes into the water soon, in pursuit of higher returns and diversification. Private markets are seen as a way to gain exposure to the energy transition, the decarbonisation shift and the technological revolution, according to Schroders.

About half (53%) of the 2,830 respondents expect to increase their allocations to private equity in the next 12 months, while 45% want to invest more in renewable infrastructure equity and 42% are looking at private debt.

What investment themes are you seeking exposure to via private markets in the next 1-2 yrs?

Source: Schroders

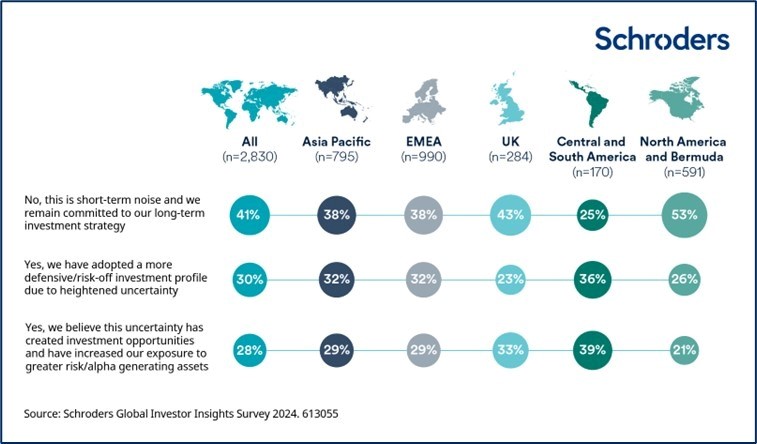

Separately, professional investors around the world were divided by how they are positioning their portfolios ahead of the US presidential election. The largest cohort (41%) is disregarding short-term noise and focusing on their strategic asset allocations, as the chart below shows.

The remaining investors were split almost equally between those taking a defensive stance and those who perceive uncertainty as a buying opportunity and are ramping up their exposure to alpha-generating assets.

Do you believe that the elections taking place globally this year will impact your investment risk appetite/positioning?

Source: Schroders

Several other matters were of far greater concern to investors than elections, including central bank policy (cited by 70% of respondents), high interest rates (68%) and a potential economic downturn (62%). Investors also revealed that global alliances on politics and trade (44%) and high levels of government borrowing (35%) are having an impact on their portfolios.

Schroders’ chief investment officer Johanna Kyrklund said: “Although private sector balance sheets have generally come out of the Covid era in good shape, public balance sheets remain precarious. A key risk to be cognisant of is whether growing debt piles may eventually significantly destabilise bond markets.”