Contested elections, geopolitical tensions, the Covid-19 pandemic and investor apathy have tested European equity managers to the limit in recent years.

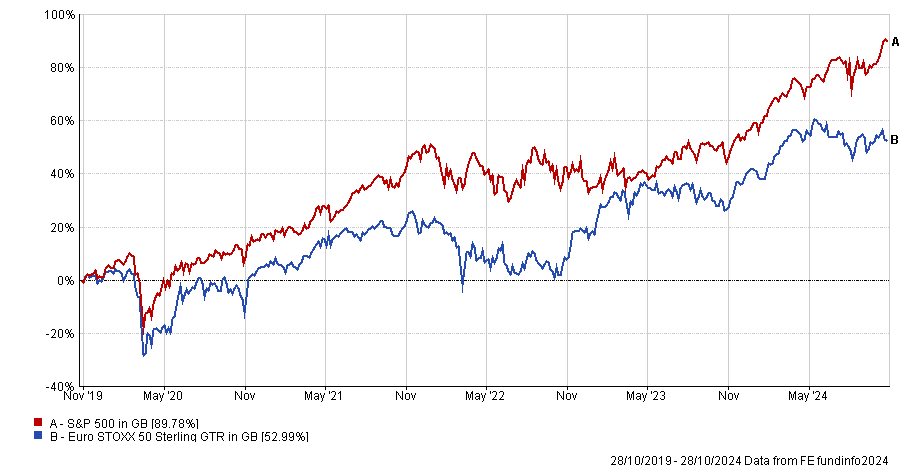

While this is true of many regions, Europe has also struggled by dint of being less exciting than the US. The Euro STOXX 50 has gained a relatively lacklustre 53% over the past five years, compared to the S&P 500's 89.8% rise, as the chart below shows.

For active managers in this challenging market, striking the right balance between risk and reward has been crucial.

Performance of indices over 5yrs

Source: FE Analytics

As part of an ongoing series, Trustnet is focussing on funds with top-decile returns as well as top-decile Sharpe ratios over five years. Below we look at funds in the IA Europe Excluding UK, IA Europe Including UK and IA European Smaller Companies sectors.

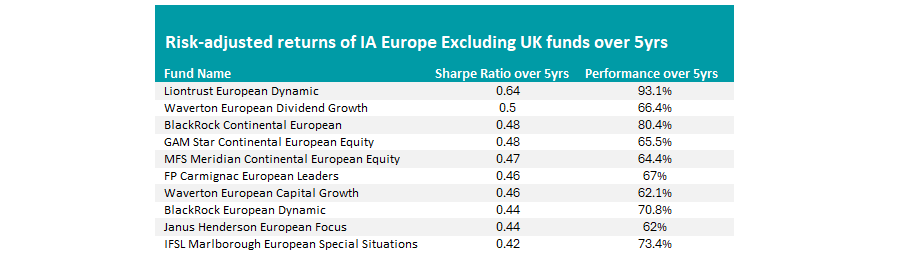

First, in the IA Europe Excluding UK sector, a range of strategies achieved top decile risk-adjusted returns over the past five years.

However, it was the £1.5bn Liontrust European Dynamic fund, led by James Inglis-Jones and Samantha Gleave, which stood out.

Risk-adjusted returns of IA Europe Excluding UK funds over 5yrs

Source: FE Analytics, total returns in Sterling, Data to 30 Sep 2024

Over five years, this portfolio enjoyed best-in-class returns of 90.3%. Given its seventh-decile volatility of 16.5%, it was one of the more 'gung-ho' approaches in the peer group. This higher risk, higher reward strategy resulted in a five-year Sharpe ratio of 0.64, better than its nearest competitor by 0.14.

Moreover, the strategy has enjoyed long-term success with consistent top-quartile returns across other periods. For example, over three years the fund was up by 24.2% and over 10 years it surged by 214.3%.

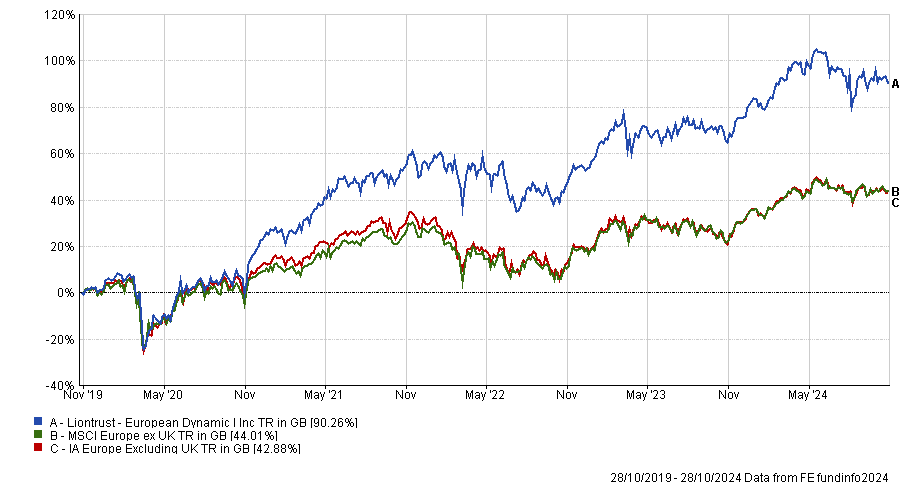

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Due to its consistent success, the portfolio has been awarded an FE fundinfo Crown Rating of five. Analysts at FE Investments said: “The combination of deep quantitative underpinnings combined with intelligent execution and stock picking from two highly experienced investors is very attractive.”

Inglis-Jones and Gleave “have proven their ability to outperform independent of whether the value or growth style is in favour, providing a compelling core offering for investors in European equity”, the analysts continued.

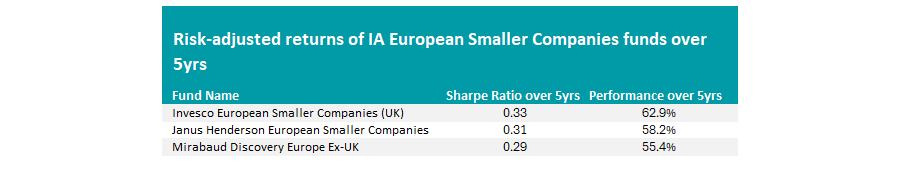

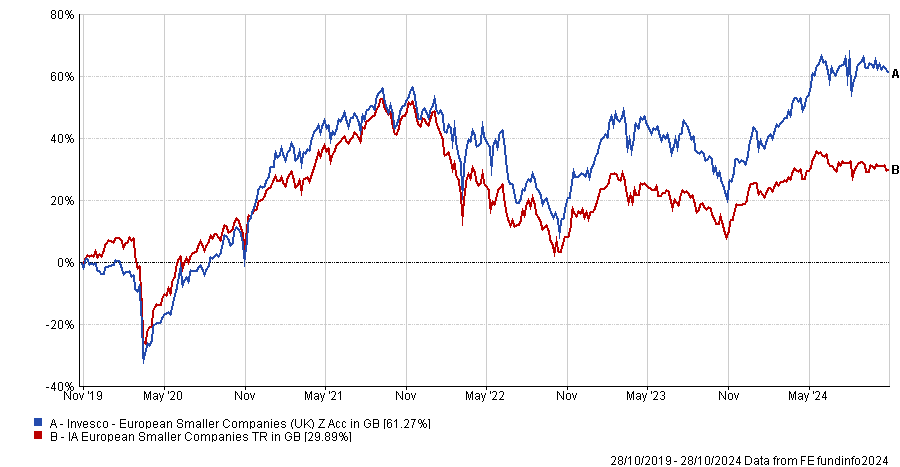

Turning to the IA European Smaller Companies sector, just three portfolios matched our criteria.

Source: FE Analytics, total returns in Sterling, Data to 30 Sep 2024

While the differences between risk-adjusted returns were minimal, this was another sector where more aggressive strategies, such as the £220m Invesco European Smaller Companies portfolio, shined.

Over the past half a decade, it surged by 62.9%, the best performance in the peer group. With an eight-decile volatility of 20.2%, the strategy paired a higher-risk approach with high rewards, leading to the best risk-adjusted returns in the sector of 0.33.

It has replicated these results more recently, ranking in the top quartile for returns over the past one and three years.

Performance of fund vs sector over 5yrs

Source: FE Analytics

However, it has not been smooth sailing for the Invesco strategy over the past five years. Its high volatility approach has led to frequent fluctuations in performance, which may have tested investors' patience. For example, in 2023 and 2021, it slid into the second and third quartiles for calendar year performance.

Moreover, 2019 proved particularly challenging for the fund, which rose in value by just 0.3%, one of the worst results in the sector.

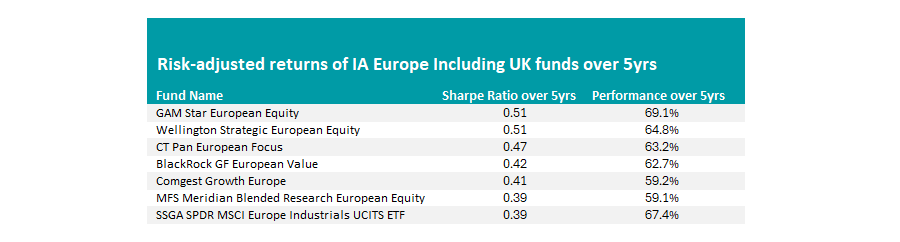

Finally, in the IA Europe Including UK sector, two funds enjoyed the best five-year risk-adjusted returns: the £2.6bn Wellington Strategic European Equity and the €524m GAM Star European Equity funds.

Risk-adjusted returns of IA Europe Including UK funds over 5yrs

Source: FE Analytics, total returns in Sterling, Data to 30 Sep 2024

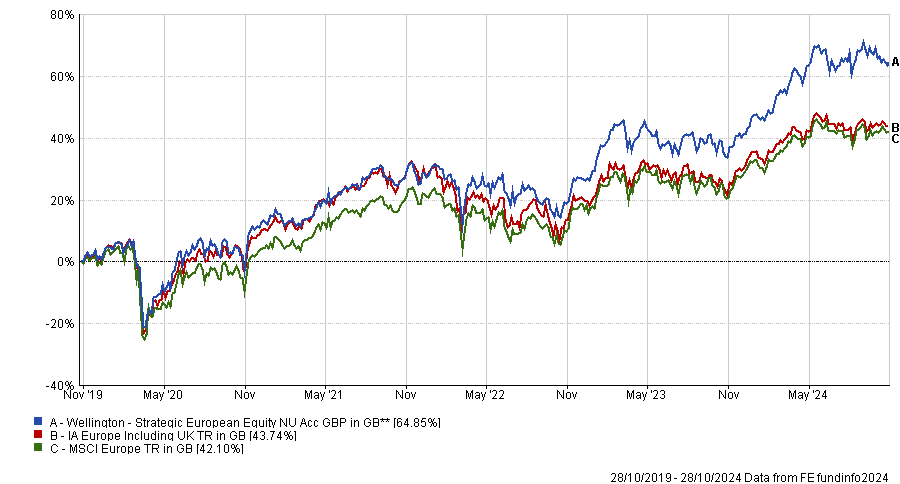

While both funds boasted a five-year Sharpe ratio of 0.51, Wellington Strategic European Equity stood out as one of the most cautious strategies on our list.

At 13.9% volatility, it ranked in the third decile for risk over the past half-decade. Despite a comparatively low-risk approach, it enjoyed some of the best results in the whole sector, climbing by 64.8% over the past five years.

Moreover, the portfolio generated 2.4% in alpha, one of the best results in the sector. This indicated that during periods of strong performance, the fund delivered supranormal returns compared to its benchmark.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

The portfolio successfully replicated these results in the near and longer term. Over 10 years, it rose in value by 184.9%, the fourth-best return in the peer group.

It has enjoyed further top-quartile performance over the past one and three years, rising 22.4% and 27.9%, respectively.

Previously in this series, we have looked at the IA Mixed Investment and Flexible Investments, IA North America, IA Global and the IA UK All Companies sectors.