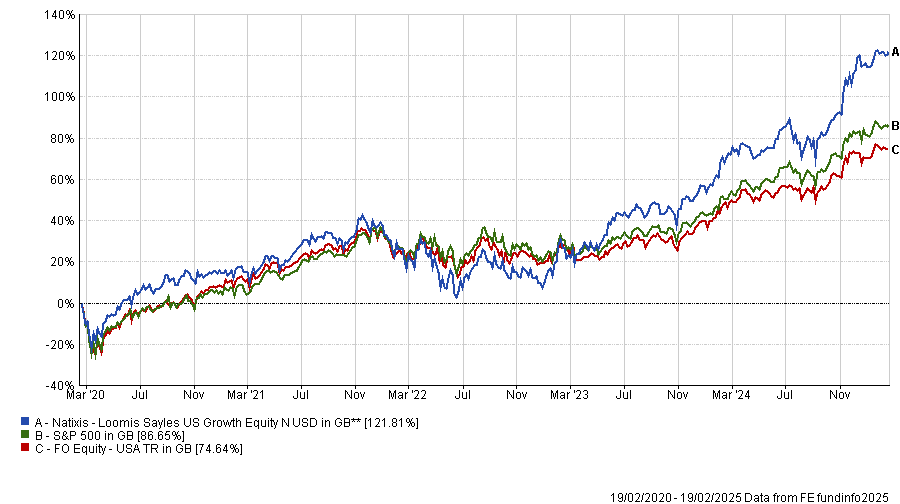

Outperforming the S&P 500 is difficult for even the most skilled fund managers. Over the past five years, the index was up by 86.7%, driven by the leading Magnificent Seven Stocks (Apple, Nvidia, Microsoft, Tesla, Meta, Amazon and Alphabet).

However, while beating the US market is challenging, it is not impossible. Over the past five years, the Natixis Loomis Sayles US Growth Equity, managed by Aziz Hamzaogullari, has surged, returning 121.8% to investors.

In recognition of this performance, Hamzaogullari took home the FE Fundinfo Alpha Manager award in 2024 for US Equities.

Performance of the fund vs the sector and benchmark over 5yrs

Source: FE Analytics

Below, Hamzaogullari explains how he achieved this, arguing what you hold matters less than how you own it, how even the best businesses will underperform and why it is a “fantasy” to think you can successfully trade the Magnificent Seven.

Could you sum up your process in three sentences?

We are an actively managed fund with a long-term private equity approach, investing only in businesses with sustainable competitive advantages and profitable secular growth, which trade at significant discounts to their intrinsic value.

We have these characteristics because we believe less than 1% of all businesses can sustain competitive advantages beyond a decade. This means we are very selective and patient investors – we make only one or two investment decisions per year and our average holding period is 10 years or more.

What differentiates your fund and why should investors pick it?

Firstly, we are long-term investors in businesses. We always say it is not what you own but how you own it. Roughly half of our holdings have been in the portfolio for over 10 years. For example, we have owned Amazon since 2006. During this period, more than 9,000 funds owned Amazon at one point or another, but just 57 held it for the same time as us.

We think focus matters. Not only do we want to hold names for the long term but we want to hold significant positions in them. This long-term focus means we have outperformed in rising and falling markets and ranked between the first and third percentile for alpha generation, Sharpe ratio and information ratio.

Has this short-term approach become more common amongst competitors?

The best evidence for us is the study of our peer group. For example, take a company such as Visa, which we have held for over 10 years.

Around 8,854 funds participated in its IPO (initial public offering) in 2008, but just 0.4% of them have held it since inception, which means 99.6% of managers prefer to trade quarter to quarter, believing they will somehow do better.

Another thing is that the average growth manager now has a portfolio turnover of around 80%, which means a growth manager might completely change their portfolio in a year.

You have never owned Apple but own the rest of the Magnificent Seven – why?

We have never owned Apple and, as far as I know, are one of the only growth managers to outperform the Russell 1000 Growth index by 100 basis points or more despite that.

Investors are fascinated with the Magnificent Seven because of the performance of these names, but they should consider not just what a manager holds currently but what they have held through time. Again, it is not what you own it is how you own it.

Our research found that 7,609 managers have owned Meta at some point, but their returns differ from ours because they traded the stock while we owned it. When Meta was down by 62% in 2022 and was the worst stock in our portfolio, we bought even more while other managers were selling it.

Investors have this fantasy they can trade these names effectively but their track record shows this does not work.

What was your best performing holding last year?

Our top three last year were Nvidia, Netflix and Meta. These are interesting because they are all driven by very different things. Nvidia is motivated by the demand for artificial intelligence (AI), whereas Meta is driven by a demand for online advertising and Netflix by the shift from TV to streaming.

Respectively, they were up by 171.1%, 66% and 83% last year.

And your worst?

Last year it was Monster Beverage, Expeditors International and Boeing. These have very different business drivers and cashflows. For example, Monster Beverages is driven by long-term demand for energy drinks, Expeditors because of increased emphasis on international trade and logistics, and Boeing by developments in aviation.

Boeing was by far the worst-performing name, down by about 32%, then Expeditors at 12% and Monster Beverage at 8.7%.

But the crucial point is even if you pick the best businesses if you look at them over a 10- or 20-year timeframe, there will be periods of underperformance.

What do you do outside of fund management?

I go cycling with my friends, travelling with my family and I play tennis with my wife.