Asia Pacific continues to be a volatile region for investors. While emerging market and Asian funds have been long out of favour, developments this year such as an improved economic backdrop and the recent stimulus package in China have kick-started a new wave of interest.

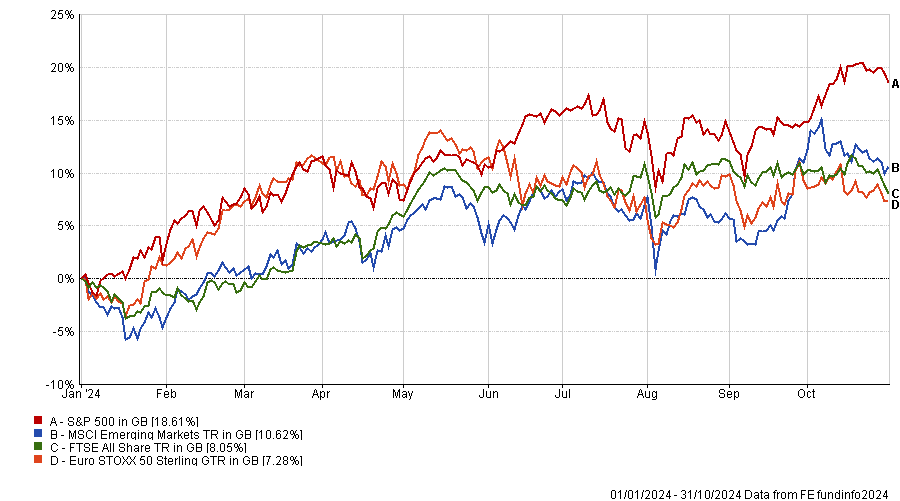

Year to date, emerging markets have done quite well, rising by 10.6%. By comparison, this is eight percentage points below the performance of the S&P 500, although it surpasses the Euro STOXX 50 and the FTSE All Share.

Performance of indices year to date

Source: FE Analytics

As with any region, investors are keen to ensure they are seeing the maximum returns for the risks they take. In emerging markets, the more defensive strategies thrived, achieving high returns while taking low to moderate risks.

In the final part of our ongoing series, Trustnet analyses the funds that have struck the best balance between risks and rewards over the past five years by comparing their Sharpe ratios and returns.

Today, we end the series by looking at the funds with the best risk-adjusted returns in emerging market equities and Asia Pacific.

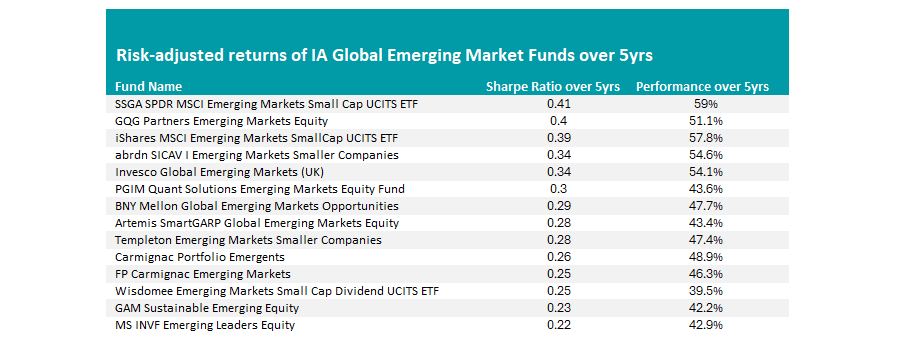

Risk-adjusted returns of IA Global Emerging Market funds over 5yrs

Source: FE Analytics, total returns in sterling, data to 31 Oct 2024

In the IA Global Emerging Markets sector, many funds enjoyed an above-average return on investment. In particular, the £2.2bn GQG Partners Emerging Market Equity fund stood out due to its low-risk approach compared to its peers.

With a 12.7% volatility over the past five years, it was one of the sector’s most risk-averse funds, ranking in the first decile. Despite taking on relatively low risks, the fund did not sacrifice its ability to deliver strong performance, rising by 51.1% - the fifth-best performance in the 141-strong sector.

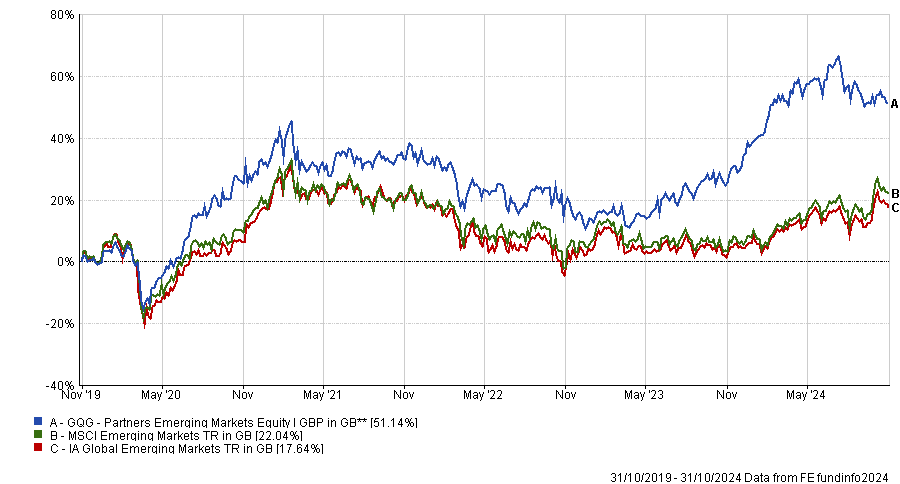

Performance of fund vs sector and benchmark

Source: FE Analytics

As a result, the fund enjoyed the sector's second-best five-year Sharpe ratio of 0.4.

Moreover, the fund’s strong relative performance has continued, with first-quartile returns over the past three years and one year.

Additionally, the fund enjoyed the second-best ranking for alpha generation in the sector, with an average of 5.5% over five years. This indicates that despite being a relatively less volatile strategy, it was still able to deliver beat the benchmark by a wide margin.

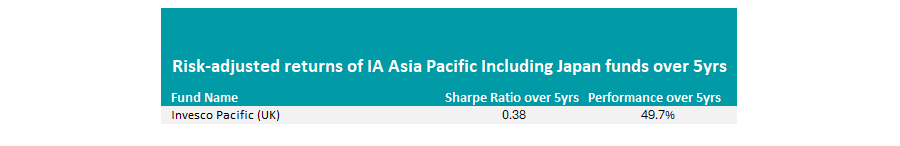

Risk-adjusted returns of IA Asia Pacific Including Japan funds over 5yrs

Source: FE Analytics, total returns in sterling, data to 31 Oct 2024

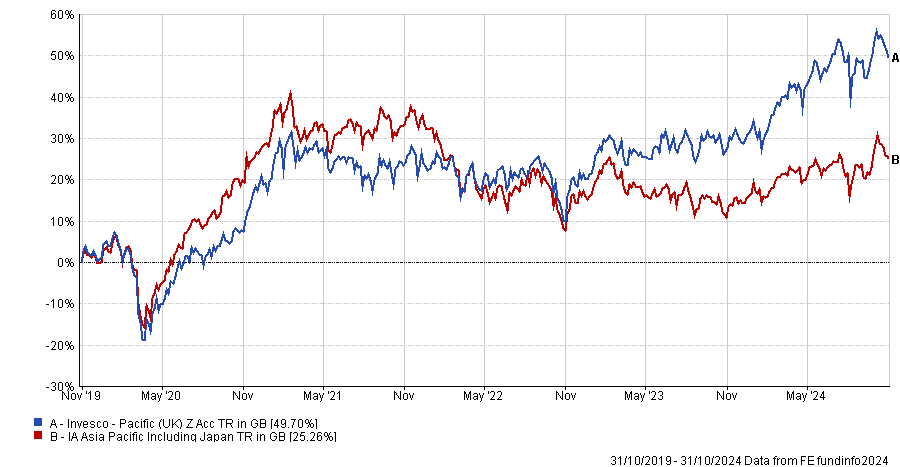

Next, we move on to the IA Asia Pacific Including Japan sector, in which the £330m Invesco Pacific (UK) fund was the only portfolio that matched our criteria.

Led by Tony Roberts and FE fundinfo Alpha Manager William Lam since 2013, the fund climbed by 49.7% over the past five years, the best performance in the peer group. Over the longer term, it has continued this record with a 10-year performance of 150.8%, also placing it as the best-performing fund in the sector.

Performance of fund vs sector over 5yrs

Source: FE Analytics

Similarly to the GQG Partners portfolio, it achieved this while being one of the most cautious funds in the sector, with a top decile five-year volatility of 12.8%. This combination of low risks but impressive returns generated a Sharpe Ratio of roughly 0.38 over half a decade.

Moreover, in this period it proved to be one of the best funds at generating excess returns, with 3.9% alpha on average, the single best result in the sector.

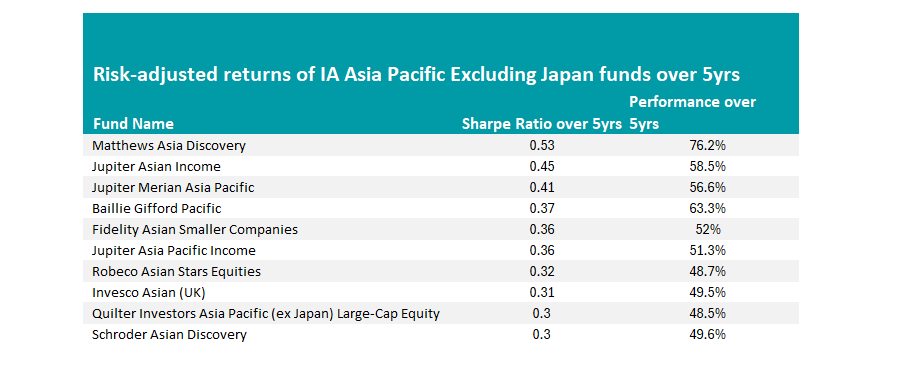

Risk-adjusted returns of IA Pacific Excluding Japan funds over 5yrs

Source: FE Analytics, total returns in sterling, data to 31 Oct 2024

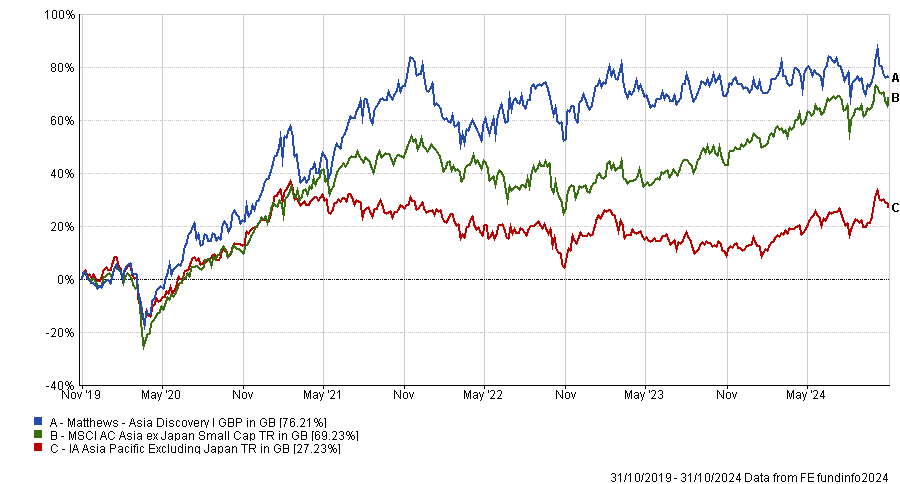

Finally, we turn to the IA Asia Pacific Excluding Japan sector. In this peer group, it was a more aggressive strategy, the £101m Matthews Asia Discovery fund, which stood out.

The portfolio rose by 76.2% over the past five years, the best result in the sector by over 13%. Paired with a modest sixth decile volatility of 15.9%, the fund has enjoyed the best five-year risk-adjusted returns of 0.53.

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics

Longer-term it also achieved first-decile results, surging by 147.2% over the past decade.

Looking at its ratios, it proved to be one of the best strategies for protecting clients’ investments. With the third-best maximum drawdown of -18.3% and the fifth-best maximum gain of 21.1%, it proved to be one of the best funds in the sector over five years.

However, the portfolio has struggled recently and was the worst performer in the peer group over the past year.

In the rest of this series, we have looked at the IA European and European Smaller Companies, IA Mixed Investment and Flexible Investments, IA North America, IA Global and the IA UK All Companies sectors.