BlackRock has launched an exchange-traded fund (ETF) investing in the 20 largest US companies, enabling European investors to gain targeted exposure to America’s mega-caps cheaply. The iShares S&P 500 Top 20 UCITS ETF has an expense ratio of 0.2% and will be listed on the London Stock Exchange, Euronext Amsterdam and Xetra.

The launch comes as BlackRock’s portfolio managers expressed positive views on US equity at the firm’s 2025 outlook forum last week. Even though valuations look steep, BlackRock’s managers believe US exceptionalism – strong economic and corporate earnings growth – has more room to run.

Jean Boivin, head of the BlackRock Investment Institute, said: “The contrast with lagging European economic growth, and stock performance, remains stark.”

Artificial intelligence (AI) has been a significant factor propelling the mega-cap tech companies at the top of the S&P 500. “Quantifying AI’s longer-term economic impact remains challenging, but we think AI has the potential to eventually reshape economies and boost economic growth,” Boivin said.

AI is also a major reason why BlackRock is overweight US equities. “Valuations for AI beneficiaries are supported as tech companies keep beating high earnings expectations,” he said. “Falling inflation is easing pressure on corporate profit margins.”

The firm is also seeking investment opportunities amongst AI beneficiaries outside the tech sector.

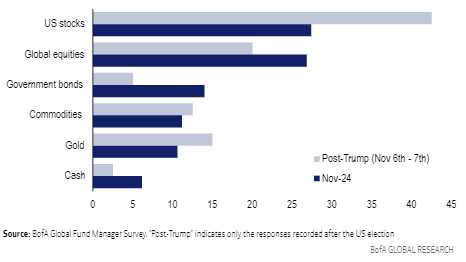

BlackRock is not alone in its bullish outlook for the US stock market. BofA Securities conducted a survey of global fund managers after Donald Trump’s election victory last week, and 43% predicted that US equities would be the best-performing asset class next year.

Trump’s victory swayed sentiment significantly. In a similar survey conducted by BofA just before the election, 27% of the 213 respondents predicted the US would outperform next year.

Which of the following do you expect to be the best-performing asset class in 2025?

This confidence played out in the stock market as US equities enjoyed their largest weekly gains of the year last week. “Markets welcomed the decisive result that took some near-term uncertainty off the table – even as medium-term policy uncertainty remains,” Boivin said.

At the start of November, a net 4% of fund managers told BofA they expected the global economy to weaken. However, after the presidential election, a net 23% said they were forecasting a stronger global economy – the most optimistic result since August 2021.

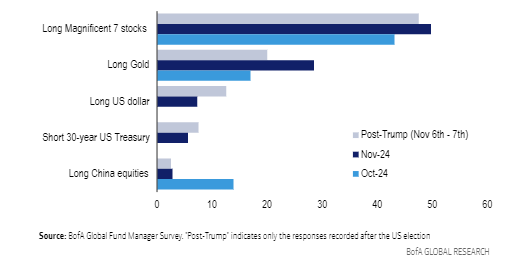

Going overweight the Magnificent Seven is still the most crowded trade in fund management, according to BofA’s global fund manager survey, released yesterday. And it has been an incredibly profitable trade. The 20 largest companies in the S&P 500 have contributed more than two-thirds (68%) of the index’s return over the past three years, according to BlackRock.

What fund managers currently think is the most crowded trade

To further illustrate the dominance of mega-caps, the largest eight US-listed companies now have a combined market capitalisation of $15trn – which was the value of the entire US stock market back in 2000.

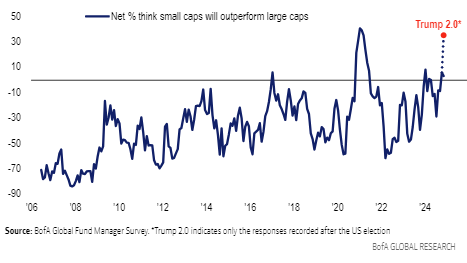

However, the relative performance trajectory of large-caps versus small-caps could soon shift. Small-caps posted strong returns during the post-election rally and Trump’s policies of ‘America First’ and deregulation are expected to favour domestically focused smaller businesses.

Net % of fund managers who think small-caps will outperform large-caps

Following the election, a net 35% of fund managers told BofA they expect small-caps to outperform large-caps, the most since February 2021. At the start of November, a net 3% of managers said they expected small-caps to outperform large-caps.