An increasing number of experts are predicting a recovery in the battered infrastructure sector. This week, Nils Rode, chief investment officer at Schroder Capital, said valuations have finally been reset and infrastructure equities now offer attractive yields.

He joins a long list of experts who have been positive about the asset class since this summer, from BlackRock to Bestinvest. Infrastructure trusts were also seen as key beneficiaries from Rachel Reeves’ Budget.

“Infrastructure equity is offering potential for high income and attractive yields, driven by the increasing economic viability, established cash flows and inflation correlation available in renewable energy assets,” Rode said.

“The supply-demand gap between available capital and renewable project development needs to meet net zero commitments, presenting opportunities for strategies that benefit from active management and the potential for enhanced cash flows across the energy transition spectrum.”

Shayan Ratnasingam, senior research analyst at Gravis, said the VT Gravis UK Infrastructure Income fund is particularly interested in investment companies with a high degree of long-dated, contracted and inflation-linked income streams, providing attractive dividend yields.

“We also prefer companies that offer the potential for growth income rather than fixed income,” he said.

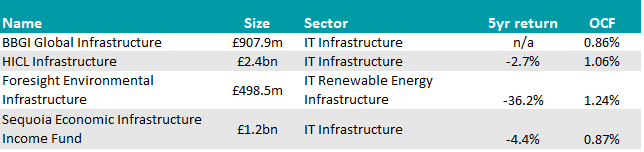

Below, he selected three trusts from the Gravis portfolios, all of which provide exposure to multi-sector infrastructure projects across the energy transition, communications, digital infrastructure and social and transport infrastructure. They “have remained resilient through several investment cycles and market shocks”, he said.

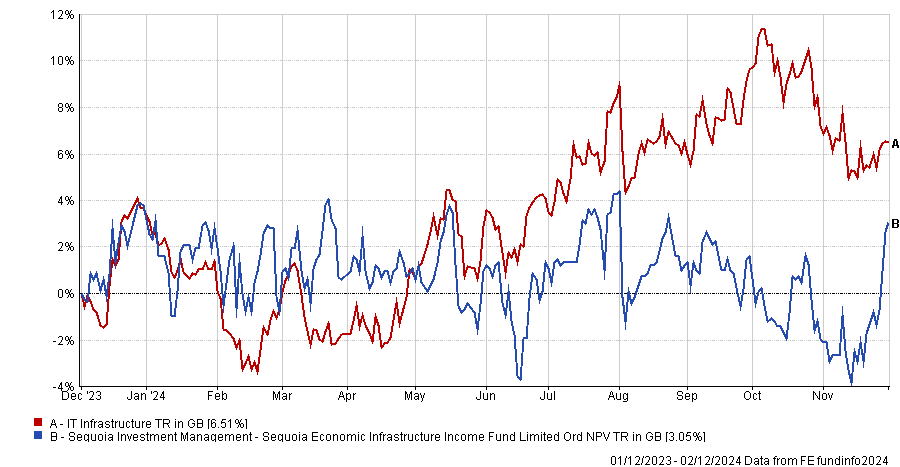

Sequoia Economic Infrastructure Income

First up was Sequoia Economic Infrastructure Income. The “relatively short maturity profile of its high-yield portfolio” allows the investment manager to “capture prevailing market interest rate dynamics and broader credit conditions”, Ratnasingam explained.

Performance of fund against sector and index over 1yr

Source: FE Analytics

In the recent past, the portfolio was positioned to capture rising interest rates, tilting towards floating rate loans whilst maintaining exposure to senior secured debt. Now that rates have peaked, the manager has been active in repositioning the portfolio towards more fixed-rate debt, locking in higher interest rates.

“The Sequoia trust offers a unique opportunity to invest in bilateral loans and ‘club’ deals through a consortium of institutional lenders, providing access to diverse sectors such as energy transition, digitalisation, and transport infrastructure,” Ratnasingam said.

This strategy has resulted in a resilient credit portfolio, evidenced by a low loss rate, and is currently trading at a 21% discount with a yield of 9.3%.

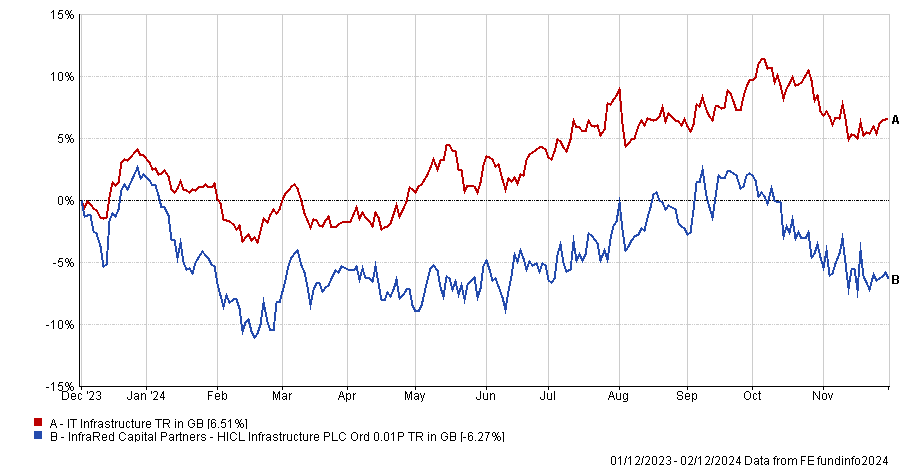

HICL Infrastructure

Going into 2025, HICL is “on a robust footing” after de-leveraging its balance sheet.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Over the past 18 months, HICL has reshaped its portfolio through £500m in asset disposals of lower-yielding investments and has been investing in growth areas such as digital and communications, notably through its stakes in the French fibre-to-the-home platform Altitude and New Zealand’s mobile tower platform Fortysouth.

Fundamentals remain strong despite some headwinds, including potentially higher discount rates if gilt yields remain elevated, a regulatory price reset and a review of the water sector impacting Affinity Water, commissioned by the new Labour government.

“With improving dividend cover nearing the board’s target of 1.10x and a 22% discount paired with a 6.76% yield, HICL looks attractive,” said the analyst.

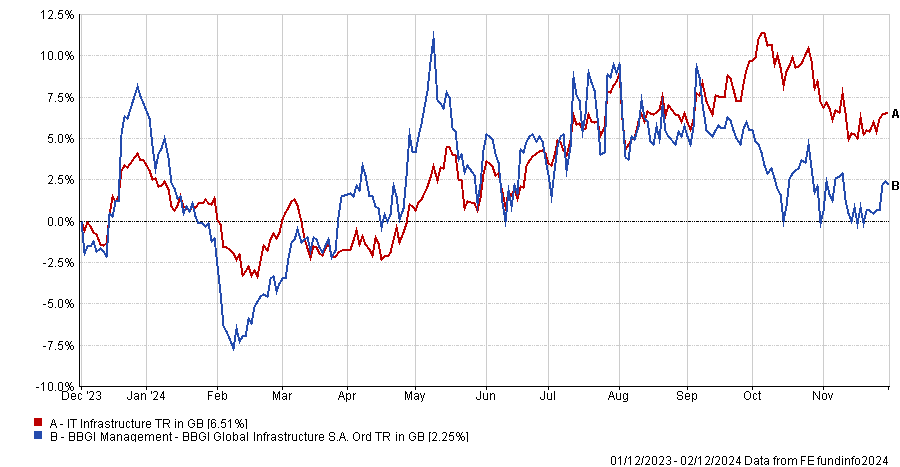

BBGI Global Infrastructure

BBGI Global Infrastructure was singled out for its “super-core” infrastructure exposure, which provides “defensive income underpinned by stable and predictable availability-based public sector-backed contracted revenues”.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Unlike its peers, BBGI has not needed to de-leverage and maintains a positive net cash position. The highly contracted nature of the portfolio gives it the visibility to deliver income growth with 6% dividend growth in 2024 expected to be 1.3x to 1.4x covered, and an additional 2% growth in 2025.

“The contractual indexation of projects further supports real dividend growth,” Ratnasingam said.

“Overall, the trust warrants trading at a tighter discount than peers due to its lower risk profile.”

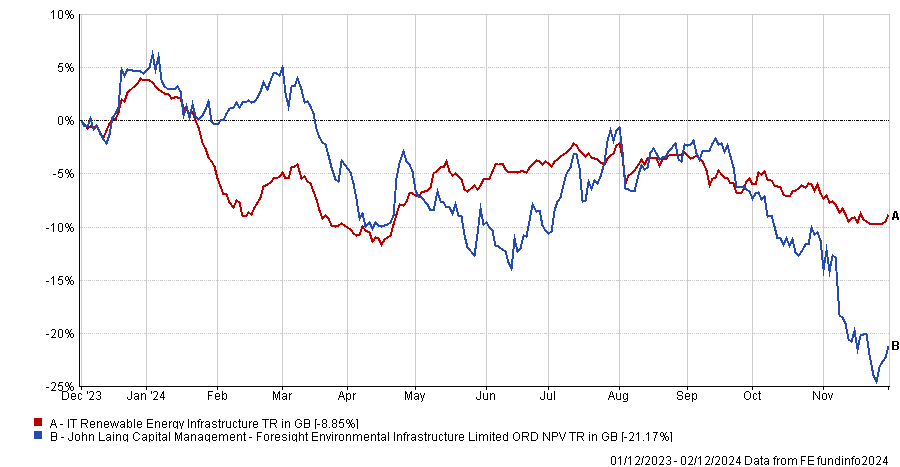

Foresight Environmental Infrastructure

Moving into the IT Renewable Energy Infrastructure sector, QuotedData analysts highlighted Foresight Environmental Infrastructure.

The trust released its results last week, as its operational assets pumped out record cash receipts, but the net asset value (NAV) took a hit as green hydrogen developer HH2E entered administration.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Despite uncertainties, QuotedData stressed that the trust has a lot going for it, including a more positive stance from the Labour government on the renewable energy sector, whose fundamental growth story remains strong, and energy prices fixed on the majority of portfolio.

The Foresight trust also has one of the broadest remits of the 21 companies in its peer group, most of which are focused on solar, wind or some combination of the two, and is one of the larger funds in the sector.

The substantial de-rating of its shares over the past month has seen its discount move from one of the narrowest in the sector to middle of the pack.

“Although disappointing, the limited exposure of the HH2E investment (2.6% of NAV), the diversification of its wider portfolio and the fund’s long-term record – ranking highly in NAV terms over longer periods – make its current discount attractive,” QuotedData analysts said.

“Wide discounts have distorted yields across the sector. Nevertheless, the 10.4% dividend yield on Foresight Environmental Infrastructure is highly attractive and offers shareholders a compelling reason to wait.”

Source: FE Analytics