The consensus forecast for next year involves a soft landing in the US and a reacceleration of growth.

For example, Schroders’ group chief investment officer Johanna Kyrklund summed up her 2025 outlook as follows: “Leaving aside political risks, the economic backdrop remains benign. Inflation has moved in the right direction and interest rates are falling in the US and Europe. We expect a soft landing and our expectation is that growth will reaccelerate as we move through 2025.”

Yet some contrarian voices are sounding warning bells. Market concentration and stocks that are priced for perfection are high among their concerns. Goldman Sachs and CG Asset Management (which manages the Capital Gearing Trust) have warned that returns from US equities could be as low as 3% per annum during the coming decade or even shallower.

This presents investors and fund pickers with a conundrum as some fund managers are positioned for sunny skies and continued growth, while others are reaching for tin hats.

Below, Trustnet asked fund selectors which equity funds they would choose for optimistic investors who agree with Kyrklund and tomorrow morning, we will return with a list of managers who are focussed on downside protection.

We begin with John Moore, a senior investment manager at Brewin Dolphin, who thinks artificial intelligence (AI) will trigger a maelstrom of change and a rich opportunity set for active managers.

Against that backdrop, he suggested GQG Partners US Equity, a high-conviction fund with a high turnover and an opportunistic approach.

Earlier this year, the fund was overweight technology but then sold down its tech holdings and bought healthcare and consumer stocks, which Moore described as a “brave call”.

“That ability to be flexible and tactical sits well with a world that’s changing,” he said.

The $1.9bn fund is run by three FE fundinfo Alpha Managers, Rajiv Jain, Brian Kersmanc and Sudarshan Murthy.

Its largest holding was Eli Lilly as of 31 October and Novo Nordisk also resided within its top five positions. Both companies are benefitting from a surge in demand for obesity, diabetes and weight loss drugs. The fund still has significant tech exposure, with Meta Platforms, Nvidia, Microsoft and Netflix amongst its top 10.

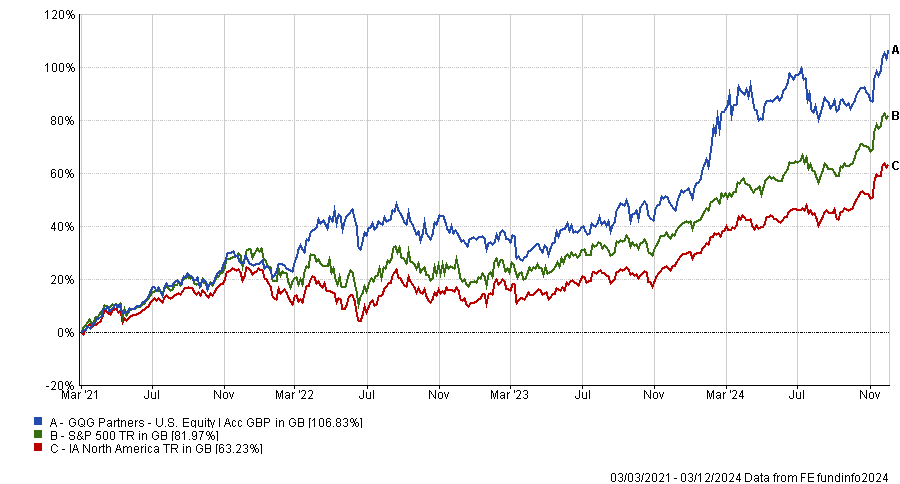

Performance of fund vs benchmark and sector over 5yrs

Source: FE Analytics

Moore also highlighted JPMorgan American, which balances growth and value plays. The trust can lean into technology and chase innovation, but its value-oriented names such as Capital One and McDonald’s help balance the books whenever growth sells off.

Having two distinct opportunity sets gives the trust more ways to make money in the deep and broad US equity market, where the pace of change is significant, he said.

Active managers will need deep research resources, stock-selection skills and flexibility in this environment, he added.

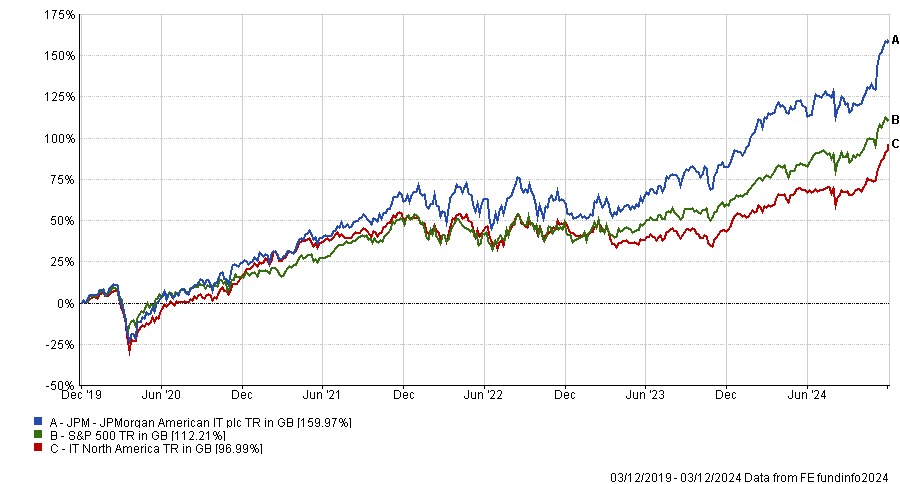

Performance of trust vs benchmark and sector over 5yrs

Source: FE Analytics

One asset class that would benefit significantly from a soft landing is US small-caps, said Charlie McCann, an investment research analyst at Square Mile Investment Consulting & Research. “Additionally, if Trump’s policy is more protectionist in nature, favouring US-manufacturers, this would also present a tailwind for smaller, domestic businesses in the US.”

He tipped Artemis US Smaller Companies, which has proven successful across a range of market conditions and is managed by an accomplished investor in Cormac Weldon.

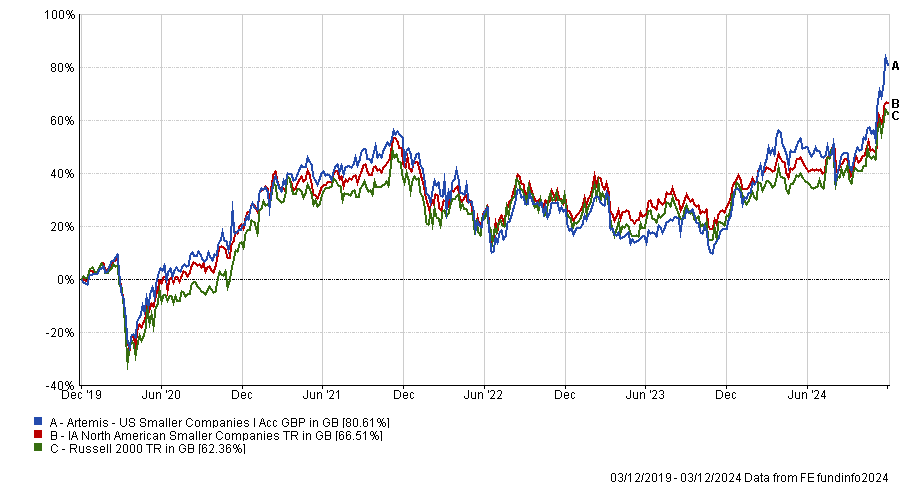

Performance of fund vs benchmark and sector over 5yrs

Source: FE Analytics

Artemis US Smaller Companies was one of the 10 best-selling funds on the Fidelity Personal Investing platform last month as investors responded to Trump’s election victory.

McCann also chose T. Rowe Price Global Focused Growth Equity, which invests in strong companies worldwide with improving returns on capital.

Performance of fund vs benchmark and sector over 5yrs

Source: FE Analytics

With its overweight to technology stocks, this fund should outperform if the current macro and market backdrop persists into 2025 and if AI stocks continue to lead market returns, he explained.

The fund is managed by David Eiswert, who holds five of the Magnificent Seven in his top 10: Microsoft, Nvidia, Apple, Amazon and Meta. He also owns the Taiwan Semiconductor Manufacturing Company (TSMC) and Advanced Micro Devices and his largest position is Eli Lilly.