Next year looks set to be an eventful, uncertain and potentially volatile one. As Donald Trump takes the reins of power with a strong mandate for change from the American people, his policies and their impact will ricochet around the world.

But that is not to say financial markets will suffer – far from it. Kate Morrisey, head of asset allocation at Evelyn Partners, expects global growth to accelerate next year and US equities to perform strongly.

“It is well known that Trump views the US stock market as one of the most important barometers of economic performance and, as such, he will look to implement supportive policies,” she said.

“This includes maintaining or even reducing an already low level of corporate taxation. He is also expected to slash bureaucratic red tape which could facilitate greater innovation and efficiency, with a resulting boost in productivity.”

However, tariffs, immigration policies and high government debt could be headwinds, she added.

Against this backdrop, Trustnet asked asset and wealth managers to explain which funds they are adding to their portfolios to take advantage of the opportunities they expect to prevail next year.

De Lisle America and the Mobius investment trust

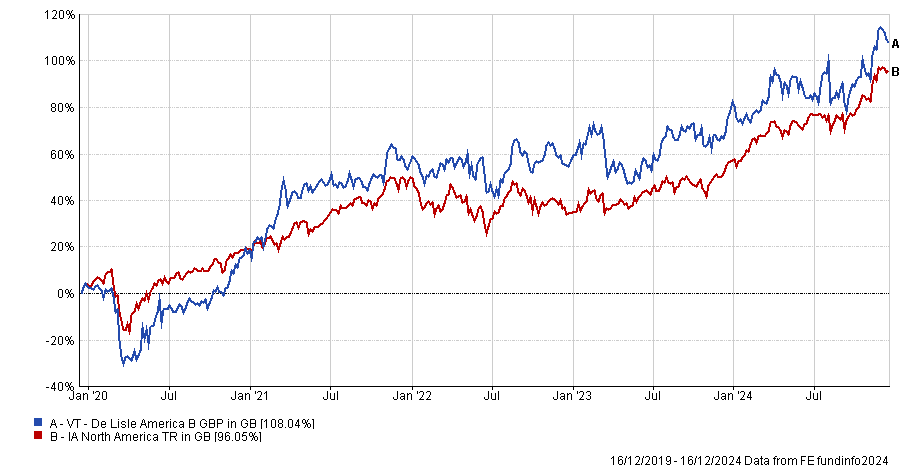

Edward Allen, private client investment director at Tyndall Investment Management, chose De Lisle America for its exposure to US small- and mid-cap value. He expects US companies to benefit from the Republican agenda but “with fireworks expected in the White House and with large-cap valuations trading at all time hights, a value bias seems a more risk-balanced approach”, he explained.

Performance of fund vs sector over 5yrs

Source: FE Analytics

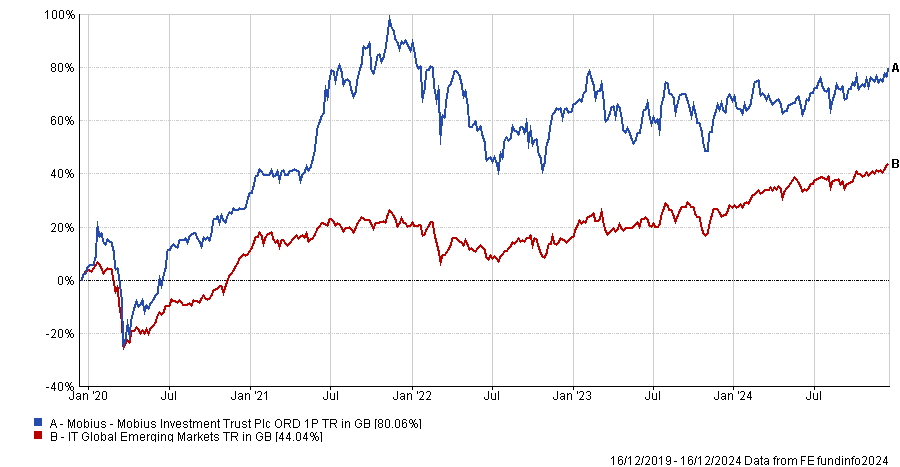

At the other end of the spectrum, from a valuation perspective he suggested the “triple discounted” Mobius investment trust.

“This gives access to emerging market mid-cap companies (a deeply unloved space), emerging market currencies (also at valuation extremes versus the G7) and it trades on a 9% discount today,” he said.

Performance of fund vs sector over 5yrs

Source: FE Analytics

L&G Equally Weighted S&P 500

Liontrust recently added the L&G Equally Weighted S&P 500 tracker to its Liontrust Dynamic Passive Multi-Asset funds to dial down concentration risk.

James Klempster, deputy head of the Liontrust multi-asset team, said: “Overall, we remain constructive on the prospects for most stocks in the US, but we are conscious of the arguably elevated valuations of the very largest and we wanted to add an exposure that diluted some of the [market’s high] concentration.

“The use of an equally-weighted tracker for a proportion of our US passive exposure means that we can upweight the more attractively valued cohort of stocks in the US whilst retaining suitable exposure to large capitalisation stocks.”

Jupiter Financials Contingent Capital

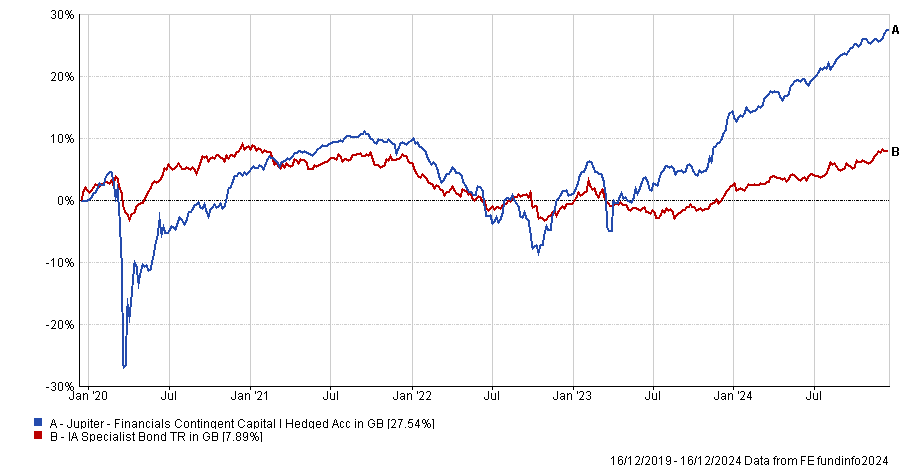

Momentum Global Investment Management chose the Jupiter Financials Contingent Capital fund, managed by Luca Evangelisti. It invests in European subordinated bank debt including additional tier 1 bonds (AT1s) – also known as contingent convertibles (CoCos) – tier 2 and insurance restricted tier 1 bonds.

Performance of fund vs sector over 5yrs

Source: FE Analytics

Gregoire Sharma, a senior research and portfolio analyst at Momentum, said: “We believe the strategy is poised to outperform other credit peers in 2025.”

The outlook for European subordinated bank debt and CoCos next year remains strong on the back of solid fundamentals, higher yields compared to other fixed income sectors and a favourable supply outlook, led by strong pre-financing activity this year.

He expects EU bank valuations to benefit from a clearer direction of travel from European rates. “This dynamic should lead CoCos’ total return in 2025 to be driven not only by attractive income and spread compression but also by a decline in rates, which should provide a cushion to performance in case of unexpected spread widening.”

There are plenty of risks on the horizon. Trade wars could potentially lead to stagflation and lower-than-expected growth in some European countries such as France.

Furthermore, the Trump administration’s growth agenda and tariffs could lead to inflation surprises and, consequently, volatility in US rates – potentially posing risks to the senior part of the capital structure (as senior bank bonds are usually longer in duration, hence more sensitive to rates).

However, Sharma expects subordinated debt and CoCos of European banks to be more insulated from these risks and to remain attractive.

On the other hand, US banks look expensively valued, especially at the preferred shares level, he said.

Japanese equities

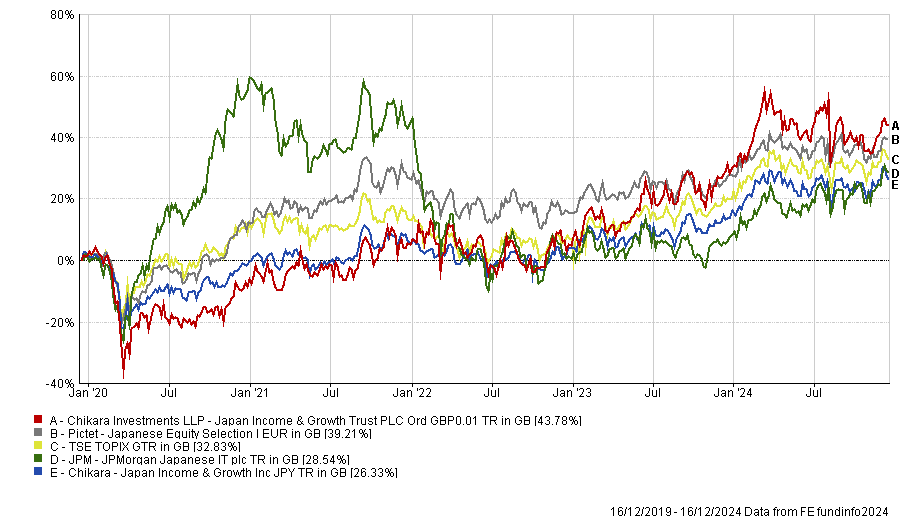

JM Finn has been adding to its Japanese equity exposure recently, said fund manager James Godrich.

“The market has valuation support, self-help through corporate reform and a great opportunity for active managers to generate outperformance through stock selection,” he explained. “As a sterling investor, there could also be the additional tailwind of a stronger yen as Japanese interest rates continue to increase.”

The wealth manager holds four complementary strategies: the growth-focussed JPMorgan Japanese trust; the value-biased CC Japan Income & Growth trust and its open-ended sibling Chikara Japan Income & Growth (a recent addition); and Pictet Japanese Equity Selection, whose style is more balanced.

Performance of funds vs benchmark over 5yrs

Source: FE Analytics

In its multi-asset portfolios, JM Finn endeavours to balance value and growth styles, liquidity and structure (using both open-ended and closed-ended funds). “This approach allows us to retain the ability to flex weightings in order to reflect differing objectives, views and liquidity requirements across strategies and time,” Godrich said.