Life has a way of teaching you a lesson when you least expect it. A couple of weeks ago, I was in Poland visiting friends, a trip I’d taken before without issue. This time, though, things went sideways – literally. I broke my leg hopping onto a kerb and ended up in a hospital for a week for some surgery to realign my tibia and fibula.

As if the physical pain wasn’t enough, I had failed to buy travel insurance. Why? I assumed I wouldn’t need it because I never had before. It was a painful (and expensive) reminder of something we all grapple with: normalcy bias.

To distract myself while staring at the ceiling in traction, I thought about how normalcy bias applies to investing, particularly in the context of the current US exceptionalism bull market. Just as I assumed nothing would go wrong on my trip, many investors today are assuming the US stock market will continue to outperform, driven by the AI boom, Nvidia’s meteoric rise and another Donald Trump presidency. But as my broken leg taught me, assumptions can carry a high cost.

Normalcy bias is our tendency to expect the future to look like the past. We see patterns that have worked before and assume they’ll continue indefinitely, ignoring potential risks. When it came to my trip, normalcy bias told me: “You’ve been to Poland several times and nothing bad has happened – why would it now?”

The same psychological trap is influencing many investors today.

For investors, normalcy bias can be comforting. After all, the US stock market has consistently outperformed other markets for nearly 15 years, ever since the global financial crisis. Why question a winning streak? But that’s exactly when caution is most needed.

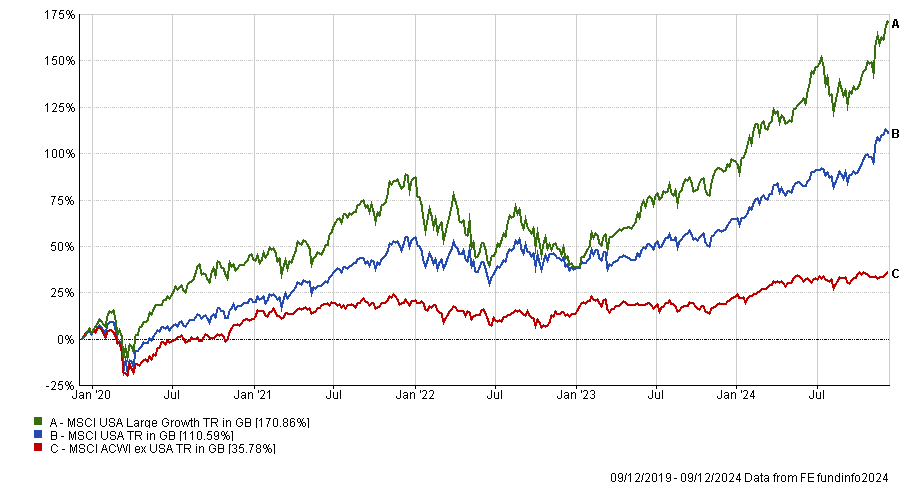

Performance of US stocks vs global peers over 5yrs

Source: FE Analytics

The numbers tell a compelling story. US equities now make up two-thirds of the market cap of the MSCI All Country World index, up from just 43% in 2010. The MSCI USA Large Growth index has surged nearly 171% in the past five years, while the MSCI ACWI ex USA index has lagged far behind at just 36%. This extraordinary performance has convinced many that the US market is untouchable.

It’s not just the market gains driving this sentiment. According to the State Street Risk Appetite Index, investors have been in risk-seeking mode for four consecutive months.

Long-term allocations to equities hit 53.8% in November, their highest level in over 16 years. State Street’s data also reveals that US equities are the only regional market where investors are overweight and by historic margins at that.

Michael Metcalfe, head of macro strategy at State Street Global Markets, sums it up: “By the end of November, holdings of US equities relative to the rest of the world were close to the most stretched in the 26-year history of State Street Global Market’s data set. In short, from the point of view of long-term investor holdings, the US has rarely been so exceptional.”

While this confidence in US exceptionalism feels somewhat justified given the backdrop, it’s also a potential blind spot. Valuations across US equities are historically high, raising questions about how much further they can go.

George Maris, chief investment officer for global equities at Principal Asset Management, offers a sobering perspective: “While US exceptionalism is clearly a key theme heading into 2025, the current situation is not unshakeable.

“Historically expensive valuations across US equities should prompt investors to look at multinational companies who increasingly do business beyond their borders and are trading at much more attractive levels than their US counterparts. As complex issues like tariff negotiations and trade disputes play out, attractive opportunities in underappreciated markets globally are likely to emerge.”

Just like my overconfidence in not needing travel insurance, investors today might be underestimating the potential risks of a concentrated bet on US stocks.

So, what’s the takeaway? I’m not saying you should dump US stocks. After all, they’ve been a cornerstone of growth for years. But, just as I should’ve taken out travel insurance, you should ensure your portfolio has adequate protection.

This means adequate diversification – across asset classes, geographies and sectors. Don’t let the current AI-driven euphoria blind you to the potential vulnerabilities of over-relying on US equities. Consider global opportunities in undervalued markets and make a plan for what to do if the US exceptionalism trade snaps like a tibia on a Krakow pavement.

Diversification is your portfolio’s equivalent of travel insurance: you hope you’ll never need it, but you’ll be glad to have it when things go wrong.

Breaking my leg taught me a valuable lesson: just because something hasn’t gone wrong before doesn’t mean it won’t in the future. The same applies to investing. The US market has been a beacon of exceptionalism, but history reminds us that no streak lasts forever.

As we head into 2025, take a moment to reflect on your own biases. Are you relying too heavily on past performance to guide future decisions? If so, it might be time to rethink and rebalance. Because whether it’s travel or investing, preparation beats assumption every time.