After a strong year from most major markets, investors may be tempted to take risk off the table, but there are reasons to be bullish.

Experts generally expect global stock markets to rise next year, with managers optimistic about areas such as China, Europe, emerging markets and technology, among others, according to a recent Association of Investment Companies survey.

Below, experts highlighted some funds and trusts for investors hoping to ride this wave of optimism, covering areas such as private equity and Asia.

HarbourVest Global Private Equity

Daniel Lockyer, senior fund manager at Hawksmoor, said private equity trusts such as HarbourVest Global Private Equity are a compelling choice for 2026.

The trust covers a range of sectors and geographies, with an emphasis on the US and technology companies, Lockyer said. This should allow them to benefit from “positive sentiment towards that sector at the moment”.

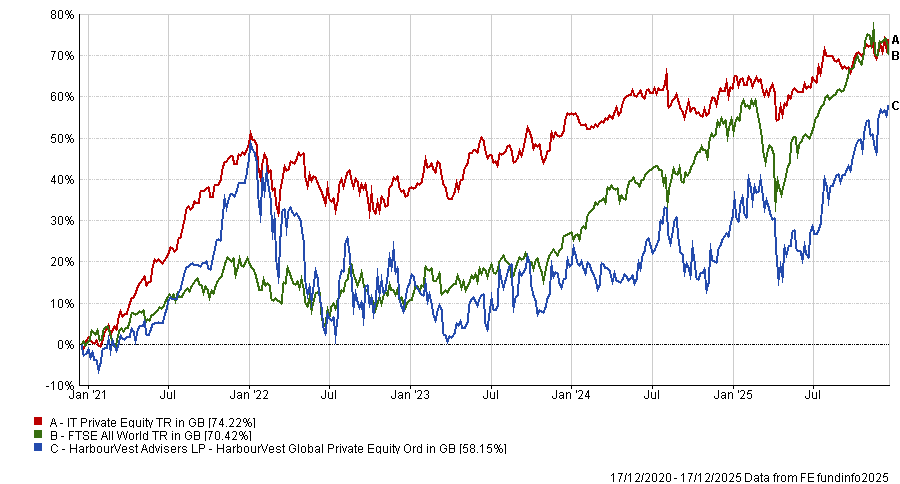

While it has underperformed global equity markets over the past five years, the trust’s managers and board are “well aware of the need to improve”.

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

To address this, the team has improved capital allocation policies in recent years and now allocates a percentage of realisations to share buybacks, according to Lockyer.

As sentiment towards the asset class continues to improve, investors should “expect net asset values (NAV) to start performing again” and the double-digit discount to continue narrowing. This “double whammy” should give the strategy potential over the long term, he said.

Chrysalis Investment

Another high-growth option is Chrysalis Investment, picked by Matthew Read, senior analyst at QuotedData. The concentrated portfolio of late-stage private growth companies offers exposure that would be “very difficult to replicate” almost anywhere else, making it a genuine diversifier, he said.

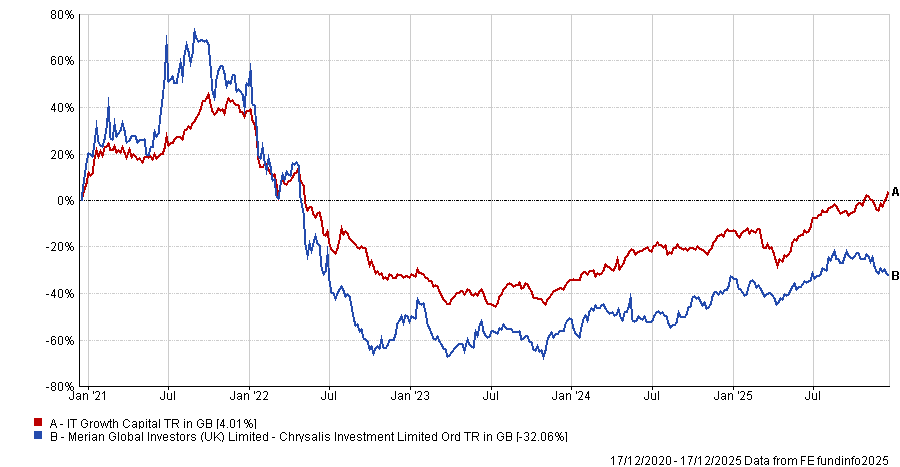

It targets disruptive companies within industries that have the potential for “outsized returns when these businesses are successful”. However, this means investors need to be prepared for some “lumpy performance” when it does not work out.

For example, over the past five years, the strategy is down 32.1%, due to headwinds such as higher interest rates, according to Read.

Performance of trust vs sector over past five years

Source: FE Analytics

“There are signs that interest rates may continue to edge down from here, which would be supportive for the value of its assets, although the investment cases do not hinge on this,” he concluded.

Pacific Horizon Investment Trust

For other investment trust fans, James Rowlinson, associate investment governance director at Forvis Mazars, pointed to Pacific Horizon Trust.

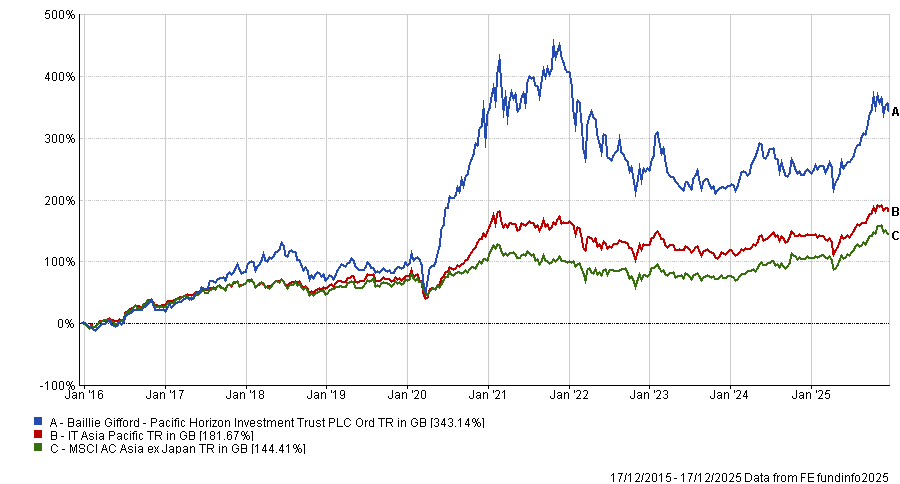

Run by Roderick Snell and Ben Durrant, the strategy follows the same high-conviction approach as most Baillie Gifford strategies, targeting companies with high earnings growth potential.

The trust is currently benefiting from tailwinds in the Asian equity market, such as strong GDP, population dynamics and earnings growth. Paired with the manager's willingness to make “bold shifts” towards certain countries and sectors, the strategy has the potential to deliver strong returns for investors, Rowlinson said.

The investment trust format offers further flexibility, such as the ability to deploy gearing or hold unlisted companies, he added.

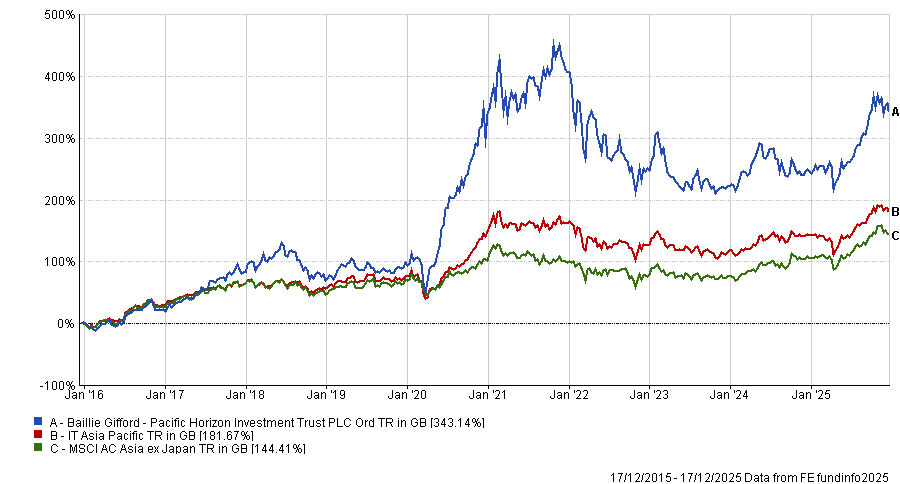

The strategy has surged 343.1% in the past decade but Rowlinson said investors should be “prepared for a bumpy ride” and should treat it as a satellite holding.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Nomura Global Dynamic Bond

Investors may not consider bond funds to be all that adventurous, but one that breaks the mould is Nomura Global Dynamic Bond, according to Freddie Thompson, investment analyst at the Fund Research Centre.

He said most of the “easy money is behind us” in fixed income, meaning investors should turn to an unconstrained fund.

Led by FE fundinfo Alpha Manager Richard ‘Dickie’ Hodges, this fund takes a high conviction view towards bonds, often investing in areas and markets that many competitors avoid, he said.

For example, the team includes a convertible bonds specialist, who buys bonds that can be exchanged for the company's shares. These are often seen as “specialised and illiquid”.

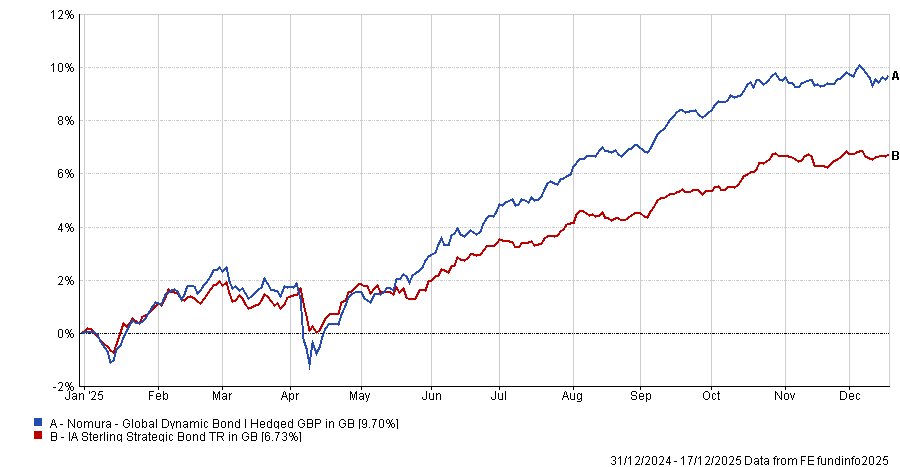

It also invests in regions such as South Africa and Romania – often overlooked by investors. This has helped the fund outperform peers in the IA Sterling Strategic Bond sector so far this year.

Performance of fund vs sector and benchmark YTD

Source: FE Analytics

However, it is not for the faint of heart. It has third-quartile volatility over the past 10 years in the IA Sterling Strategic Bond sector but has made a top-quartile return.

While the fund has the potential to make double-digit returns in a single year (as it did in 2020), it can also make double-digit losses (it did so in 2022).

Hodges has a flexible approach to risk, using measures such as credit default swaps to manage credit risks, which allows the team to “retain allocations to higher yielding/higher risk positions”.

“Investors should be prepared for idiosyncratic risk/return behaviours at times, but the quid pro quo is that they are exposed to a fund where the manager enjoys great freedom to be creative, both in terms of taking opportunities and in calibrating risk,” Thompson said

Evenlode Global Equity

Gary Moglione, manager at Momentum Global Investment Management (MGIM), pointed to Chris Elliott and James Knoedler’s Evenlode Global Equity fund.

The managers have a quality strategy with low exposure to “high-beta, AI-driven and cyclical stocks”, causing the fund to underperform peers in the IA Global sector over the past five years.

Performance of the fund vs the sector and benchmark over 5yrs

Source: FE Analytics

“While the fund’s focus on quality, asset-light, cash-generative businesses with strong moats has historically delivered resilience, this approach is now firmly ‘against the grain,” Moglione said.

However, if the market reverts to fundamentals, this should favour the types of companies Elliott and Knoedler hold – those with “robust cash and great pricing power”.

While this requires “betting on a reverse” in the AI momentum, for adventurous investors, Evenlode represents a “bold, anti-AI play”.