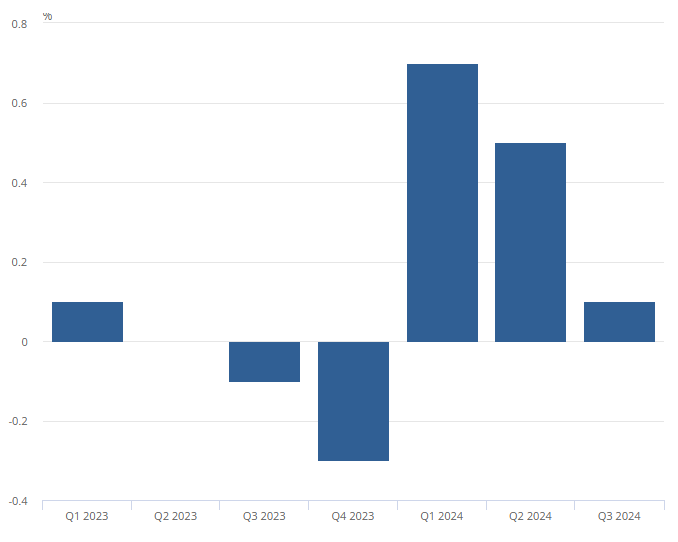

The UK economy has done better that many might have expected this year, but that isn’t saying a huge amount. UK GDP increased by 0.1% in the third quarter of 2024, following growth of 0.5% and 0.7% in the second and first quarters.

To David Coombs, head of multi-asset at Rathbones, growth has flat-lined, although he still thinks that come the end of this quarter, the country might dip into negative territory.

“Recessions are brought on by a lack of confidence and since the Budget, the UK economy outlook looks even worse than it did before,” he said.

“The recession has already begun – there are signs if you look at the confidence surveys, at what's happening in the housing market and talking to employers.”

Real-GDP estimates

Source: GDP first quarterly estimate from the Office for National Statistics.

Many of the chief executive officers Coombs has spoken with have criticized the Budget because of the impact National Insurance contribution hikes will have on their employment plans.

While Labour’s doom-and-gloom narrative might look really smart in the political think tank room, telling the world that the UK has fiscal black holes and that the whole country is broken is “not great”, said the manager.

“So if you're in Tokyo, Frankfurt or New York, you're not sure you'd want to invest in the UK, which is just ratcheting up costs and is just not business friendly.

“I can't prove that we're already in a recession – economists will [do so] in six months’ time. But as a fund manager, I have to try and make a view on where we are now. And that’s that we are already entering into that recession.”

The Rathbone Strategic Growth Portfolio – and all other nine strategies Coombs manages – reflect that, as the manager has been taking profits from equities, raising cash levels and buying government bonds.

Over the past few weeks, he has been aggressively trimming some of his winners, including the Magnificent Seven, of which he owns five, as well as hardware and software companies such as Shopify and Salesforce, which have recovered substantially since Trump's election win.

“The growth rates are pretty good, but the worry you have going to 2025 is that next earning season, if they slightly disappoint, there's not a lot of resilience in those prices,” he said.

“These names are quite heavily owned, so you do worry what the disappointment discount might be if any of those companies miss earnings. It's prudent to take profits in a lot of those tech names at the moment, and just be adding to some of our weaker names.”

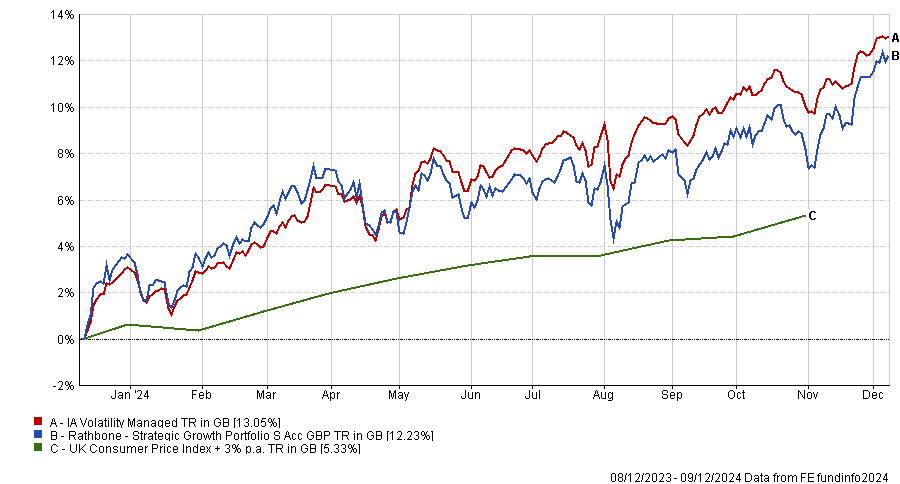

Performance of fund against sector and index over 1yr

Source: FE Analytics

One company he has added to is L'Oreal, as beauty has been “pretty depressed” because of the lack of recovery in China.

But mostly, Coombs has been taking profits to raise cash, as it's good to have some liquidity as volumes tend to drop off in second half of December.

“I always like to have liquidity when the markets are illiquid, so you can take advantage of that liquidity sometimes. Today, you're getting paid a lot on cash anyway,” he explained.

Cash accounts for 5.6% of Coombs’ portfolio, with an equity exposure at 66.6% (down from about 68%).

The main move in the portfolio is in government bonds, the manager said, as “decent” real yields are available even in the UK (at about 1.5% now, while the US is near to a 2% real yield). That's “quite attractive” on a historic basis, he said.

“We've been spending much more time looking at the sovereign bond market and diversifying into countries like Romania, Portugal and New Zealand, and hedging those back to sterling, picking up quite a nice return. Government bonds are also acting as a key risk-reduction asset class,” he said.

The manager is also buying German bunds yielding 2%. “That's telling you that I'm not overly optimistic on the European economy either,” he said.

As for alternatives, investors “don't need to get too clever” at the moment. A 5% yield on 30-year gilts is a big hurdle for alternative investments to surmount in order to get into the portfolio, he concluded.