The gap between the FTSE 100 and FTSE 250 is smaller than investors may think. For example, the two markets performed similarly last year and the five best-performing companies of 2024 were actually FTSE 250 constituents.

FTSE indices are rebalanced quarterly, with mid-caps being promoted to the FTSE 100 throughout the year. One of the most recent examples of this was Games Workshop, the company behind the globally successful Warhammer franchise.

At these rebalances, companies are ranked by their market capitalisation. Any company already in the FTSE 100 that falls below the 111th position is automatically demoted, with the largest FTSE 250 company added to the large-cap index. Meanwhile, any stock that rises to the 90th position or above is automatically added, with the smallest FTSE 100 name dropping out (even if it is higher on the list than 111).

It can be a major boon for companies to be included in the FTSE 100, as passive funds tracking the larger index are forced to buy shares in the company. Additionally, their larger weighting in FTSE All-Share indices has a similar effect. Taking Games Workshop as an example, shares rose 21.4% in the two weeks leading up to the reshuffle on the back of strong results and potentially as investors began to price in its move.

But it is not easy. Duncan Green, manager of the Schroder UK Multi-Cap Income fund, said: “Earning a position in the FTSE 100 is no mean feat, requiring sustained shareholder value creation, robust cash flow generation, and strong returns on capital.”

Alexandra Jackson, manager of the Rathbone UK Opportunities fund, added this kind of stock movement was “ideal” as it means “the makeup of the FTSE 100 is being constantly refreshed”.

Below, Jackson and Green identified two mid-cap companies poised to become new cornerstones of the FTSE 100.

Softcat

Firstly, Jackson pointed to the tech infrastructure firm Softcat. The business's primary service is to resell Microsoft’s software to smaller companies on its behalf in exchange for incentives. The better this reselling process does, the better incentives Microsoft can offer, allowing Softcat to give better deals to its clients.

“Around we go in this lovely virtual circle, and it does not require much capital down from Softcat”, Jackson explained. Because Softcat is so capital-light, it has a strong balance sheet and a lot of free cash that it can distribute to shareholders.

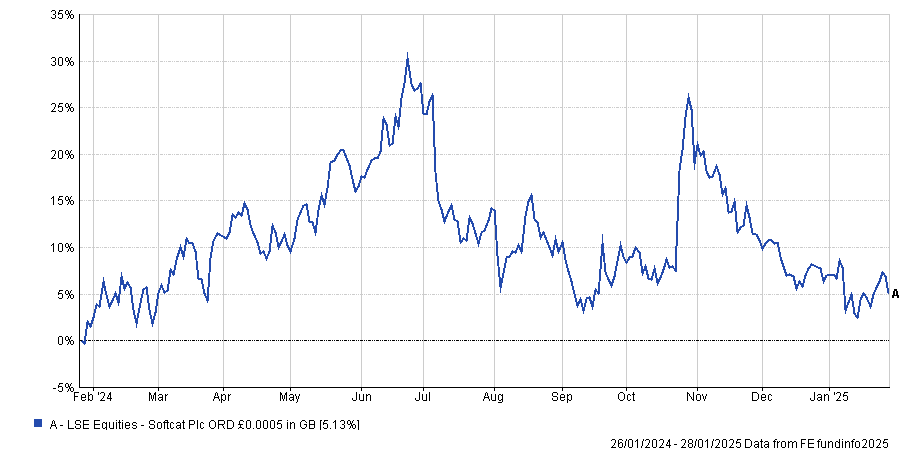

However, Jackson explained it has not been plain sailing for the business. Last year, investors became overexcited by the prospect of artificial intelligence (AI), which led to a decline in its share price

“Shares probably got ahead of themselves and needed to take a little pause,” she said.

Share price performance over the past year

Source: FE Analytics

Nevertheless, she did not believe this "wrinkle" was enough to undermine Softcat’s range of qualities. She said it remained a “fantastic business” with “solid fundamentals” that positioned well for an eventual entry into the FTSE 100.

Green agreed with Jackson and credited Softcat for its customer-centric approach and “deep client relationships”. He argued this gave the firm a loyal customer base that has enabled it to grow its dividend and market share consistently.

He added it was well-positioned to play on megatrends and broader market developments, such as digital transformation and cybersecurity, which will add “IT complexity”. This in turn “fuels demand for Softcat’s expertise, ensuring businesses stay agile and secure”.

Cranswick

Next, Jackson pointed to food producer Cranswick. This is a favourite holding for Jackson and currently is the third-largest holding within the Rathbone UK Opportunities portfolio.

Cranswick is attractive in part because of its operational efficiency. She described it as a “true nose-to-tail” producer that used every part of the pig, including non-traditional cuts such as the liver and other organs.

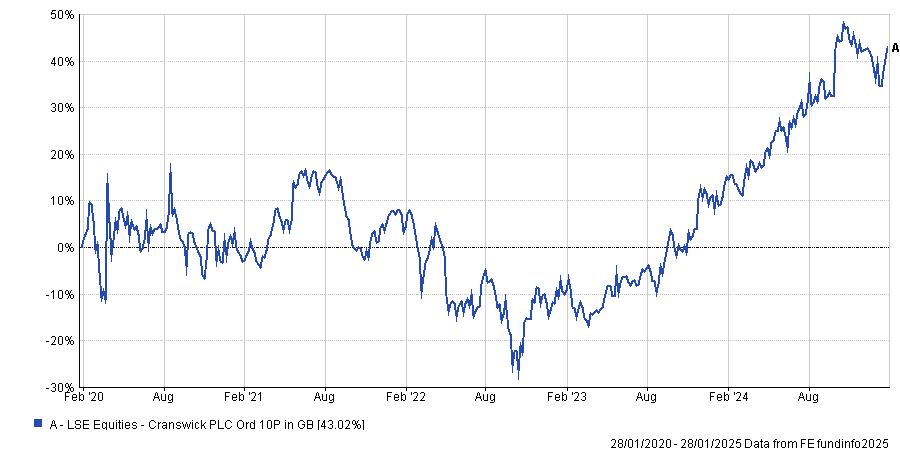

She argued this efficiency enabled the business to grow substantially, increase capacity and significantly improve its allocation of capital. This growth has been reflected in its recent numbers, with the share price up by 43% in the past five years.

Share price performance over the past 5yrs

Source: FE Analytics

She added Cranswick was particularly notable because it was not a “super high margin business”, noting it tends to operate around a single-digit return. She concluded: “It is interesting that even a business like Cranswick will eventually be within a whisker of the FTSE 100”.

Green also favoured Cranswick. He described it as having grown from "modest beginnings" to become a major player in the pork, poultry and convenience food sectors.

The business has delivered enormous shareholder value over the long term, he said, and has grown its dividend relatively consistently over the past three decades through steady earnings growth.

Cranswick’s commitment to premium, sustainable products “aligns seamlessly with the modern consumer’s appetite for quality and environmental responsibility”, Green said.

Moreover, it partners with major UK retailers such as Tesco and Sainsbury’s on their high-end product ranges. Green explained that this made it an incredibly well-known business and gave it an edge over its rivals in a "fiercely competitive industry".