The consensus forecast for next year involves a soft landing in the US and a reacceleration of growth, yet some contrarian voices are sounding warning bells.

Ben Leyland, an FE fundinfo Alpha Manager who runs the JOHCM Global Opportunities fund, said US equities are “hideously concentrated” – a phenomenon that “doesn’t usually end well”.

“The real question is how much of clients’ wealth do you want to put in tech?” he stated.

Vanguard, Goldman Sachs and CG Asset Management have also warned that returns from US equities may disappoint in the coming years.

Nick Clay, manager of Redwheel Global Equity Income, concurred. “The US market has really decided that AI Goldilocks – a perfect [outcome] with AI sprinkled all over the top of it – has become a complete certainty and nothing can derail that. The S&P 500 is having the best year it’s had for 100 years,” he said.

The current wave of exuberance rings hollow for Clay. “At a time when the market is certain about everything, that is the time when risk is at its greatest because invariably, nothing is certain, nobody knows what the future holds.”

Clay and Leyland are both veering away from mega-cap tech to position their portfolios more defensively, which has served them well in the past. Their funds delivered positive returns in 2022 when their respective sectors and benchmarks both lost money.

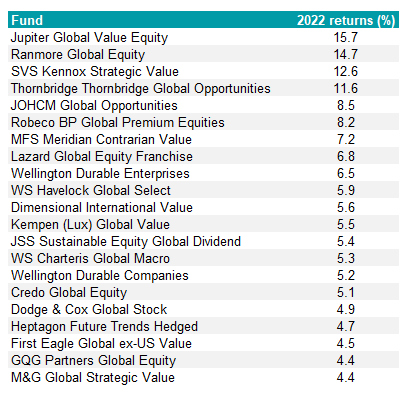

Investors who share their concerns need only look back to 2022 to see how fund managers held up during a bear market. That year, the MSCI World fell 7.8% and the MSCI All Country World Index lost 8.1% in sterling terms. The average fund in the IA Global sector fared even worse, down 11% according to FE Analytics

However, several global equity funds delivered strong returns. In the IA Global sector specifically, 21 actively managed, broadly diversified global equity funds returned more than 4% in 2022 in sterling terms (sector-specific and passive funds have been excluded from the list below).

Global funds returning over 4% in 2022

Source: FE Analytics

It was a good year for value funds, especially those holding energy stocks, which saw profits soar as the oil price spiked. Growth funds suffered as interest rates rose, causing the cost of capital to shoot up.

Funds that did not lose money in 2022 had less of a mountain to climb afterwards and 19 of the 22 funds listed above beat the peer group average for the three years to 11 December 2024. Of those, 15 delivered top-quartile performance over three years and four were second-quartile.

This indicates the funds were able to roll with the punches during the recovery in 2023 and bull market of 2024, as well as protecting against the downside in 2022.

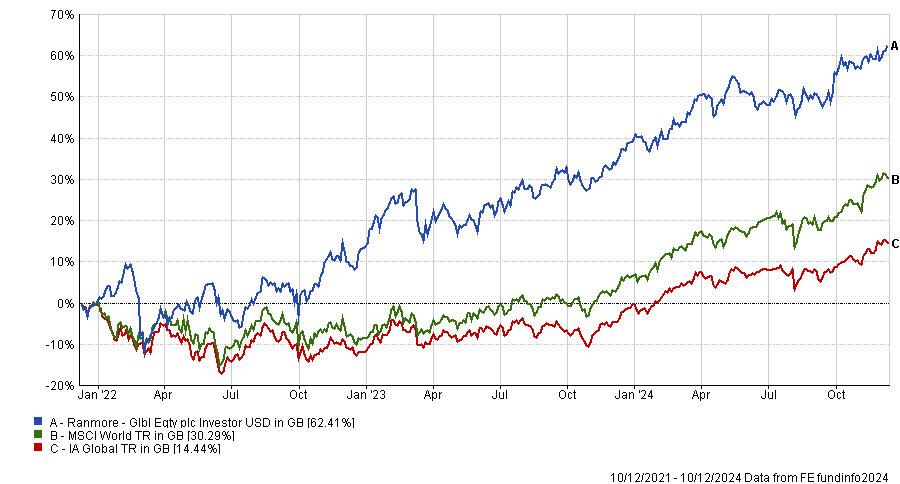

Of this cohort, Ranmore Global Equity has the strongest three-year return of 62.4%.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

Ranmore encountered its own troubles in 2022 when it had to write off an investment in Russian equities but the fund nonetheless delivered top-quartile returns that year and again in 2023, when many other value funds struggled.

Petrobras and European banks such as Banco de Sabadell and AIB Group were among its winners in 2022, but fund manager Sean Peche pointed out that his investment process is not reliant on a few outsized winners.

“We are valuation sensitive investors who believe price matters. We look for value where others aren’t looking, usually out of fear or a low benchmark weighting. This enables us to invest at great prices,” he explained.

“Our performance is reliant on stock selection and the compounding of capital by selling our positions once they reach fair value and reinvesting the capital in companies with higher return potential.”

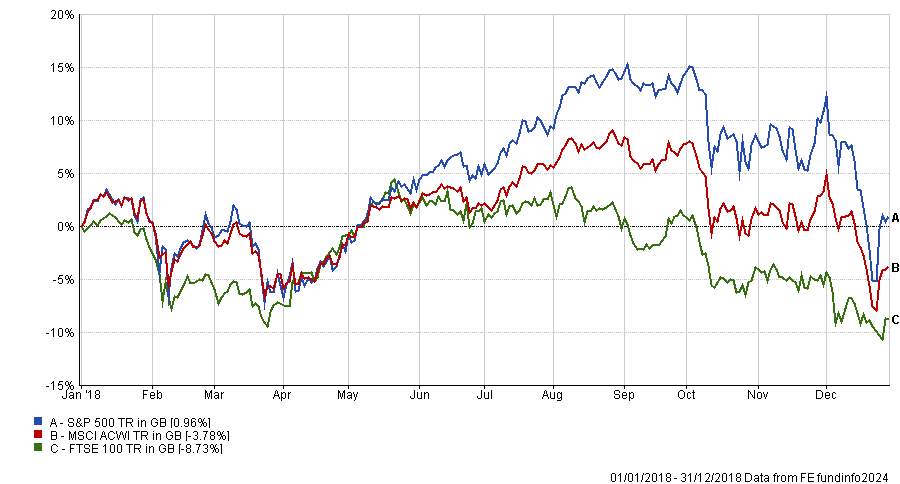

Looking further back in time, Bevan Blair, chief investment officer of One Four Nine Group, argued that a future downturn will look more like 2018 than 2022, making the former a better litmus test of funds’ defensive credentials.

Markets sold off in the final quarter of 2018 due to concerns about Donald Trump’s trade war with China, slowing global economic growth and the US Federal Reserve’s pace of interest rate hikes.

Performance of US, UK and global stock markets in 2018

Source: FE Analytics

Disregarding sector-specific and passive strategies, 13 funds in the IA Global sector returned more than 4% in 2018 – a year when the sector as a whole lost 5.7%, the MSCI World lost 3% and the MSCI ACWI was down 3.8% in sterling terms.

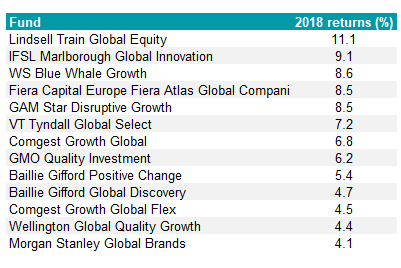

Global funds returning over 4% in 2018

Source: FE Analytics

Most of these funds (10 out of 13) parlayed their strong 2018 into a sector-beating six-year run. Between 1 January 2018 and 10 December 2024, six funds were top-quartile within the IA Global sector and another four funds were second quartile. All 13 lost money in 2022, however.

Only three actively managed global equity funds delivered positive absolute returns in the very different down markets of 2022 and 2018: JOHCM Global Opportunities, Lazard Global Equity Franchise fund and Heptagon Future Trends Hedged.

Leyland’s JOHCM Global Opportunities fund beat its benchmark by a wide margin in 2022, 2018 and 2015, when the benchmark returned a measly 3.3% but the fund climbed 13.7%.

However, the fund fell behind its benchmark and peers during the post-Covid recovery and then the tech-fuelled boom of the past two years. In short, performance diverges greatly from the benchmark.

Further attesting to its defensive credentials, the fund’s downside capture ratio versus the MSCI ACWI was 24.3% for the three years to 30 November 2024 and 69.4% over 10 years.

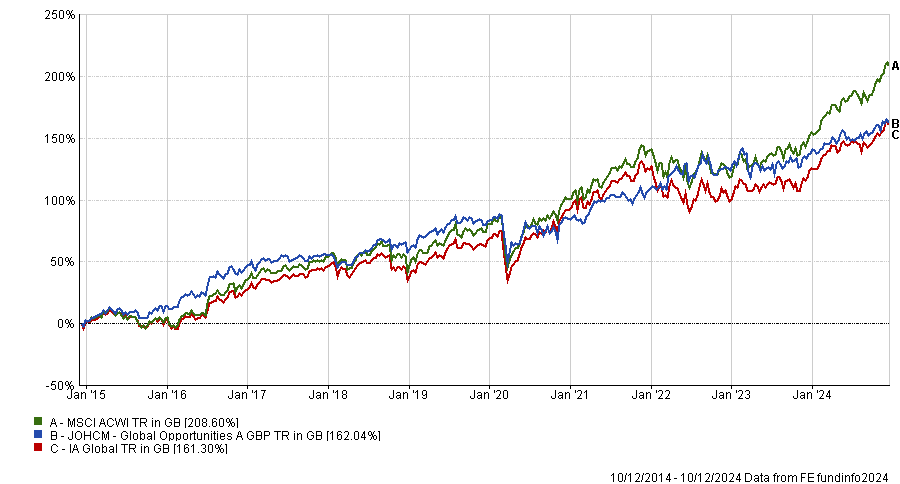

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The fund focuses on large multinational companies and its largest holdings are building materials manufacturer CRH, Sempra Energy, Canadian insurer Intact Financial, Deutsche Börse and tobacco giant Philip Morris International. The only member of the Magnificent Seven within its top 20 positions is Microsoft.

Leyland’s investment approach involves looking for areas encountering short-term difficulties or disruptions and laying down capital for long-term growth.

He believes supply chain disruption during Covid and Russia’s invasion of Ukraine highlighted vulnerabilities in globalised trade and Europe’s underinvestment in defence and energy security. To address this, the pendulum is swinging back towards capital expenditure, infrastructure, utilities, industrials and materials. Donald Trump’s policies are likely to accelerate these tailwinds, he said.

To find other managers with a track record of protecting capital in downturns, Trustnet canvassed fund selectors last week, who suggested Stewart Investors’ Asian and global strategies and Redwheel Global Equity Income, among others.