The move towards passive investing has proven to be a frustration for Joe Bauernfreund, manager of the £1bn AVI Global Trust, but at the same time, it has led to “huge swathes of the market” being ignored by investors, despite offering cheap valuations and solid fundamentals.

Bauernfreund’s strategy involves rolling up his sleeves more than most active managers and getting closely involved with company management. He endeavours to combine careful stock selection with an active ownership process to directly deliver catalysts for growth.

“The idea of investing in good quality businesses at low valuations and then working to deliver that value creation has worked, and I believe it will continue to do so,” he said.

Below, he outlines three underappreciated stocks with considerable upside potential.

News Corp

While he admitted that finding undervalued opportunities in the US was challenging, Bauernfreund pointed to News Corp as a particular favourite.

Stock price performance of News Corp YTD

Source: Google Finance

News Corp owns a range of high-quality US and global businesses, such as global real estate firm REA Group, in which it has a 60% stake. REA Group is worth $22 per share, but News Corp's total share price is around $28.

As a result, he explained, investors are paying just $6 for News Corp’s other assets, including “jewels in the crown”, such as the Dow Jones Group, which owns high-quality companies across a range of sectors, including the Wall Street Journal and the New York Times, as well as Opus, a data provider to the oil industry.

When considering all of News Corp’s assets, he estimated that News Corp was trading at a 45% discount to its actual value.

For Bauernfreund, this undervaluation is partly a consequence of uncertainty about the value of unlisted businesses such as Dow Jones, which forces investors to do more research to determine if the investment is worthwhile.

Secondly, investors' narrow focus on mega-cap tech means that money has poured out of businesses such as News Corp despite significant runway for growth. “This is a very high-quality collection of businesses that are undervalued materially for the wrong reasons by the market,” he concluded.

D’Ieteren

Shifting focus to Europe, Bauernfreund has owned a stake in the Belgian family-holding company D’leteren for several years.

While D’Ieteren has operated in several sectors, one of its most interesting current holdings is the glass repair service Belron. D’Ieteren’s share price has declined by 8% year to date (YTD) following Belron’s announcement that it will pay a substantial dividend of €74 per D’Ieteren share.

Stock price performance of D’Ieteren YTD

Source: Google Finance

Bauernfreund said this was not well received amongst Belgian shareholders, who will suffer a 30% tax hit on the dividend, causing many to sell out.

However, he argued: “We think the market is missing something about D'Ieteren."

Bauernfreund noted that as cars become more complex, glass repair services need to continue to develop to keep up, making holdings such as D’Ieteren attractive ways of playing on trends such as car manufacturing at lower costs.

Additionally, there is an increased interest in holdings such as Belron in the private sector, demonstrating the strength of the business. For example, when D’Ieteren sold a minority holding in Belron several years ago, it received massive interest from private investors, showing how in-demand the company was.

“They [D'Ieteren] had no idea that their stake in Belron was worth as much as these private investors were willing to pay,” he said.

“We still see tremendous value in D’Ieteren and Belron, and we think it is an opportunity to acquire shares and receive substantial returns on capital.”

DTS Corporation

AVI Global's approach to stock picking has led to an overweight towards Japanese equities within the portfolio.

For Bauernfreund, Japan is a great market for AVI’s brand of shareholder activism. Several Japanese companies had management deficiencies but were open to suggestions and willing to restructure. Ongoing corporate governance reform has continued to draw investors' eyes.

Within the portfolio, IT software reseller DTS Corporation plays on these trends.

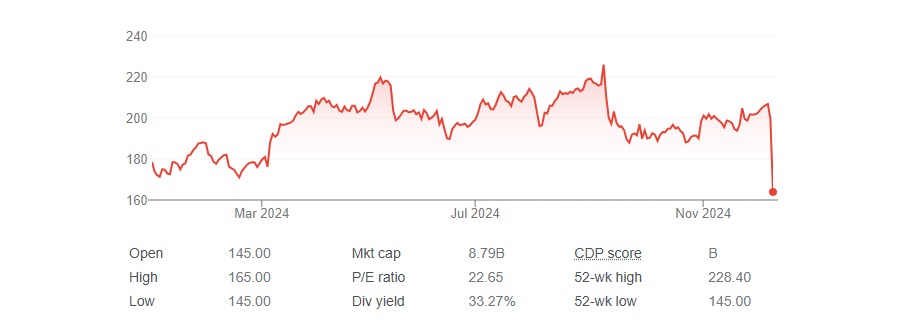

Despite high volatility this year, including a major slide in share price at the end of July, DTS has rallied, with share prices up by 20% YTD.

Stock price performance of DTS Corp YTD

Source: Google Finance

“It had a large proportion of its market cap sitting in idle cash, which gave rise to an inefficiency,” he explained.

This presented an opportunity for AVI Global, which has since become one of the largest shareholders in DTS. Bauernfreund and his colleagues have been engaging with the management team at DTS, who have responded well to many of their suggestions.

While this has led to a measurable increase in the share price and a narrowing of the valuation gap, Bauernfreund said that DTS remained attractive and was expected to continue to perform well.