Saba Capital Management has published a letter proposing dramatic changes to seven investment trusts in which it is the largest shareholder.

Its targets include three trusts managed by Baillie Gifford (Edinburgh Worldwide, Keystone Positive Change and Baillie Gifford US Growth) and two from Janus Henderson Investors (European Smaller Companies and Henderson Opportunities), alongside CQS Natural Resources Growth & Income and Herald.

Saba has requested that the trusts convene general meetings by February 2025 to offer shareholders the chance to vote out their boards and appoint new directors.

If elected, the new directors would consider a range of options, including: replacing the trusts' investment managers with Saba; changing their investment mandates to purchasing discounted trusts; merging with other trusts to achieve economies of scale; and liquidity events such as tender offers and share buybacks.

Saba has suggested two directors per trust. It has put forward Boaz Weinstein, the firm’s founder and chief investment officer, for Baillie Gifford US Growth and Paul Kazarian, principal executive officer of Saba’s publicly traded investment trusts, for the other six trusts.

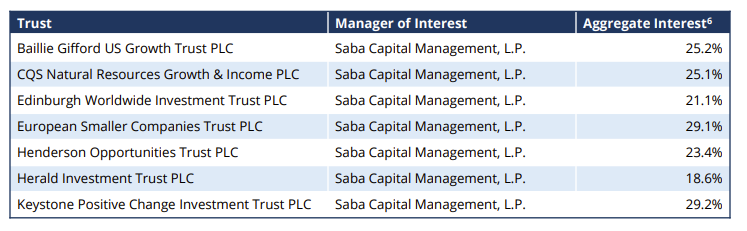

Saba is the largest investor in all seven trusts, with a stake worth 19% to 29% of each trust’s shares, totalling £1.5bn.

Saba’s stake in each trust

Source: Saba Capital Management, data to 18 Dec 2024

Weinstein wrote: “We called these general meetings because the current boards have failed to hold the investment managers accountable for the trusts’ wide trading discounts to net asset value (NAV) and their inability to deliver sufficient shareholder returns.

“While there are multiple levers to narrow these persistent discounts, inaction has been the consistent course of current leadership.”

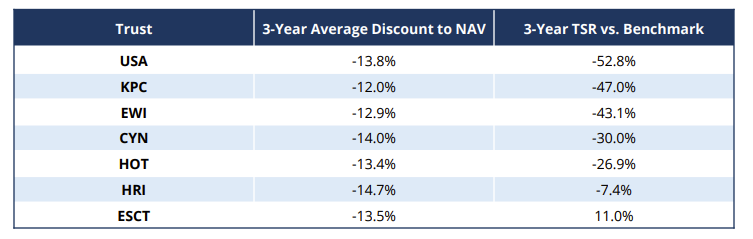

Performance of investment trusts over 3yrs

Sources: Saba Capital Management, Bloomberg; data is in sterling and as of 13 Dec 2024.

The acronyms are as follows: Baillie Gifford US Growth (USA); Keystone Positive Change (KPC); Edinburgh Worldwide (EWI); CQS Natural Resources Growth (CYN); Henderson Opportunities (HOT); Herald (HRI); and European Smaller Companies (ESCT).

The trusts have delivered “underwhelming, and in some cases disastrous, total shareholder returns” during the past three years, Weinstein added.

Deutsche Numis analysts Gavin Trodd, Ash Nandi and Andrew Rees countered that several of the trusts in question are now trading at or close to NAV. The performance of SpaceX has lifted sentiment towards Edinburgh Worldwide and Baillie Gifford US Growth, while Saba’s stake-building has boosted share prices.

Matthew Read, senior analyst at QuotedData, said there is an “obvious flaw” in Saba’s strategy to quickly deliver substantial liquidity and long-term returns. “Those two are often mutually incompatible, particularly for some of the funds it is targeting where the underlying holdings are less liquid,” he explained.

“Herald is the obvious example as it is a big fund with a huge tail of small illiquid positions that trade by appointment that could take years to sell off and you would likely move the market against you in many of these, particularly once the market spots you as a forced seller.

“The call for substantial liquidity also ignores the unquoted positions held by trusts such as Edinburgh Worldwide and Baillie Gifford US Growth. These are long-term investments and, for some, the pay outs can be big as has recently been illustrated by the spectacular success of SpaceX.”

CQS Natural Resources is facing cyclical challenges but “history suggests that when Chinese demand for commodities picks up, this fund will perform extremely well and Saba’s plans would mean that ordinary shareholders miss out on that”, Read continued.

Meanwhile, the board of Keystone Positive Change has proposed merging the trust with its open-ended sibling. “We don’t see how Saba can really accuse KPC’s board of inaction given the steps that it has taken,” he said.

“This and the other challenges we highlighted above have long made us feel that Saba doesn’t really understand some of the funds that it is invested in.”

As for whether Saba’s plans will be successful, that depends on the trust’s other shareholders. Saba Capital’s proposals will be ordinary resolutions, which require 50% of votes cast to pass, Deutsche Numis’ analysts said.

“Clearly Saba will be voting in favour of the proposals, and given participation from retail investors is typically low, Saba will likely represent a significant proportion of the turnout. Therefore, the participation of other shareholders is key to the outcome of the respective votes,” they noted.

“We believe that some shareholders may be questioning Saba's approach and would prefer to own the current strategies, some of which are unique and only possible in the closed-end structure, whilst acknowledging that more can be done to manage discounts.”

Read agreed and urged shareholders to “make sure their interests are being protected and get out and vote”.