Pharmaceutical companies often grab the limelight in the healthcare sector. From Covid vaccines to weight-loss drugs, ground-breaking pharma products aim to cure the afflictions of humanity and improve quality of life. Investors are often enamoured by the promise of a potential blockbuster drug to eradicate an intractable illness – and deliver a healthy flow of profits.

Since big pharma companies rank among the largest healthcare weights, they often dominate sector positions in a global equity portfolio or a standalone allocation. Yet focusing too much on pharmaceuticals could limit a portfolio’s potential. Companies that manufacture diagnostics, technology and equipment to address the world’s most pressing medical issues have become increasingly important for progress in the healthcare sector.

Healthcare stocks can conjure up images of clinical trials, blockbuster drugs and supersized marketing campaigns. But that’s a one-dimensional way of viewing a fast-growing, dynamic sector – and a risky way to invest. For investors looking to avoid the rollercoaster ride, we recommend a different approach: evaluating companies based on their business acumen, not their drug pipeline.

High-profile drug breakthroughs get a lot of attention and for good reason. At the height of the pandemic, the race was on for a Covid-19 vaccine that could save lives and hasten a return to normalcy. How about a drug that can treat Type 2 diabetes and help you lose weight? There’s a reason GLP-1 drugs are so popular. And who doesn’t want to invest in the cure for cancer, Alzheimer’s and any number of other devastating illnesses?

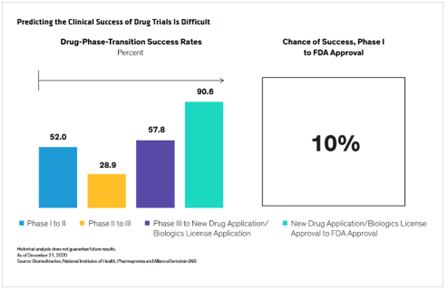

Unfortunately for investors, it’s notoriously difficult to handicap outcomes as a drug passes through the various stages of the development pipeline. In fact, the likelihood that a drug in human trials will complete the journey from Phase I to final approval by the Food and Drug Administration (FDA) is a mere 10%, as the chart below shows.

Put another way, the failure rate for developing a drug is 90%, a figure that doesn’t include the extensive pretrial process that can stop a drug from moving into Phase I. That’s a challenging investment proposition, to say the least.

A case in point: In November 2020, when Pfizer and Moderna first announced their breakthrough Covid-19 vaccines, there were 236 Covid-19 vaccines in various stages of development. Only three were given FDA approval for use in the United States. More than 90% of the vaccines under development failed to get the FDA’s blessing.

This isn’t to say that drug trials aren’t worthy of investors’ attention. Pharmaceutical breakthroughs have the potential to change lives and generate enormous profits for companies and their shareholders. But the outcomes are highly unpredictable. Ideally, the drug pipeline should provide an optionality – a potential bonus – but not a core reason for investing in a company.

So what should investors be looking for instead? Healthcare businesses with strong, sustainable business models have the same hallmarks as firms in other sectors. These include clean balance sheets, high – or at least improving – returns on capital, and strong reinvestment rates. When a company earns profits above its cost of capital and then reinvests those profits, our research suggests that the business is more likely to have staying power.

Diagnostics and life sciences tools and services

These areas are just as important for medical processes as treatment. Advanced testing and imaging can help medical professionals detect disease at much earlier stages, improving the efficacy of treatment and chances of recovery. And the power of sequencing the human genome will unlock additional potential new drugs and help identify diseases earlier.

Waters Corporation manufactures analytical instruments for scientific research in the drug development and production processes. In the highly regulated pharmaceutical industry, the company’s strong reputation has kept customers loyal and generated recurring revenue streams that bolster its competitive advantages.

There is also US-based IDEXX Laboratories, which specialises in animal diagnostics such as accurate, in-house, laboratory-level tools that deliver results for veterinarians within 10 minutes.

In biotech research and development, innovative drug-development processes are enabling new treatments that can be profitable even when addressing relatively uncommon disorders.

For example, United Therapeutics manufactures a treatment for a relatively rare condition called pulmonary arterial hypertension – high blood pressure in the pulmonary artery in the lungs. It’s also been reinvesting in its organ transplant business, where it seeks to use gene editing technology that may make it easier for people to receive animal organ transplants, which are often rejected by human bodies.

Technology and artificial intelligence (AI)

Compared to other sectors, healthcare has been a laggard in our high-tech society. But things are changing. Companies that can successfully adopt new technology may be able to dramatically change the way care is provided and delivered – and can be found in different parts of the sector.

AI is being introduced in commercial tools by companies including Veeva Systems of the US and GE HealthCare. As AI capabilities improve and become more widely used to diagnose diseases, we believe companies that offer software-as-a-service for healthcare will enjoy greater demand.

Veeva offers a range of software services, from clinical trials to home health monitoring to marketing software for pharmaceutical sales.

GE HealthCare, a medical equipment company, is using AI in various products, for example to improve the quality and diagnostics ability of medical imaging devices, which can lead to better patient outcomes.

Equipment and supplies

From global drugmakers to your family doctor, the equipment and tools used to deliver healthcare products and services are constantly changing. Innovative equipment used in lifesaving procedures can improve outcomes for patients.

For surgeons, a technological revolution is rapidly unfolding. Today, an increasing number of procedures are using robotic tools that allow surgeons to access hard-to-reach spots inside the body with high-precision, minimally invasive incisions, fewer complications and faster recovery times.

Intuitive Surgical of the US manufactures a robotic surgery system that is popular in US operating rooms and is gaining momentum outside the US, with significant growth opportunity in Europe, Japan and China, in our view.

Three attributes that define healthy growth

While each industry has different dynamics, we believe investors should look for three attributes to identify attractive healthcare businesses across the sector.

First, look for products and services that improve healthcare outcomes for patients. Second, companies that can help cash-strapped healthcare systems save costs are likely to benefit from strong demand drivers. Third, products that improve outcomes and save costs must generate a profit for the business.

In our view, companies that possess these three attributes are operating in a virtuous ecosystem. The dynamics of a healthy ecosystem provide a foundation for companies to profitably reinvest cash flows, which helps support consistent earnings growth over time.

We believe equity investors should always stay focused on business fundamentals when choosing healthcare stocks, rather than trying to predict scientific success, which is extremely hard to do.

To be sure, pharmaceutical companies that meet the criteria of a healthy ecosystem should be included in a diversified allocation of healthcare stocks. But instead of having drugmakers anchor a healthcare portfolio, the starting point should be to search for high-quality business models –wherever they may be found across the evolving spectrum of medical products and services.

Vinay Thapar is portfolio manager of AllianceBernstein’s AB International Health Care Portfolio. The views expressed above should not be taken as investment advice.