The UK has a lot going for it at the moment, prompting managers to cautiously up risk as we move into 2025.

This year, we kickstart the Trustnet outlook season with good tidings for domestically-focused investors, as several managers are positive about stock valuations, company earnings and the UK consumer, and are generally optimistic about the new year.

New-found political stability could reverse outflows

The UK has long been an underweight for global investors and money has been actively flowing out of UK stocks.

That is because of the turbulent political climate that began with Brexit, according to Mark Costar, manager of the JOHCM UK Growth and UK Dynamic funds, but today’s greater political stability might change that.

"Brexit started off the bad news, then we’ve had a revolving door of prime ministers," he said. “Now we have retreated back to the centre and the relative certainty that that may now yield going forward could prove beneficial for UK markets.”

But it’s not just foreign investors who have been shunning the UK. UK pension funds have notoriously moved towards lower allocations to domestic equities due to de-risking strategies. This trend, according to Costar’s colleague James Lowen, who runs the JOHCM UK Equity Income fund, could soon reverse if policymakers take action.

“There is a lot of pressure on politicians to reverse issues such as sluggish productivity growth, which could lead to policy changes that encourage investments”, he said.

Against a background of sluggish economic growth, not helped by tax rises, the need for positive policy action to encourage more investment is stark, said Anthony Cross, head of the Liontrust Economic Advantage team.

“We will continue with our active lobbying in support of the idea that UK pension funds should be investing more [in the UK]. We believe that a vibrant domestic stock market is the linchpin of a dynamic economy,” he said.

“Improved investment flows will have a positive impact upon the valuations of UK-listed companies, which are cheap when compared with overseas markets. Improving valuations should lead to a virtuous circle whereby benchmark-aware investors increase allocations to the UK, more companies seek to list on the London market, and merger & acquisition activity rises, resulting in a positive overall impact on UK economic buoyancy.”

Low valuations offer opportunity for diversification

Although politically the UK looks like “an island of calm” against several other countries, including some in Europe and the US, the market still needs to catch up, according to Alexandra Jackson, manager of the Rathbone UK Opportunities fund.

“We are no longer the economic or political outlier, far from it, yet valuations still suggest this. Sterling is often seen as the ‘PE multiple’ on UK PLC and, unlike its peers, it has held its own against the dollar,” she said.

For Jackson, positive earnings momentum is the factor that performs best when, like now, there are many variables at play.

“This is where we are focusing our efforts, which keeps us largely in the FTSE 250, seeking out our global niche businesses with financial metrics that match larger US peers,” she said.

“With Trumped-up valuations vulnerable to noise, and disarray in the rest of Europe, sensible British compounders at record-low valuations look like an interesting diversifier.”

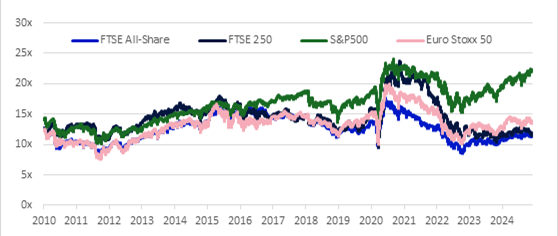

UK companies are much cheaper than counterparts on either side of the Atlantic

Source: Rathbones, FactSet; price divided by next year’s estimated earning, data 1 January 2010 to 29 November.

Low valuations are a boon for bottom-up stock pickers such as JP Morgan Asset Management’s Guy Anderson, FE fundinfo Alpha Manager of the Mercantile Investment Trust.

“For us, investing always comes down to the individual stock opportunities and right now, we are finding more companies that we want to buy than those that we want to sell. We continue to see exciting opportunities to invest in high-quality, growing businesses that are executing strongly, at attractive valuations,” he said.

“With the UK market trading at a material discount compared to international peers, there is a significant opportunity for investors to take advantage. Our elevated gearing levels reflect our conviction and we remain confident that the improving macroeconomic backdrop will deliver strong results in the year ahead.”

‘Palpable fear’ of cheap takeovers

But a boon for some is a concern for others. The rampant wave of mergers and acquisitions targeting UK firms has left UK boardrooms in fear that they will be acquired at undervalued prices.

JOHCM’s Lowen reports that each meeting with company management ends with the question: ‘Why is the share price so low?’

“There is a palpable fear that companies will be taken over cheaply, which is leading to proactive measures by management teams to fend off potential bids,” he said.

The manager highlighted a specific case where a company that rejected a bid paying 67% premium for its shares is now trading 20% above that. He still thinks it can double this.

“It feels like we’re under attack. We have had 45 companies leave the UK market. That’s the highest in 15 years and there’s been bids for £160bn of our market cap.”

Lowen’s own 60-stock portfolio has had six bids for this year (four consummated and two warded off), the highest level of M&A activity in 20 years.

Housing spree will boost growth

Changes in the regulatory landscape may help to accelerate growth in areas such as housing and energy infrastructure, as JOHCM’s Costar pointed out. The government is planning to build 1.5m new homes over the next five years, a significant increase from historical levels. “This will help drive and accelerate growth,” the manager said.

JP Morgan’s Anderson is keeping “a substantial overweight position” to housebuilders.

A company he is particularly bullish on is Bellway, which he has been buying since 2023, acquiring shares at nearly a 40% discount to net asset value.

“Even without hitting Labour's ambitious targets, a recovery in housing production to pre-2020 levels would present meaningful upside potential, making housebuilders an area of focus for us as we navigate this new political and economic landscape,” he said.

As for infrastructure, the government committed over £320bn over the next five years. For Lowen, this spending could “significantly boost growth and provide opportunities for private sector investment”.

Consumer resilience will benefit smaller companies

For the first time since 2015, 2025 will be defined by small-cap outperformance, according to Premier Miton's Gervais Williams, manager of the Diverse Income trust.

"There is a risk that quite a few large-caps won’t be able to dodge the radically changing economic and political bullets. Clearly, quite a few small-caps might get caught out as well. But there will be others that don’t just survive better but also happen to be in exactly the right place at the right time and deliver quite exceptional returns,” he said.

"At times like this, there is scope for well-financed businesses to accelerate their growth, as they expand into the vacated markets. Or better still, buy an overleveraged but otherwise viable business, debt-free from the receiver for a nominal sum – sometimes as low as £1. These kinds of acquisitions can sometimes deliver transformational returns for quoted small caps.”

For mid- and small-caps, the consumer environment is important, Anderson noted. Despite the uncertainty created by the taxation changes in the recent Autumn Budget, the manager was optimistic about spending (propped up by falling interest rates) and therefore small-caps.

“Discretionary spending is likely to remain resilient, given ongoing real wage growth, low household debt and low unemployment. There should be further support from monetary policy, with interest rates now on a downward trajectory,” he said.

Anderson has exposure to consumer-facing companies such as Trainline, which has experienced robust revenue growth driven by the post-pandemic recovery in rail travel and increasing adoption of e-tickets, both in the UK and internationally.

“With a largely controllable cost base, these revenue gains have been resulting in significant improvements to profitability, validating our decision to add it to the portfolio earlier this year,” he said.