The technology sector – now a whopping 25.3% of the MSCI World index – will continue to dominate the investment landscape in 2025 and beyond, but fund and wealth managers are looking for opportunities elsewhere. Renewable energy, industrials and healthcare stocks are amongst those attracting attention.

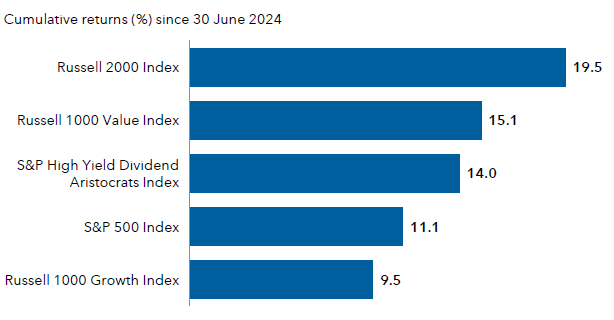

Indeed, the broadening out of stock market leadership away from the Magnificent Seven tech giants was a key theme for several fund managers’ 2025 outlooks and had already started to happen in the second half of 2024 as dividend payers, value-oriented stocks and small-caps pulled ahead.

Market gains have extended beyond tech

Sources: Capital Group, FactSet, data to 30 Nov 2024

Below, fund and wealth managers reveal which stocks they are holding or watching outside of the tech sector to gain exposure to megatrends such as ageing populations, artificial intelligence (AI) and capital expenditure.

Healthcare stocks and longevity

Meeting the needs of an ageing population is a key theme for Guy Foster, chief strategist at RBC Brewin Dolphin. Companies such as Haleon, which supplies multivitamins for adults over 50, arthritis pain relief and denture care products, are well placed to profit from demographic trends.

Foster also highlighted medical technology company Stryker, which offers hip and knee implants, robotic arm-assisted technology and data analytics for orthopaedic services. Stryker has expanded through strategic acquisitions into medical and surgical equipment, neurotechnology and digital healthcare, he said.

Alcon, the second largest manufacturer of contact lenses and the largest company in ophthalmic surgery, also caters to ageing consumers. “Expenditure on eyecare generates a relatively high return, as most causes of visual loss are reversible and it has a disproportionate impact on productivity and care requirements,” Foster said.

Global drug developer Novartis has a Diseases of Ageing and Regenerative Medicine group (DARe), where researchers are working on novel treatments to address age-related illnesses, such as experimental medicines to regenerate lost hearing and tissue or strengthen weakened muscles.

Finally, although Novo Nordisk and Eli Lilly have garnered a lot of attention for the success of their GLP-1 weight loss and diabetes drugs, Foster highlighted an ancillary player in this space – Nestlé Health Science – which supports the nutritional needs of GLP-1 consumers.

James Thomson, manager of the Rathbone Global Opportunities fund, has achieved recent success in the healthcare space. Medtech company Boston Scientific and robotic surgery business Intuitive Surgical were among his top performers in 2024 – alongside Nvidia and discount retailers Costco and Walmart.

All five companies have “the star quality that we look for in a growth stock: innovation, a protected competitive position, resilience, adaptability, scale and strength”, he said.

Within healthcare, the life sciences sector is emerging from a challenging environment following the Covid-19 pandemic. Over-capacity, high inventories and reduced biotech funding led to an earnings downcycle. Malcolm McPartlin, co-manager of the Aegon Global Sustainable Equity fund, said valuations are therefore attractive, creating a timely opportunity to access the sector’s strong growth prospects.

“Advances in technology and knowledge are driving increased research and development in modern therapeutics such as genomics, proteomics and synthetic biology. This, combined with ageing populations and increasing prevalence of chronic diseases, leads to an expected 13% compound annual growth rate (CAGR) for the industry over the next decade,” he noted.

McPartlin highlighted Avantor, which provides mission-critical products and services to the life sciences and advanced technology industries, and Danaher, a global life sciences and diagnostics company.

“Avantor has high exposure to consumable products (as opposed to capital equipment), which we think will lead the sector’s earnings recovery. We think customers have depleted high inventories and expect demand in consumable, such as reagents, to recover in 2025,” he explained.

McPartlin described Danaher as “a case study in long term value creation, with the founders’ relentless pursuit of business improvement revered by the business community”.

The healthcare sector could be a key beneficiary of AI, according to Justin White, portfolio manager of the T. Rowe Price US All‑Cap Opportunities Equity strategy. “It is going to be fascinating to see how AI impacts the healthcare sector, from advancement in robotics and precision surgery to enabling the discovery and diagnosis of novel treatments. The technology is still in its infancy, but AI could have a disruptive impact in terms of greatly improved patient treatment/long‑term care,” he said.

“Identifying the likely winners at an early stage represents a potentially huge investment opportunity.”

Renewable energy, industrials and AI enablers

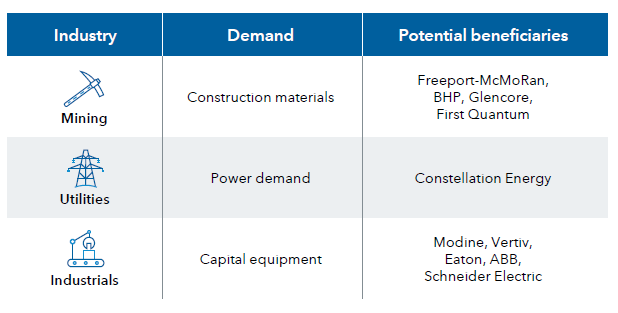

As AI adoption becomes more widespread, fund managers are casting a wider net to find companies on the receiving end of a capital expenditure super-cycle.

Building and running data centres requires vast physical resources, causing demand for copper, capital equipment and electricity to soar, said Mark Casey, an equity portfolio manager at Capital Group. This is a boon for ‘old economy’ utility, industrial and mining companies, as the chart below illustrates.

AI supply chain boosts old economy companies

Source: Capital Group

“The four so-called hyperscalers – Alphabet, Amazon, Meta and Microsoft – are spending about half of their capex budget on technology and half on buying land, constructing as many data centres as possible near reliable power and locking in long-term contracts with energy suppliers,” Casey explained.

RBC Brewin Dolphin expects renewable energy to become the dominant source of power supporting an AI-driven productivity boom. However, investing directly in renewable energy has proven challenging, Foster said. “This is because installing it requires significant upfront investment, with returns coming much later. In a market awash with highly profitable cash generative beneficiaries of AI, renewables remain in the shade.”

Fund managers have therefore found other ways to gain exposure to both data centres and renewable energy. For instance, JPMorgan American owns Trane Technologies, which specialises in building systems to cool data centres. Stablemate JPMorgan European Growth & Income holds Prysmian, whose cables connect offshore wind farms to the electrical grid.

In a similar vein, the Aegon Global Sustainable Equity fund holds Schneider Electric and HD Hyundai Electric to gain exposure to global electricity transmission and distribution, McPartlin said.

“One of the key bottlenecks in grid modernisation is a scarcity of electrical transformers, which are a critical component in transmission and distribution. With acute supply shortages, companies that manufacture transformers like HD Hyundia Electric are seeing unprecedented demand for their products with orders booked out until 2027,” he explained.

“A lack of supply and strong demand is driving the ability to charge premium prices to customers eager to secure essential components.”