Three years is often the timeframe investors use to watch a fund before deciding whether or not to buy. This practice gives some level of confidence on how a portfolio will perform but can mean they miss out on early returns, which can be higher when fund sizes are lower and managers are trying to make a name for themselves.

In this new series, Trustnet looks at the funds that were launched in 2021 and passed through their three-year track record in 2024. We look at their three-year returns to the end of 2024 to make it an even playing field.

In the UK, six funds were launched in 2021 across the IA UK All Companies and IA UK Equity Income sectors. There were no new launches in the IA UK Smaller Companies peer group.

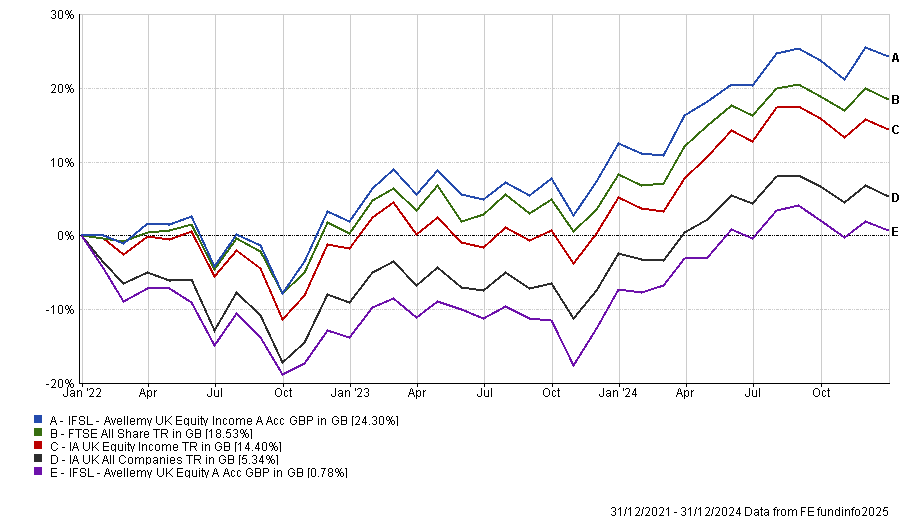

Of these, the best performer has come from the sole UK equity income specialist: IFSL Avellemy UK Equity Income. The £168.4m fund has been a top-quartile performer in the past three years, up 24.3% against its peer group’s 14.4% average return.

It aims to provide a greater income than the FTSE All Share net of fees over three years, with a positive return over five years.

In the fund’s portfolio statement to the end of August, its largest weightings were to media companies (10.9%) pharmaceuticals (8.1%) and investment banks (7.5%).

Performance of funds vs sectors and benchmark over 3yrs

Source: FE Analytics. Data to end of 2024.

Also launched in 2021 was IFSL Avellemy UK Equity, which sits in the IA UK All Companies sector and has struggled by comparison. Up just 0.8% over three years to the end of 2024, the £169.4m fund has higher weightings to industrials (13.4%) and software companies (11.8%).

The former fund was launched at the end of June 2021 (28th), while the latter was launched at the start of the same month (1st).

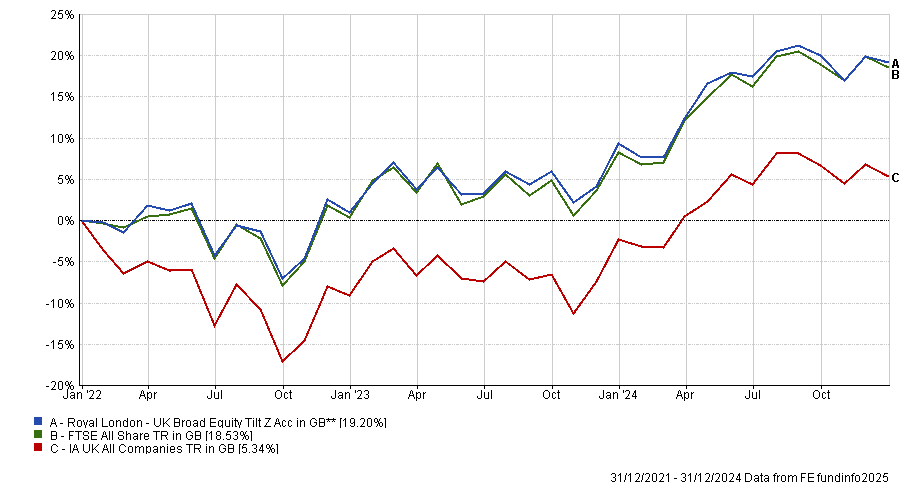

By contrast, the best performer in the IA UK All Companies sector over the past three years was Royal London UK Broad Equity Tilt.

It has hoovered up investors’ cash when compared to the others on the list since its launch in December 2021, with £942.5m in assets under management.

Over the three years to the end of 2024 the fund has made 19.2%, a top-quartile effort in the IA UK All Companies sector during this time.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics. Data to end of 2024.

Analysts at Square Mile gave it a ‘Recommended’ rating and said: “Our rating on this fund is based upon our opinion of the suitability of the index tracked, the management group's commitment to operating passive strategies, the size of the fund, the fund's cost and its good historic record of tracking the index.”

Managed by Nils Jungbacke and Michael Sprot, this fund looks at the 600 largest UK companies and uses environmental, social and governance (ESG) principles within the portfolio.

It aims to replicate the performance of the FTSE All Share over rolling three-year periods while achieving carbon intensity of at least 10% lower than that of the index. It also takes into account a company’s ability and willingness to transition and contribute to a lower carbon economy.

“This does mean that the fund's tracking error will be slightly higher than a traditional passive fund, however we believe that this is justified because of the environmental approach taken, while the tracking error will remain within a reasonable range,” the analysts said.

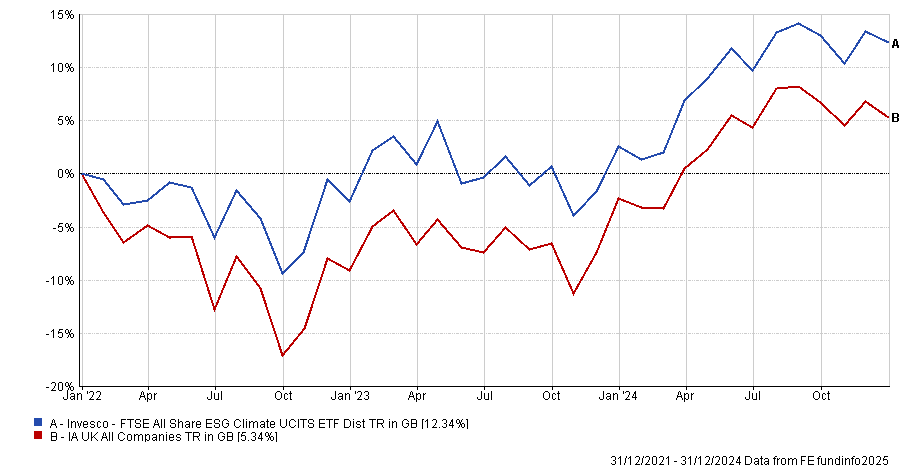

The only other fund to make an above-average return was the environmentally aware fund Invesco FTSE All Share ESG Climate UCITS ETF.

Launched in March of 2021, at £50.4m the Invesco fund has yet to attract the inflows of the Royal London vehicle, but it has made 12.3% over the past three years to the end of 2024.

Performance of fund vs sector over 3yrs

Source: FE Analytics. Data to end of 2024.

Rounding out the list, the £144m Margetts BLENHEIM UK Equity fund, launched in January 2021 and managed by Tony Yousefian, Samantha Owen and Ian Goodchild, has made a third-quartile 5.3% return.

It is a fund-of-funds, investing in just 10 names. Royal London Sustainable Leaders, WS Gresham House Multi Cap Income and Jupiter UK Multi Cap Income are the top three positions in the fund, making up a combined 41.7% of the portfolio.

In last place, Dominic Weller, Chris McVey, Richard Power’s FP Octopus UK Future Generations has lost investors 17.4%. The only fund with a negative return over the three years to the end of 2024, it was launched in August 2021 and has £14.2m in assets under management.