Jupiter UK Mid Cap was the only fund to receive a new ranking by Barclay’s Smart Investor in 2024. The number of approvals by Barclays analysts have historically been more sparse than those by the other four main UK platforms, whose best-buy lists include a handful of new vehicles every year.

This isn’t the first time Jupiter UK Mid Cap has been recognised by the platform – it had been in Barclay’s best-buy list until 28 July 2023, when it was removed because it didn’t pass Jupiter’s own assessment of value.

Performance was the key issue, with the fund having trailed the IA UK All Companies sector in a number of timeframes. It was in the bottom 10 of its peer group over 10 years, was the worst-performing fund over five years by losing 26%, and came third-to-last over three years with a -29.1% performance.

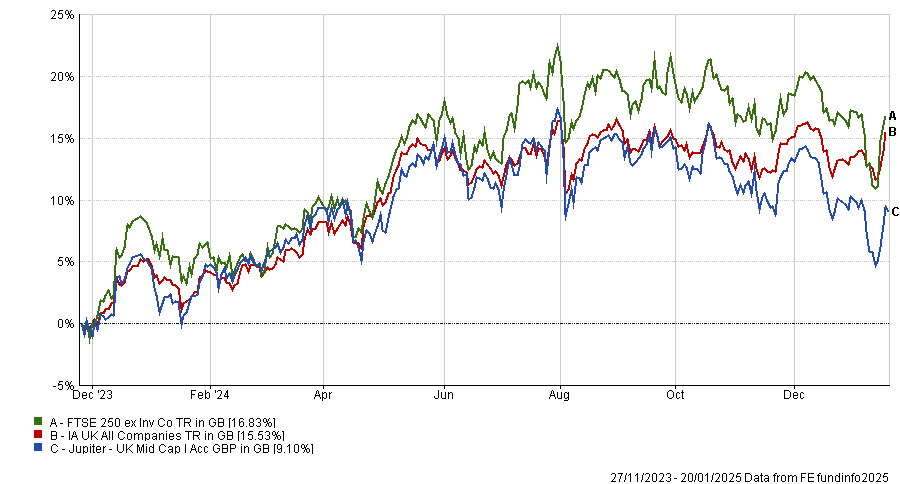

It didn’t have much luck in the past 12 months either, when it only made 9.5% against the 13% return made both by the average peer and its benchmark, the FTSE 250 (excluding investment companies) index.

“The [reviewing] board has concluded that this fund has not demonstrated value for investors in all share classes,” the 2023 report read. “Changes have since been made to the fund over the review period, with updates to investment positioning.”

On 30 June 2024, the head of small and mid-cap UK equities at Jupiter Asset Management Dan Nickols retired and was replaced by Tim Service, who has been co-managing the Jupiter UK Mid Cap portfolio with James Gilbert since 27 November 2023. Previously, it had been managed by Ashton Bradbury.

Jupiter’s subsequent assessment, ending 31 March 2024, concluded the fund “has demonstrated value, although not consistently for investors in all share classes”.

Changes have been made, with updates to the team structure and the selling out of positions that negatively detracted from the fund’s overall performance, and on 18 December 2024 Barclays reinstated it to the list.

Performance of fund against sector and index during managers’ tenure

Source: FE Analytics

The fund invests in the ‘breeding ground’ for future successful large businesses – FTSE 250 constituents that might make the leap to the FTSE 100.

Many of them will have been classed as smaller companies, when they first floated on the stock market but moved into the mid-cap arena after growing by increasing their product or service offering, expanding into new markets and developing areas, Barclays analysts explained.

As a result, the average FTSE 250 company grows its earnings at a faster rate than both the large-cap and small-cap average and the fund aims to take advantage of this dynamic.

Based on the belief that this area of the market is less well researched than the large companies that make up the FTSE 100, the managers try to take advantage of share price inefficiencies by choosing companies whose share prices look cheap given the future growth outlook and that are growing their earnings strongly.

The portfolio currently includes 53 names, with Games Workshop being the first holding at 4.4%. It is followed by residential property developer Bellway (3.9%) and internet provider Telecom Plus (3.3%). Other notable positions include low-cost airline Jet2 (3%) and wealth manager St James’s Place (2.8%).

Barclays analysts said Jupiter UK Mid Cap is “one of the most successful funds among its peer group” and praised Service’s and Gilbert’s “large and experienced team with a proven track record”.

Service has managed the UK Specialist long-short fund since 2015 and also a segregated institutional small-and-mid-cap long-only fund, which delivered outperformance of its benchmark index under his tenure. This track record also swayed Rayner Spencer Mills Research (RSMR) analysts, who rank the fund.

“We view the manager as talented but also pragmatic and risk-aware, and believe he will be a good team leader,” they said.

“His overall career record is strong. The fund will be managed in a less concentrated manner on the stock side and will be similar to the pragmatic approach taken by the first manager of this mandate [Bradbury] who Tim trained under.”

The RSMR analysts said this fund is most suitable as a satellite holding among UK equity funds.

This article is part of a Trustnet series on best-buy lists. Earlier this week, we covered the funds added by Fidelity, interactive investor and Hargreaves Lansdown. We also covered fund removals.