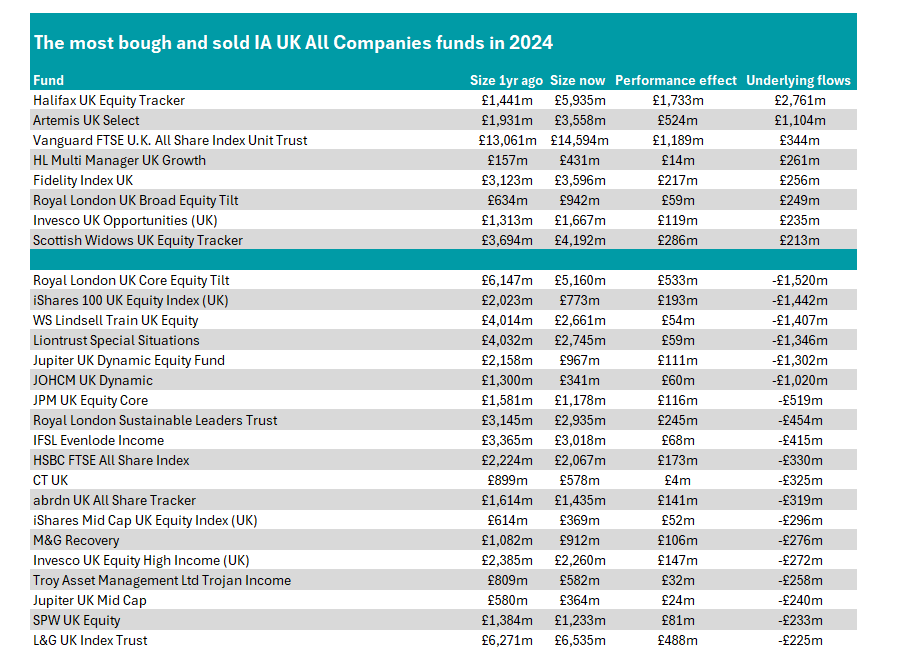

Halifax UK Equity Tracker, HL UK Income and Fidelity UK Smaller Companies topped their respective sectors as the most bought UK funds of 2024, according to FE Analytics data.

In this new series, Trustnet looks at the funds that took in the most net inflows from investors, as well as those where money flowed out.

In the IA UK All Companies sector, Halifax UK Equity Tracker topped the list, with the large inflows were the result of fund consolidation.

In second place, and perhaps a truer reflection of fund flows, was Artemis UK Select, where assets under management rose from £1.9bn at the start of 2024 to £3.6bn by the end of the year. While performance accounted for £523m of this increase, some £1.1bn came from net new money.

Managed by Ambrose Faulks and FE fundinfo Alpha Manager Ed Legget, the fund has been exceptionally strong. It has been the best performer over 12 months and five years, while it is the third-best fund of the peer group over three and 10 years.

It is heavily skewed to financials at present, with Barclays, Standard Chartered Bank and NatWest Group its three largest holdings. In total, the fund has 39.4% in this area, which has benefited from higher for longer interest rates.

It was by far the most bought UK fund of 2024, with the next-best in the IA UK All Companies sector – Vanguard FTSE U.K. All Share Index – taking in £344m. Several other passive funds took in more than £200m, including Fidelity Index UK and Scottish Widows UK Equity Tracker.

Source: FE Analytics

Of the biggest losers, investors pulled £1.5bn from the Royal London UK Core Equity Tilt, although some of this could have been repatriated to the Royal London UK Broad Equity Tilt fund, which added £249m.

There were six funds in the sector where more than £1bn was removed, including behemoth active funds WS Lindsell Train UK Equity and Liontrust Special Situations, which have both suffered from underperformance in recent years.

Both funds remain in the top quartile of the sector over 10 years but have slipped to below average over three and five years. Their 12 month returns are both in the bottom 25% of the sector, with each struggling due to a fall from grace for their quality-growth approaches.

Meanwhile, Jupiter UK Dynamic Equity and JOHCM UK Dynamic were hit by a change of manager. Alpha Manager Alex Savvides left JO Hambro Capital Management to replace the outgoing Ben Whitmore at Jupiter, leading to the outflows for both funds.

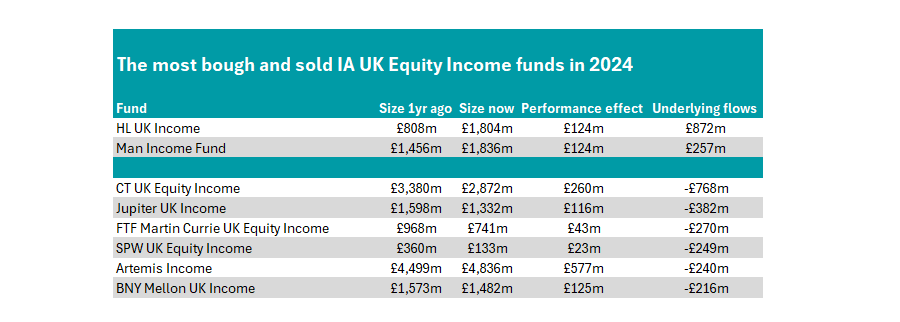

In the IA UK Equity Income space, HL UK Income was the clear winner, taking in £872m in net new money from investors, with assets under management climbing from £808m at the start of 2024 to £1.8bn by year’s end.

The fund had a strong year, making 12.1%, but has underwhelmed over the long term, up just 53% over the decade to the end of 2024. Manager Ellen Powley has been in charge of the portfolio since 2006 and was joined by Richard Troue in 2022.

Man Income was the only other portfolio in the sector with more than £200m of new money brought in last year. Run by Alpha Manager Henry Dixon, it has been the best performer in the sector over the past decade to the end of 2024, and is in the top quartile of the peer group over one, three and five years as well.

Source: FE Analytics

Conversely, six funds suffered more than £20m in net outflows for the year. CT UK Equity Income was the most adversely affected, with assets under management dropping from £3.4bn to £2.9bn in 2024. The fund has been an above-average performer in the sector over three years and was in the top quartile in 2024.

However, Jeremy Smith took charge in 2022 and the continued selling could be a fallout from the retirement of the fund’s veteran manager Richard Colwell in 2023.

It was followed by Jupiter UK Income (another of Whitmore’s former funds) and FTF Martin Currie UK Equity Income as the three most-sold income funds of the year.

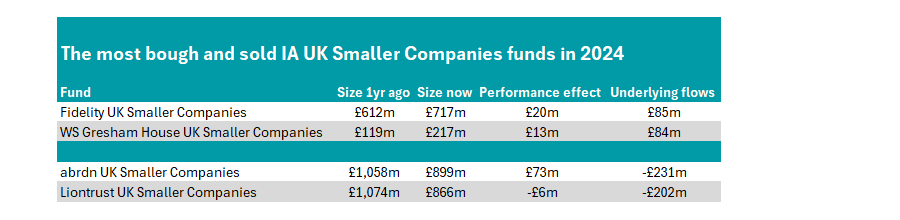

Lastly, there were no IA UK Smaller Companies funds to rake in more than £200m in net new monies in 2024. In fact, the best-selling fund – Fidelity UK Smaller Companies – took in just £85m. Close behind was WS Gresham House UK Smaller Companies with inflows of £84m.

Source: FE Analytics

However, two funds from the sector suffered net outflows of more than £200m, including Abbie Glennie and Amanda Yeaman’s abrdn UK Smaller Companies. It was the most-sold fund with outflows of £231m after a difficult time over the past half a decade.

The fund sits in the bottom quartile of the sector over three and five years, although made an above-average 7.4% return in 2024.

Liontrust UK Smaller Companies followed in the Special Situations fund’s footsteps, with £202m in outflows. Both portfolios are run by the Economic Advantage team. One of its two founders – Alpha Manager Julian Fosh – retired towards the start of this year after an illness. His longtime co-manager (and fellow Alpha Manager) Anthony Cross remains head of the team.