GS Goldman Sachs Eurozone CORE Equity Portfolio has gone under the radar of investors since its launch in 2021, but returns suggest it is worth taking a closer look.

With just £5.3m in assets under management, Len Ioffe, Osman Ali and Takashi Suwabe’s portfolio has failed to garner much attention, making it the smallest of the four funds from the IA Europe Excluding UK sector launched three years ago.

But it has been much more successful in terms of performance.

Making a 23.2% return over the three years to the end of 2024, the fund has been the 10th-best performer in the IA Europe Excluding UK sector during this time. Over one year the fund is in second place among its 130 peers, with a 21.1% gain.

According to the fund’s factsheet, it is designed for investors who want an equity portfolio with the same style, sector, risk and capitalisation characteristics as the benchmark but aims to outperform through stock and country selection.

It currently holds 132 names in the portfolio, with SAP SE the largest holding at 6%. This is followed by ASML (3.9%) and Siemens AG (3.8%).

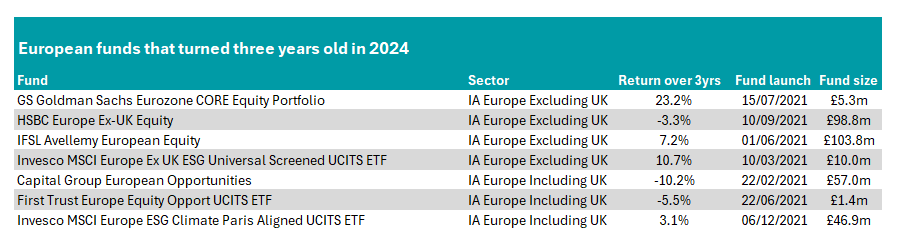

This is part of Trustnet’s series on young funds. We look for portfolios launched in 2021 that went through their three-year track record in 2024 and compare their three-year performance to the end of last year. Having covered the UK last week, this time we are hopping across the channel to Europe, looking at funds in the IA Europe Excluding UK and IA Europe Including UK sectors.

Sticking with those that do not invest in the domestic market, the next-best performer was the Invesco MSCI Europe Ex UK ESG Universal Screened UCITS ETF. Launched in March 2021, its 10.7% three-year return to the end of 2024 was good enough to place it in the second quartile of the sector.

It tracks the MSCI Europe ex UK ESG Universal Select Business Screens Index, which aims to replicate the performance of large and mid-cap companies in Europe by adjusting the weightings based upon environmental, social and governance (ESG) metrics.

Despite being the second-best performer of the young funds, it was also the second smallest, with assets under management of £10m.

Both HSBC Europe Ex-UK Equity (£98.8m) and IFSL Avellemy European Equity (£103.8m) have attracted more money, but have proven to be worse performers. The former is in the fourth quartile of the sector over three years having made a 3.3% loss, while the latter has fared better, producing a third-quartile return of 7.2%.

Source: FE Analytics. Performance data to end of 2024 in local currency.

Turning to the IA Europe Including UK sector, funds launched in 2021 have been an underwhelming crop – at least so far.

All three have failed to beat the average peer over three years to the end of 2024 but the best performer was Invesco MSCI Europe ESG Climate Paris Aligned UCITS ETF. It made 3.1% over the three years, placing it in the third quartile of the sector over this time.

The fund tracks the performance of the MSCI Europe ESG Climate Paris Aligned Benchmark Select Index, which has a low exposure to transition and physical climate risks.

Instead, it screens stocks looking for opportunities arising from the transition to a lower carbon economy and aligning with the Paris Agreement requirements.

The fund is 17.3% weighted to the UK, with financials and industrials its two largest sectors. Novo Nordisk and ASML (2.9%) share the top spot in the portfolio, with SAP SE, AstraZeneca and Novartis rounding out the five largest positions.

Launched in December 2021, the fund has made a 3.1% three-year return and has assets under management of £46.9m.

It was followed by First Trust Europe Equity Opportunities UCITS ETF, which tracks the IPOX 100 Europe Index – an equal-weighted benchmark that tracks the largest 100 stocks in Europe.

The only active fund on the list – Capital Group European Opportunities – is managed by Lawrence Kymisis, Michael Cohen and Patrice Collette. Over three years to the end of 2024, the fund has lost 10.2%.

It is the largest of the three young funds with £57m in assets under management and is overweight industrials, financials, technology and consumer discretionary stocks. It is made up of 91 holdings, with ASML its largest position at 4.7%, while the top 10 represents 28.4% of the portfolio.