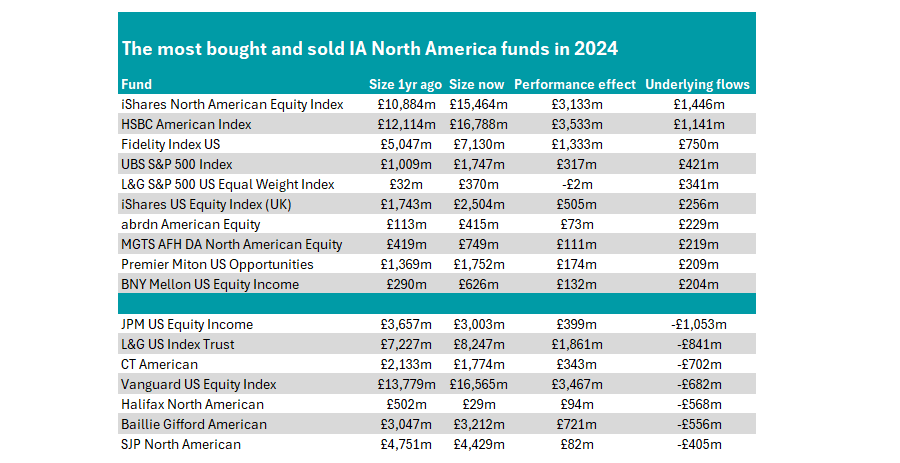

Passive US funds dominated flows in 2024, according to data from FE Analytics, with iShares North American Equity Index taking in the most new money from investors over the course of the year.

The £15.5bn fund added some £3.1bn from performance last year as the FTSE North America index it tracks soared thanks to the continued rise of the Magnificent Seven.

Investors put in £1.5bn in new money last year on top of this, meaning assets under management (AUM) of the fund, which started the year at £10.8bn, rocketed.

It was joined by HSBC American Index and Fidelity Index US in second and third place respectively. The former was the only other fund in the IA North America sector to rake in more than £1bn of new money from investors, while the latter took in £750m.

Six of the 10 funds with more than £200m added in net inflows last year were passives including the fledgling L&G S&P 500 US Equal Weight Index fund, which went from £32m at the start of the year to £370m by year’s end despite making a loss overall.

The index gives each member of the S&P 500 an equal weighting, which means it is less dominated by the large-caps as some of its market capitalisation-weighted peers.

It was not a clean sweep for passive funds, however, with some active portfolios also making the list, as the table below shows.

Source: FE Analytics

The most-bought active fund was abrdn American Equity. Managed by Ralph Bassett, Qie Zhang, Virgilio Aquino and Mike Cronin, it aims to beat the S&P 500 index by 3% per year over rolling three-year periods. As such, at present it is heavily skewed to technology, which makes up around a third of the portfolio.

Software developer Microsoft, Google parent company Alphabet and online retailer Amazon are the three largest positions by some way in the fund, accounting for almost a quarter (23.6%) of the portfolio.

It took in £229m of new money last year, taking its assets under management from £113m to £415m after performance was also included.

MGTS AFH DA North American Equity, Premier Miton US Opportunities and BNY Mellon US Equity Income also made the list.

The latter two are both recommended by analysts at FE Investments. The Premier Miton fund is headed by Hugh Grieves and Alex Knox, who worked together at Gartmore, and gained FE Investments’ approval as a “solid option as an active US equity fund, providing exposure to the full spectrum of the US equity market, and particularly smaller- and medium-sized companies at different points in the cycle”.

Conversely, the BNY Mellon fund is run by John Bailer, who invests with a value tilt, something FE Investments said offered “important diversification away from the growth-oriented US market and average peer”.

“It is a clear positive that each stock position contributes meaningfully to income, rather than an approach combining some growth stocks with some of the highest yielding names, as the fund is therefore simultaneously a pure-play on the value style whilst avoiding businesses that are in structural decline,” it said.

Turning to the most-sold funds on the list, investors pulled £1bn from JPM US Equity Income last year despite the fund adding £399m to its AUM through performance.

CT American, Halifax North American, Baillie Gifford American and SJP North American were the other active names on the list, while investors also withdrew from passive options L&G US Index Trust and Vanguard US Equity Index.

In the IA North American Smaller Companies sector, no funds suffered net withdrawals of more than £100m, while there were two that raked in more than £100m.

Artemis US Smaller Companies took in the most with £245m of new money added to the fund, which is managed by Cormac Weldon and Olivia Micklem. Assets under management rose from £775m at the start of the year to £1.2bn by the end of 2024.

Analysts at Square Mile Investment Consulting & Research, gave the fund a ‘AA’ rating, stating Weldon is an “accomplished investor” with a “highly credible track record” throughout his career, most notably at Threadneedle Investments (now Columbia Threadneedle Investments).

They noted that the team is small, but said: “In this case we think its size is advantageous as it leads to swift decision making in a market that can be prone by short, sharp changes in investor sentiment.”

T. Rowe Price US Smaller Companies Equity was the other small-cap fund to garner interest from investors. With £123m in net inflows last year, the fund’s AUM rose from £220m to £368m.