The US equity market was the place to be for investors in recent years. The S&P 500 has significantly outperformed all other regions over the past decade and the US now represents 66.6% of the MSCI ACWI index.

As Rob Morgan, chief analyst at Charles Stanley Direct, said: “Simply being market weight or overweight in the US has been the ticket to good performance.”

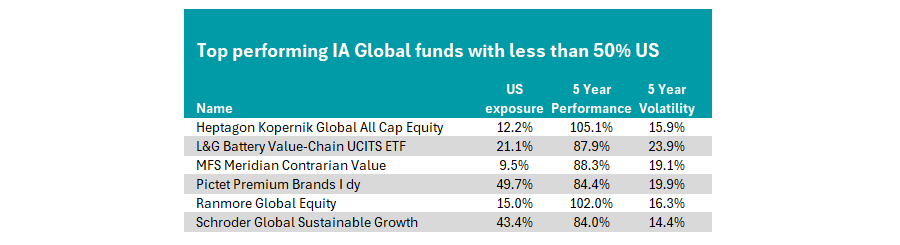

However, while the US may have been a favourite destination for investors, especially in the past five years, some global strategies were able to thrive while going against the consensus. Of the 414 IA Global funds with a five-year track record, six delivered top-quartile performance with less than a 50% allocation towards America, according to their most recent factsheets.

Source: FE Analytics

Jason Hollands, managing director at Bestinvest, explained: “This is an eclectic group of funds, reflecting that over the past five years, you’d need to have been doing something very much off the beaten track to beat the MSCI All Country World Index.”

Value funds

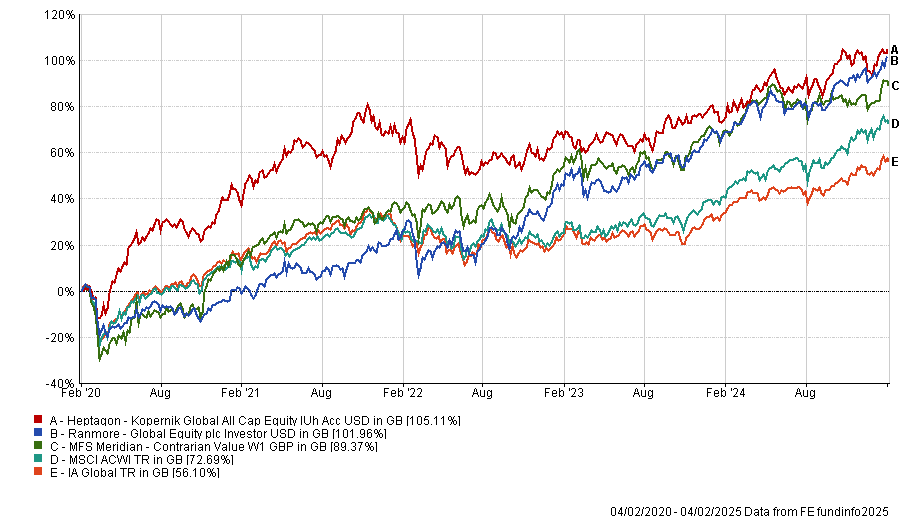

Of the six qualifying funds, three (Ranmore Global Equity, Heptagon Kopernik Global All Cap and MFS Meridian Contrarian Value) were value funds.

This might be a surprise, as the difference between value and growth stocks is now more extreme than the height of the dot.com bubble, which has left value investing out of favour. Despite this, the strategies posted first-quartile returns of 102%, 105.1% and 88.3%, respectively.

Performance of funds vs sector and MSCI ACWI over 5yrs

Source: FE Analytics

As a result of their value investment style, Hollands explained that they “had no resemblance to the index”. Indeed, of the six funds, these three had the lowest allocation to the US.

However, while these funds have performed well recently, Hollands explained that they were an inconsistent option and have experienced large deviations in results. This is demonstrated by the fact they ranked in the third or bottom quartile for volatility in this period.

Nevertheless, Morgan said these value funds made great diversifiers in investors’ portfolios. For example, he explained that the Ranmore fund had delivered good returns for investors by targeting “less fashionable” areas of the market. For example, the fund has a 40% allocation towards Consumer Products, while Consumer Discretionary and Staples represent a combined 17% of the MSCI ACWI.

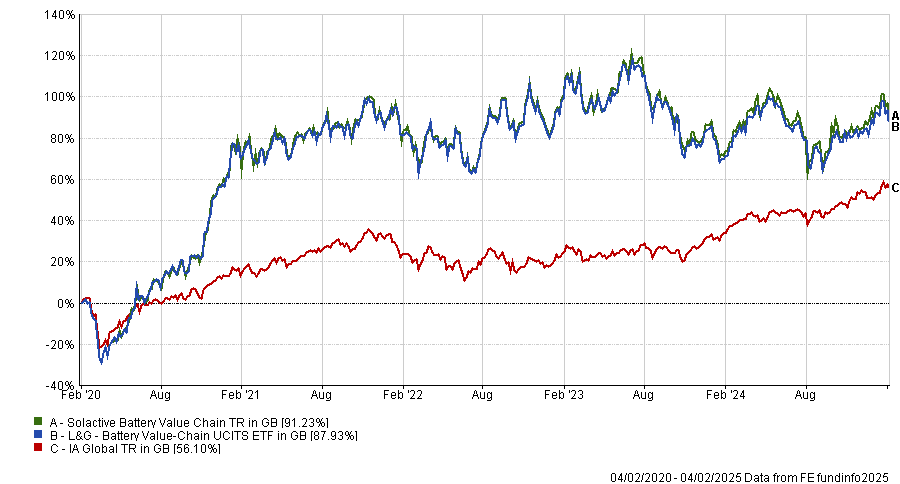

L&G Battery Value Chain UCITS ETF

Not all the funds that beat the market were value strategies. For example, Morgan drew attention to the L&G Battery Value Chain UCITS exchange-traded fund (ETF), which tracks a basket of battery technology and energy storage stocks. While he conceded this was a niche, high-risk approach, he argued it has performed “exceptionally well”. For example, it was up by 87.9% over the past five years.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

It has broad geographical exposure to both Japan and Europe, making it an interesting potential diversifier, he said. However, the fund has slid in recent years, with bottom-quartile results over the past one and three years.

Hollands was more critical of the fund, drawing attention to its niche offering and investible universe. “I do not see such narrow strategies as suitable for most retail investors,” he explained.

Schroder Global Sustainable Growth

Instead, Hollands pointed to Schroder Global Sustainable Growth, led by FE fundinfo Alpha Manager Charles Somers and his co-manager Scott MacLennan. Over the past five years, it was up by 84%.

Performance of fund vs sector and MSCI ACWI over 5yrs

Source: FE Analytics

“It underperformed last year, in common with most global equity funds, but otherwise, it has consistently delivered index-beating returns,” Hollands explained.

For Morgan, this was due to “exposure to the renowned Magnificent Seven” (Nvidia, Microsoft, Apple, Meta, Amazon, Alphabet and Tesla) and a large growth capital tailwind.

Indeed, Microsoft and Alphabet are the fund’s two largest holdings. Taiwan Semiconductor Manufacturing Company (TSMC), which has benefitted from recent investor fixation with artificial intelligence, is another prominent holding in the portfolio.

Pictet Premium Brands

Finally, we have Pictet Premium Brands. Over five years, it surged by 84.4%, beating the index by more than 30 percentage points. Hollands explained that the fund has a “strong consumer discretionary narrative” and invests in well-known, high-end brands such as Mastercard and Ferrari.

Performance of fund vs sector and MSCI ACWI over 5yrs

Source: FE Analytics

However, Hollands warned that recent geopolitical events may cause a headwind. “Things could be about to get interesting in this space with a global trade war kicking off, which will test how resilient some of these luxury names are,” he said.