It was five years ago to the day that the market began tumbling as the outbreak of Covid sent shockwaves around the world. Now I know what you may be thinking: ‘Covid was so far five years ago’. And you are right. But the effects of the global pandemic are still being felt today.

Higher interest rates are a result of rampant inflation over the past three years which, among other factors, has a direct link to the global supply chain backlog caused by the coronavirus. So although Covid may have been five years ago, it still lingers across markets.

As such, I thought it would be a good time to see what has done well and what has struggled in a post-Covid world.

In markets there has been a clear winner: the US. The American market headlined by the ‘Magnificent Seven’ of Nvidia, Tesla, Microsoft, Apple, Amazon, Meta and Alphabet has dominated.

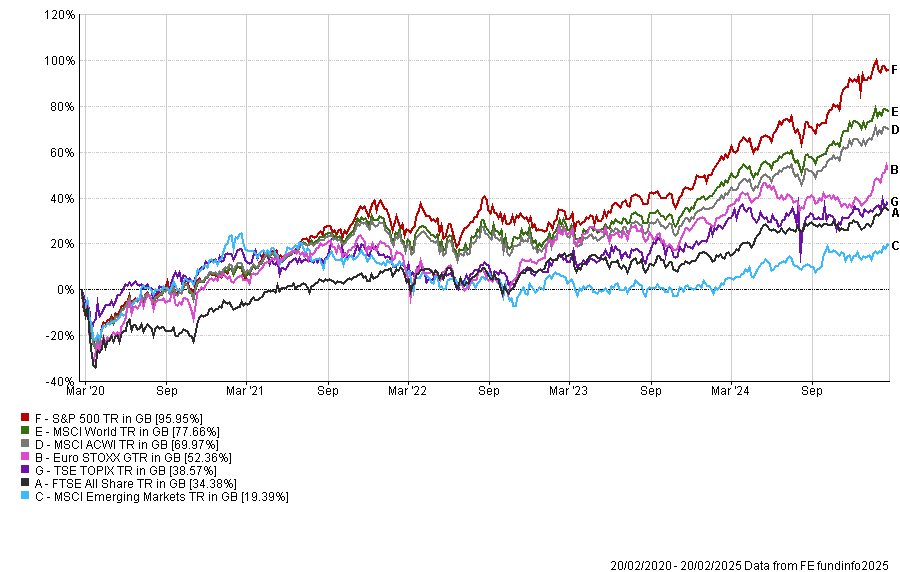

The S&P 500 has risen 96% over the past five years, which includes the initial market crash during Covid. This has also dragged the MSCI World and MSCI ACWI higher, as both are global indices with high weightings to the US.

Performance of markets over 5yrs

Source: FE Analytics

Tech stocks should have an issue with higher interest rates, as it affects their future earnings growth forecasts. Put simply, the more investors can make today, the less they are willing to pay up for potential future growth.

But the rapid increase in artificial intelligence (AI) has allowed these companies to thrive at a time when they perhaps would not have otherwise.

Rob Burgeman, senior investment manager at RBC Brewin Dolphin, said: “Tech has done remarkably well and the sector’s products have become even more integral parts of our lives over the past five years, through trends such as hybrid and remote working.

“The large increases to the share prices of these companies have been based on strong growth, cashflow, and profitability – these are seriously large and impressive businesses and it is difficult to see that changing.”

Other markets have been far less fruitful. European stocks are up 52.4%, the Japan market has gained 38.6%, UK shares are 34.4% ahead and emerging markets rose just 19.4% during this time. All these figures are in sterling terms.

Some have questioned whether now would be the time to sell out of some of these US names and to diversify, but Burgeman is unsure, noting “there seems to be no obvious catalyst for markets beyond the US to narrow the gap”.

“Looking ahead, it is difficult to see the big tech companies that have driven markets since the pandemic being dislodged – if anything, they will likely only continue to grow,” he said.

If this is the case, investors will want to continue backing the big winners of the past five years – namely US tech-related passive funds.

The best performer in the Investment Association sector during the past half-decade has been the iShares S&P 500 Information Technology Sector UCITS ETF, up an astronomical 178.7%.

But it is far from alone. Five other funds would have made investors more than 150% (or 2.5x their money). They are Xtrackers MSCI USA Information Technology UCITS ETF, L&G Global Technology Index Trust, Xtrackers MSCI World Information Technology UCITS ETF, SSGA SPDR MSCI World Technology UCITS ETF and SSGA SPDR S&P U.S. Technology Select Sector UCITS ETF.

Investors would have done well to avoid areas such as gilts and other government bonds, which have floundered over five years as interest rates have rocketed. But with central banks expected to cut rates, there are tentative hopes that these funds could recover from here.

Diversification has not paid off over the past five years but there are some who believe times are changing. US tech valuations are high, interest rates could be coming down, AI will need to be expanded and geopolitics remains well and truly in the foreground.

Others think it will be more of the same going forward, with tech still the pre-eminent place to be.

What is clear to me is that the next five years could prove equally as unpredictable as the previous five. However you choose to invest, I wish you the best of luck.