Two months into the new year and the investment-grade credit market is already making headlines with record-breaking issuance levels. The first week of January alone set a new high for euro and sterling issuance. Over the year, we expect to see heavier gross supply than usual, supported by very healthy demand, with manageable net supply as Covid-era five-year issuances come due.

This activity underscores the confidence among corporates and investors to capitalize on favourable market conditions, setting the stage for a dynamic year ahead in the investment-grade credit market.

The US: A solid foundation amidst change

In the US, the investment-grade credit market is standing on solid ground. After multiple quarters of softer revenue growth, companies are now seeing a resurgence in growth.

The story here is one of cautious optimism. Leverage ratios are stable and interest coverage, though slightly down from its peak, is aligning with expectations after a period of refinancing at higher rates.

The macro backdrop is also shifting. Following a Republican sweep in the general election, markets have recalibrated, now expecting a 4% federal funds rate. With the current rate at 4.25% to 4.5%, the market is bracing for stability rather than further cuts. By our calculations, this environment has led to a 40% likelihood of above-trend growth, suggesting a more robust economic outlook.

Europe: Following the US lead

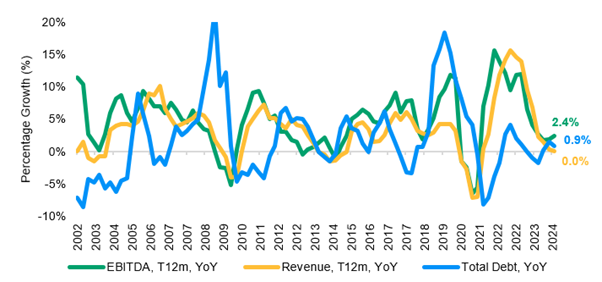

Across the Atlantic, Europe appears to be mirroring the US recovery with a one-year lag. We view the decline in earnings growth as having bottomed, with a modest uptick in EBITDA growth for industrial companies. Revenue growth is slowing but the rate of deceleration is easing, hinting at stabilisation.

European companies are maintaining healthy balance sheets, a key driver behind the surge in merger and acquisition activity. The narrative here is one of recovery, while certain sectors such as autos and luxury retail are still grappling with challenges.

With the new US administration, European names will likely be caught in the crosshairs of tariffs. However, we expect a modest tariff regime to be relatively manageable for European investment-grade corporates due to their globally diversified revenue and manufacturing base.

In Europe, Q3 2024 was the first quarter since 2022 when EBITDA growth was higher than the prior quarter. Revenue growth also looks to be troughing as it nears zero, as the chart below shows.

Sources: J.P. Morgan Asset Management, FactSet, Bloomberg; based on median industrial company

Policy shifts: A double-edged sword

We expect considerable policy changes under Donald Trump’s administration and note four main areas that could be impactful to US companies: tariffs; regulatory oversight; a lower corporate tax rate for companies that produce in the US; and change in some of the provisions of the Inflation Reduction Act and the Chips and Science Act. With details still forthcoming, we have based our analysis on many assumptions and focused primarily on first order effects.

Taking into account these key policy areas that could impact forward-looking fundamental metrics, and assuming a 10% universal tariff, we found that the overall impact for US corporates was neutral for just over half industrial sectors, with key trends remaining the same.

The healthcare and technology sectors, which were expected to outpace others, will continue to do so.

Sectors already seeing flat or declining baseline growth, such as retail, consumer products and autos, will face additional pressure.

Midstream companies within energy emerge as a clear winner, as policy impacts would be a catalyst for growth, while utilities are not expected to be impacted.

Banks are expected to benefit from regulatory easing, though we don’t expect a major deregulation.

When looking at Europe, applying the impact of a 10% tariff across the board on goods exported to the US would result in a delayed rebound in European earnings growth from our base case. However, many large European companies have operations in the US, so exports constitute a relatively small percentage of US sales, dampening the effect of tariffs. European companies with pricing power, such as capital goods manufacturers, are expected to pass along pricing, while auto manufacturers, already under pressure, will experience greater margin and earnings deterioration.

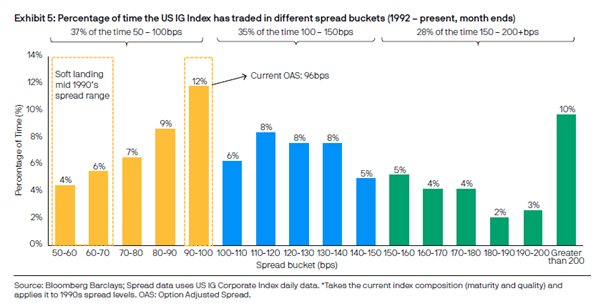

The view ahead parallels with the ‘90s

In line with our expectations throughout 2024, valuations across the board are approaching the narrower side of history. Historically, when US investment-grade credit spreads trade inside 80 basis points, yields are almost always at or above the current level of roughly 5.1% and during periods of higher all-in yields, credit spreads tend to be more compressed. In the two periods (mid-1990s and mid-2000s) where spreads traded around current levels for sustained periods of time, yields were close to or above the current 5.1%.

Given this, we believe the recent sell-off in rates is supportive of investment-grade credit maintaining at these tight spreads over the longer term.

Looking ahead

2025 is shaping up to be a promising year for investors in the investment-grade credit market. In the US, we think the potential for less regulation will benefit both large global banking institutions and regional banks. While policy changes under the new administration present some challenges, they also open doors for growth in sectors such as healthcare, technology and midstream energy.

In Europe, banks engaging in merger and acquisition activity look attractive while heavy supply for French bank bonds in January continues to present buying opportunities.

Investors can look forward to capitalizing on these favourable conditions, making 2025 an opportune time to explore the investment-grade credit market.

Andreas Michalitsianos is portfolio manager of the JPM Global Corporate Bond fund. The views expressed above should not be taken as investment advice.