As far as precious metals go, none seems to fascinate investors more than gold. For some it is shining brighter than ever, reaching a new high of more than $2,900 per ounce earlier this month.

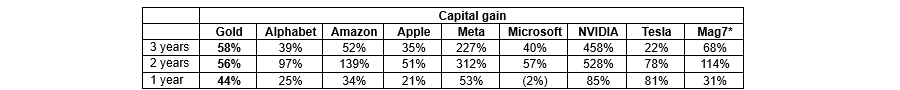

It has even outperformed Magnificent Seven tech darlings (Nvidia, Microsoft, Apple, Alphabet, Tesla, Meta, Amazon) over the past year.

As a result, investors may be excited to take advantage of the recent rally, but commodity managers have cautioned against it. Vince Childers, head of real assets at Cohen & Steers, said: “Gold is part of portfolios as a strategic holding, but trying to trade it is perilous”.

He explained this was because even for investors with a "perfect set of information" the direction of gold is unpredictable. A crystal ball that could perfectly tell investors the direction of interest rates or the dollar would only explain "some of the variance in gold returns”, he said.

Performance of Gold vs the Magnificent Seven over 3yrs

Source: AJ Bell. Refinitiv data. Mag7 based on change in aggregate market capitalisation of the seven stocks.

Even though "strictly speaking, gold is currently a bit expensive”, investors can draw very little about how much further the rally has to go. As a result, he argued investors would find it difficult, if not outright impossible, to be successful over the long term while making tactical bets on the value of gold.

“If it is difficult to explain in a world where you have perfect information and having that information does not even matter, why try and predict its value at all?”, he said.

Instead of obsessing over gold’s latest bull market, investors should remember it is “a unique asset that is valuable when the monetary wheels start to fall off the bus”. But for those interested in trading it, he added: “I cannot recommend it”.

For investors looking to add value to their portfolio’s and genuinely diversify their income he argued real estate would be a more compelling option than gold. Despite very attractive cashflows and long-term growth potential, it is an asset that Childers said many investors underestimate.

Childers explained in the current investment landscape market concentration is the “major driver of risk, whether investors know it or not”. With more than 70% of the MSCI World now made up of US companies, he argued investors cannot rely on equities to add diversification to their portfolio.

He added bonds are no longer sufficient for this either, with it “not always being the case that bonds and equities diversify each other”.

Indeed, top multi-asset manager Jason Borbora-Sheen argued earlier this month the changing dynamic between bonds and equities had made diversification through alternatives more important.

Childers explained this is where real estate should come in because, as an asset, it has a low correlation with bonds and equities, which makes it an effective diversifier for more adventurous investors.

Ned Naylor-Leyland, manager of Jupiter Gold and Silver, was another commodities investor who said investors were focusing on the wrong thing by obsessing over the value of gold.

He explained investors should buy gold with an understanding it is the “true risk-free currency”. Unlike a government bond or an equity, it is best seen as a way of maintaining purchasing power, not as an asset you trade.

“When you look across history, all fiat currencies (those not backed by a precious metal or commodity) have gone to one number: zero”, he said.

So, he argued, the price or value of gold is “irrelevant, because what you want to know is that if you have 100 gold bars, in five years, it will buy you the same goods and services”.

For Naylor-Leyland, if the value of gold was “irrelevant” then the “value of silver was far more interesting”.

Silver, he explained, is currently valued at about $32 per ounce, compared to gold hitting near record highs. Despite this, he said it is as crucial to investors' purchasing power and value as gold but investors are not taking advantage of it yet.

He explained that by 2030 demand for silver will outpace supply by around 110%. As such, for investors who had a long-term time horizon, it could be a worthwhile investment.