Funds run by Vanguard, Barclays and Liontrust are among the multi-manager strategies with the strongest long-term track record in the IA Mixed Investment 40-85% Shares sector, FE fundinfo data shows.

Multi-manager funds often serve as a one-stop-shop for investors, allowing them to access the holdings and expertise of the underlying strategies without the need to research each one individually.

However, they have fallen in popularity over the past decade – although the launch of Vanguard’s LifeStrategy funds and other ranges built on passive strategies from BlackRock, HSBC, Aberdeen and others helped revitalise the space.

That said, some have delivered strong returns. Therefore, Trustnet researched which multi-managers in the popular IA Mixed Investment 40-85% Shares peer group – formerly known as the ‘balanced’ sector – have made the highest returns over the past 10 years.

The best performance has come from a member of the Vanguard LifeStrategy range; Vanguard LifeStrategy 80% Equity is up 110.6% over the period under consideration.

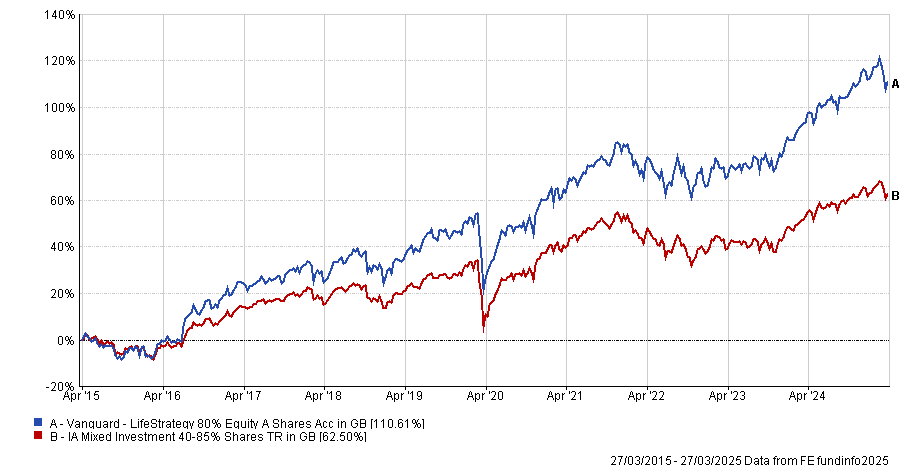

Performance of Vanguard LifeStrategy 80% Equity vs sector over 10yrs

Source: FE Analytics. Total return in sterling.

This makes it the only multi-manager fund in the sector to post a total return of more than 100% over the past decade. It’s also the fourth best fund of the entire sector, beaten only by Royal London Sustainable World Trust (up 158.7%), Orbis Global Balanced (154.2%) and WS Waverton Portfolio (113.4%).

Like all the funds in the Vanguard LifeStrategy range, it is built from underlying Vanguard equity and bond trackers and is rebalanced automatically, providing a simple way to maintain a consistent asset allocation over time.

The £13.1bn fund’s top holdings are Vanguard FTSE UK All Share Index (19.5% of the portfolio), Vanguard US Equity Index (19.3%) and Vanguard FTSE Developed World ex-UK Equity Index (19.2%).

Analysts at Square Mile Investment Research & Consulting give the fund a ‘Recommended’ rating but pointed out that its static asset allocation, passive exposure and use of only two asset classes can create some risks. Among these are high levels of correlation between stocks and bonds in the short term, reducing its diversification benefit, and an inability to adjust the asset allocation or fund selection to account for “extreme” valuations.

“These risks have the potential to impact the fund in the short term, however over the long term the fund should provide similar returns and market exposure to a fund which takes more active decisions,” they added.

“Many may also see the static allocation as a positive as it means that investors are not exposed to a fund manager making strong ‘bets’ on a certain asset class or region nor is the fund exposed to the emotional biases associated with active fund managers.”

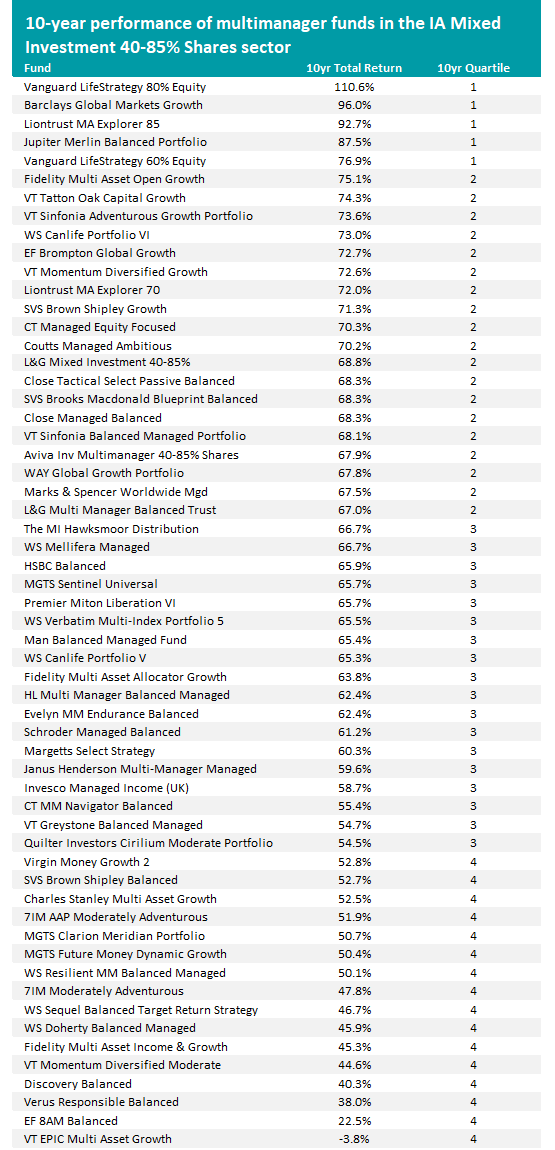

The table below reveals the 10-year total returns and quartile ranking of all 58 multi-manager funds in the IA Mixed Investment 40-85% Shares sector.

Source: FE Analytics. Total return in sterling.

Barclays Global Markets Growth comes in second place with a 96% total return. Aiming to generate both capital growth and income over the long term, it holds at least 70% of its assets in passive funds.

Currently, the top holdings are iShares North America Index (16.2% of the portfolio), iShares S&P 500 Swap ETF (14.8%) and iShares Core MSCI Emerging Markets IMI ETF (13.3%).

Manager Finlay Macdonald is running an overweight to emerging market equities, is neutral developed market equities and bonds (government, investment-grade, high-yield and emerging market debt), and underweight cash and short maturity bonds.

In third place is Liontrust MA Explorer 85 with a 10-year return of 92.7%. Managed by John Husselbee and James Klempster, the fund – like the others in the same range – aims to outperform over the long run by limiting losses in falling markets.

The core strategic asset allocation is outsourced to third-party consultancy Hymans Robertson, with Husselbee and Klempster able to tweak positioning as part of their tactical asset allocation. The managers aim to increase exposure to assets that look cheap and their focus is on valuations rather than market timing.

Top holdings include Brown Advisory Beutel Goodman US Value (8.6%), Evenlode Income (6%) and HSBC American Index (5.8%).

Jupiter Merlin Balanced Portfolio is in fourth place after making 87.5%. This fund, like the others in the Jupiter Merlin range, leans very much on the active side of fund management.

Manager John Chatfeild-Roberts and his team believe in investing in “the right people at the right time”. Their approach also avoids a formal method for asset allocation, instead giving them freedom to invest wherever opportunities seem best.

At present, the fund’s holdings include Jupiter Global Value, Morant Wright Nippon Yield and Evenlode Income.

Rounding out the top five balanced multi-manager funds of the past decade with a total return of 76.9% is Vanguard LifeStrategy 60% Equity. Its approach is the same as Vanguard LifeStrategy 80% Equity, aside from having a 60% allocation to stocks.

These five funds are the only multi-manager strategies to make first-quartile total returns in the IA Mixed Investment 40-85% Shares sector over the past decade.

Overall, more multi-manager funds are in the peer group’s bottom quartile than the top – 16 have made a fourth-quartile 10-year return.

The worst performer in VT EPIC Multi Asset Growth, which is down 3.8% and the only fund in the sector to make a loss over the period under consideration.

Joining it at the bottom of the sector are the likes of EF 8AM Balanced, Fidelity Multi Asset Income & Growth, 7IM Moderately Adventurous and SVS Brown Shipley Balanced.