It was easy to forget about regional diversification when the US was shooting the lights out and US exceptionalism seemed an innate advantage that would endure.

But this year, the S&P 500 has slid from the top to the bottom of the performance charts like in a game of snakes and ladders.

As such, global equity funds that ignored their benchmarks (which had two-thirds to three-quarters in the US) and pursued a radically different approach to regional asset allocation were best placed to protect investors’ capital this year.

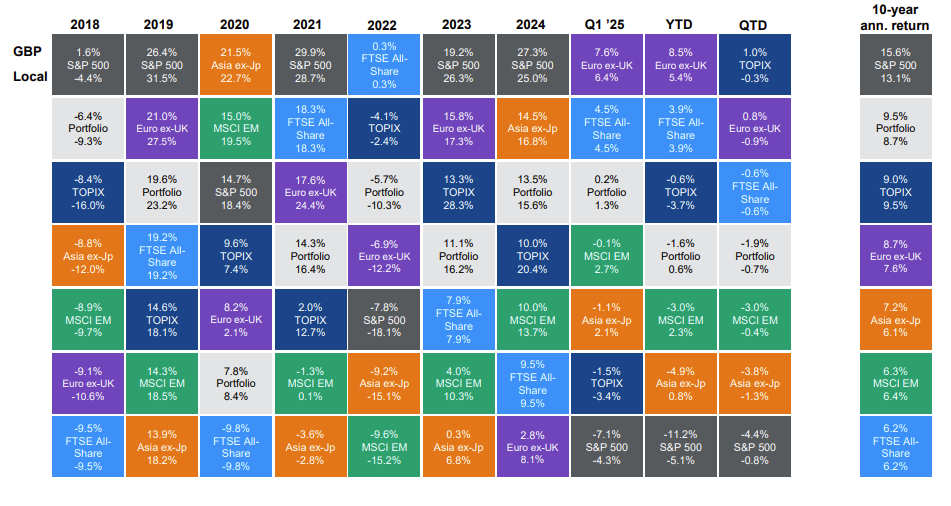

Geographical diversification would also have served investors fairly well over the past decade, as the table below illustrates. A broadly diversified portfolio with a substantial home bias would not have kept up with the S&P 500 but it would have outperformed all other major regions over 10 years.

The grey box in the table below represents a hypothetical portfolio with 25% apiece in the FTSE 100 and S&P 500, then 15% each in emerging markets and Europe ex-UK and finally 10% each in Asia ex-Japan and the TOPIX. By comparison, the MSCI All Country World Index had 64.6% in the US and 3.4% in the UK, as of 31 March 2025.

This diversified portfolio was not the best performer in any of the past seven full calendar years and it only came second once but, equally, it never incurred the worst losses and was only second-worst once. Overall, as mentioned above, its 10-year annualised return in sterling beat every other major region except the US.

World stock market returns vs a geographically diversified portfolio

Source: LSEG Datastream, MSCI, S&P Global, TOPIX, J.P. Morgan Asset Management. All indices are total return, data as of 29 Apr 2025.

Spreading an equity allocation across different regions can also help give investors a smoother ride, as their portfolio is not over-exposed to one market when economic shocks hit, said Natasha May, global market analyst at JP Morgan Asset Management.

“Take 2022: the UK stock market was one of the few regional indices to post a positive total return, as its defensive characteristics and high energy weighting helped returns during high inflation and rising interest rates. Broad regional diversification in this period would have helped limit losses in equity investors’ portfolios, more so than a fully benchmark-aligned strategy,” she explained.

“Investors should expect to experience periods in which one market outperforms for an extended interval. But over the long run, broad regional diversification has proved its worth in insulating equity portfolios from economic uncertainty and geopolitical shocks.”

Ultimately, the chart above suggests that instead of cherry-picking the best-performing market from here on, investors would be better off with a well-diversified portfolio – especially now, with the outlook for US equities being so uncertain.

Indeed, several asset managers have predicted that the US will be one of the worst-performing regional equity markets during the decade ahead.

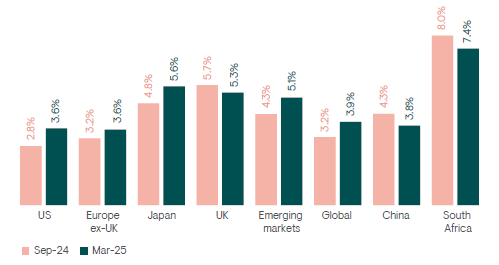

Ninety One, for example, expects US equities to return 3.6% per annum on average in dollar terms for the next 10 years. This puts the US on a par with Europe ex-UK (in local currency terms), although Ninety One expects the UK, Japan and emerging markets to each deliver more than 5% per annum.

Dan Morgan, a multi-asset analyst at Ninety One, said: “US equities in aggregate now score poorly in many estimates of long-term equity returns, both in an absolute and relative sense, and investors are anticipating a continuation of historically exceptional outperformance of earnings growth well into the future.”

Ninety One’s 10-year local currency return forecast

Source: Ninety One. The chart shows the firm’s forecasts made in September 2024 and March 2025 for returns over the next 10 years. The March forecasts were published last week and have been adjusted upwards due to US equity valuations having moderated.

Morgan agreed with May that investors should diversify their portfolios far more broadly than the weightings of global equity benchmarks.

“On a more strategic investment horizon, it would certainly seem prudent to lean against the concentration in both large-capitalisation growth stocks and the US market to sustain an adequate level of diversification in equity portfolios, rather than let exposure to both drift even higher,” he said.

“Market-cap weighted benchmarks cannot be said to be sufficiently geographically diversified with close to 70% in a single market, even when that market is the US, which offers unparalleled breadth and depth of investment opportunities in companies exposed across all areas of the domestic and global economies. Another simple alternative, GDP weights, fails to account for the global business models of the majority of large, listed companies.”

Instead, Morgan suggested using dividends as a starting point. “For an income-focused investor, a more relevant metric could be the proportion of dividends derived from the US market, which has been very steady at around 40% of global dividends historically and is only slightly higher than this today, even after more than 15 years of US equity outperformance,” he said. A 40% allocation to the US might therefore “make sense as a neutral starting point”.