Square Mile Investment Consulting & Research has swung the axe on its fund ratings, removing titles from four funds and downgrading three more portfolios in April.

Among those removed from its Academy of Funds entirely were a trio of UK equity funds: Unicorn UK Income; Unicorn UK Ethical Income; and SVM UK Opportunities.

On the former, analysts at the firm said they had made the “difficult decision” to remove the two Unicorn funds, which held an ‘A’ and ‘Responsible A’ rating respectively.

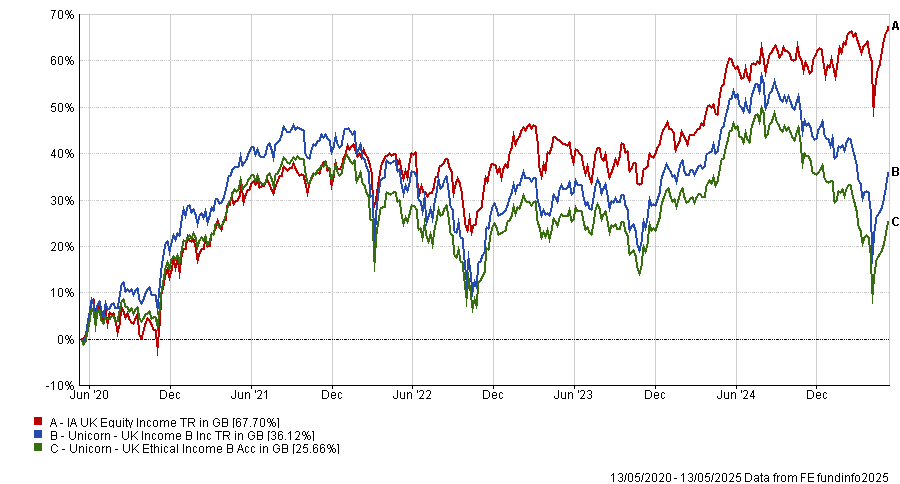

Both have sat in the bottom quartile of the IA UK Equity Income sector over the past one, three and five years. UK Ethical Income has been the worst performer in the sector over these time periods, while UK Income has been among the bottom five funds in each. The older UK Income fund is also the fourth-worst performer in the sector over the past decade.

Performance of funds vs sector and benchmark over 5yrs

Source: FE Analytics

“Whilst we acknowledge the tough environment for UK small- and mid-cap investors over recent years, the return profile of both funds has not been in line with expectations. Consequently, our conviction has waned to a level where we feel we can no longer support the funds’ inclusion,” the analysts said.

SVM UK Opportunities also lost its ‘A’ rating following a review of the UK equity sector. While long-tenured fund manager Neil Veitch has run the fund since 2006 and has made strong returns over the portfolio’s lifetime, recent performance has underwhelmed.

This decision “in part reflects the diminishing investor interest for UK actively managed equities over recent years,” the analysts said.

“In addition, whilst acknowledging the tough environment for UK equity strategies that invest across the market-cap spectrum, we have concerns over the fund's medium-term return profile within what is a competitive landscape.”

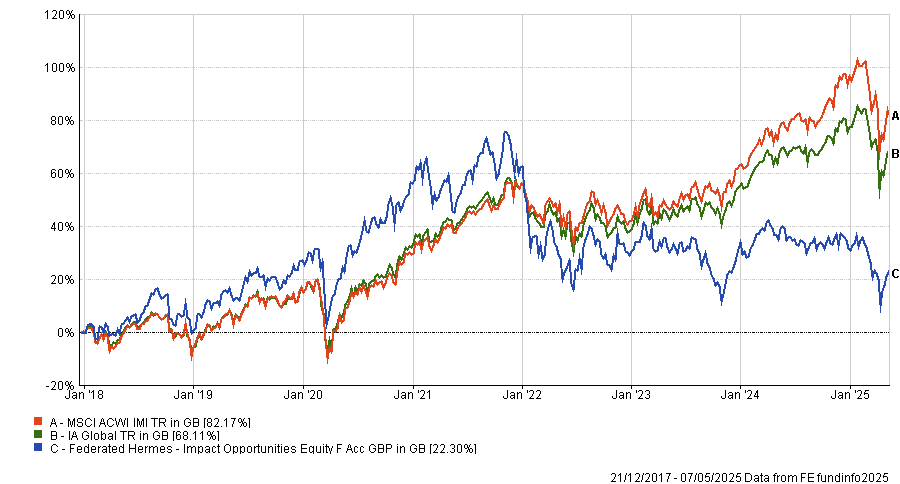

Elsewhere, Federated Hermes Impact Opportunities lost its ‘Responsible A’ rating following a period of underperformance. Indeed, the fund has sat in the bottom quartile of the IA Global sector over one, three and five years, making just 2.9% over the past half decade.

Since launch, it has gained 27.6% at a time when the average peer is up 74.2% and the MSCI ACWI benchmark has risen 89.7%, as the below chart shows.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

What’s more, analysts at Square Mile said there could be more pain to come for investors as the fund is facing “multiple headwinds due to its inherent impact biases”.

They said the fund has struggled to deliver the expected outcome the analysts were forecasting – beating the MSCI AC World IMI Index by 2-3 percentage points per year.

While it is “commendable” that the fund managers have remained true to their impact approach, “in an environment where positive investor sentiment and flows into the fund have dissipated, we do not see a catalyst that would provide renewed buoyancy to this proposition”, the analysts said.

Lastly, the Barings Emerging Market Debt Blended Total Return fund also had its ‘A’ rating removed after Ricardo Adrogué, head of global sovereign debt and currencies, announced he is to retire at the end of August 2025.

“Despite the resources within the firm's emerging markets debt team, we have always considered Adrogué as a key figure for the fund as head of the team, architect of the strategy and lead manager of the local currency element of the portfolio,” they said.

Square Mile also downgraded the Baillie Gifford Global Alpha Growth fund and Monks Investment Trust from ‘AA’ to ‘A’.

“The performance of the two strategies has seen challenges over recent years and the managers have made some adjustments to the process as a result. The analysts feel that these have not yet addressed the issue and believe that an A rating better reflects their current conviction in the funds,” the ratings agency said.

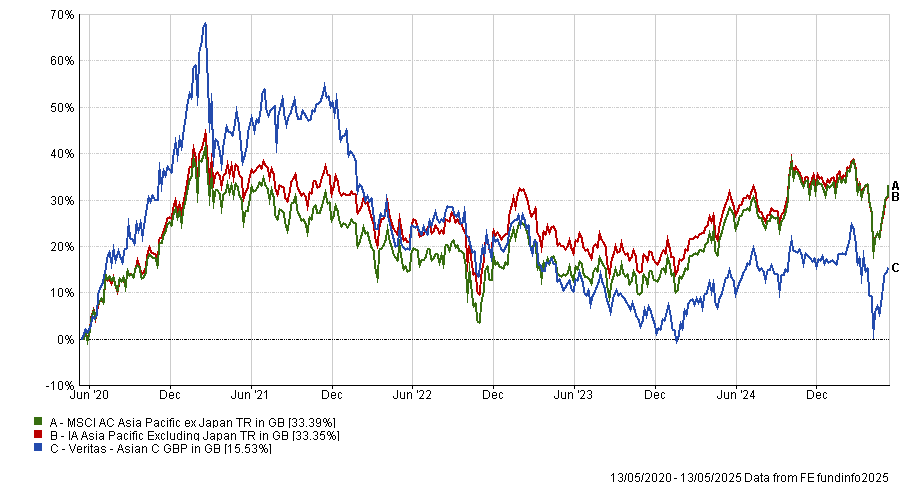

Meanwhile, the Veritas Asian fund was also downgraded to an ‘A’ rating after a “challenging period of performance” in recent years. The fund is in the bottom quartile of the IA Asia Pacific Excluding Japan sector over three and five years, although it remains in the top quartile since its launch in 2016.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

“Whilst we continue to believe it to be a differentiated and attractive strategy and acknowledge that the broader market environment has not been helpful, we feel an A rating is more reflective of our current level of conviction in the fund,” analysts said.

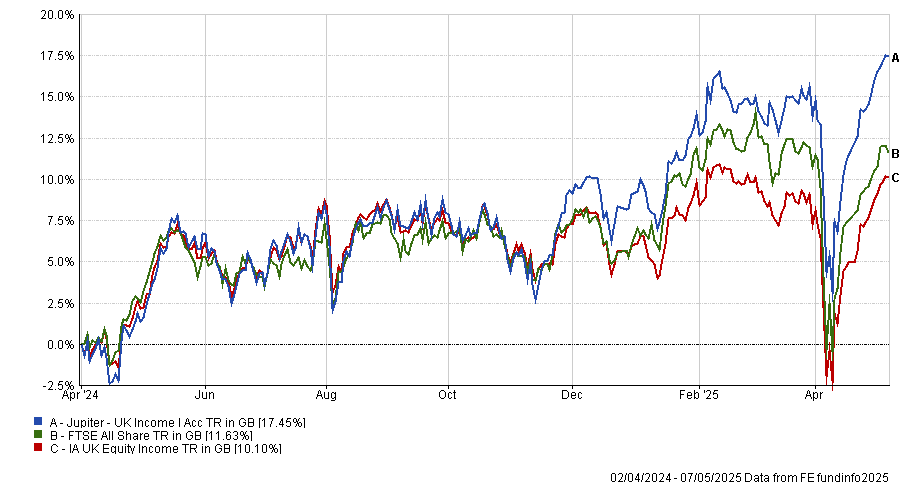

It was not all bad news however, with four funds given new ratings. Jupiter UK Income was one of two to be given an ‘A’ rating. Run by Adrian Gosden and Chris Morrison, who took over from Ben Whitmore in 2024, the new managers invest with the belief that dividends are an important driver of total equity returns over the long term.

“With this focus in mind, the investment approach has been designed to identify stable, cash-generative companies that can pay strong and progressive dividends,” the analysts said.

“We view this as a solid option for investors seeking exposure to a relatively high conviction portfolio of income-generating stocks, managed by a highly capable investment duo.”

Since the new management team took charge of the fund it has made the seventh-best return in the 68-strong IA UK Equity Income sector, up 18.4%.

Performance of fund vs sector and benchmark since manager start

Source: FE Analytics

Regnan Sustainable Water and Waste also received an ‘A’ rating. It invests in companies that tackle global water and waste environmental challenges, with the analysts noting it is a “compelling proposition driven by a durable thematic tailwind, a stable investment process and highly experienced fund managers”.

Lastly, the CT Universal multi-asset range, including the Defensive, Cautious, Balanced, Growth and Adventurous funds, were all given a ‘Recommended’ rating based on the “breadth” of the Columbia Threadneedle team.

It “represents a robust range for clients seeking low-cost, actively managed multi-asset funds with a bias toward UK equities,” they said.

Abrdn Asia Pacific ex Japan Equity Tracker also garnered a ‘Recommended’ rating. The fund is managed by Aberdeen’s Quantitative Index Solutions team.

“Although smaller than some of its peers, the team has significant experience in running index strategies and we believe they have the necessary resources to achieve good tracking outcomes, as demonstrated historically. Additionally, the fund is competitively priced, offering good value for money to investors looking to invest in the region,” they said.