The UK has been an unfavourable area to invest in for years but there are signs that things are turning around, with the domestic market holding up better than global peers so far in 2025.

While this recovery is nascent—and economic momentum remains uncertain—Anthony Lynch, manager of the £417m JPMorgan Claverhouse investment trust, sees reasons for optimism.

“With interest rates gradually easing and economic activity already at depressed levels, we are confident that, in time, companies will see better opportunities for growth,” he said.

“As a result, we are finding many compelling valuation opportunities, allowing us to invest in high-quality businesses at historically attractive earnings multiples and dividend yields.”

Although there remains a question mark over the catalyst for investors’ attention returning to the UK, he suggested the combination of potential earnings recovery alongside valuation re-rating bodes well for expected returns in the coming years.

Below, Lynch – who joined JPM Claverhouse in 2024 with Katen Patel to run it alongside longtime co-manager Callum Abbot – outlines three unheralded stocks currently outside the trust’s top 10 holdings he is particularly “optimistic” about.

Galliford Try

Construction contractor Galliford Try is the first name on the list. “It is benefiting from a number of tailwinds, including increased spending by water companies as they seek to improve their infrastructure and better contract execution which has driven significant improvements to margins,” said Lynch.

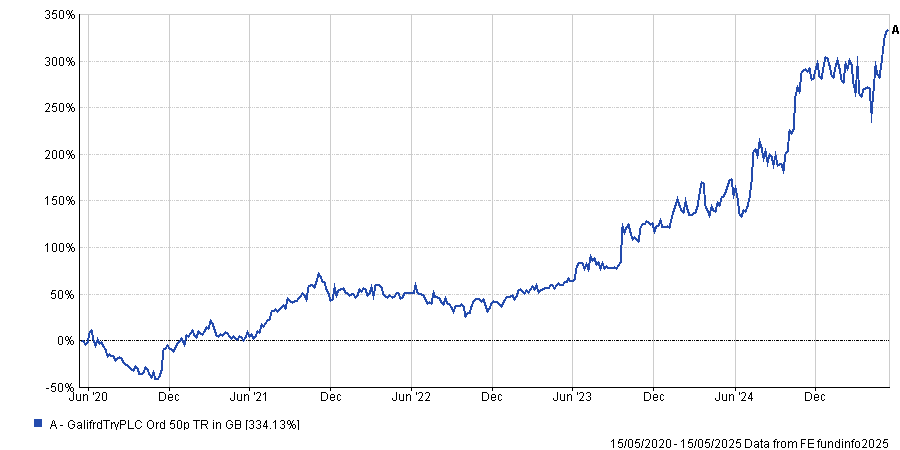

The share price performance has been strong for the company, up 8.4% year to date, and it has more than tripled over the past five years. With dividends taken into account, investors have made a total return of 334.1% over half a decade, as the below chart shows.

Total return of stock over 5yrs

Source: FE Analytics

But there are reasons to believe there is more to go, said Lynch. “With around 60% of the market cap in net cash and saleable investments, we believe that the market significantly undervalues their prospects.”

The manager is not alone in his recommendation. At the end of April, Edward Prest, analyst at Berenberg Bank, suggested the stock had 13.8% upside with a target price of 470p, according to data from Tipranks – an online tool that collates analyst recommendations.

XPS Pensions

Up next is pensions consultant XPS Pensions, which Lynch believes is “well positioned” to benefit from regulatory changes necessitating increased demand for advice from pension schemes.

“XPS is also benefitting from a changing competitive landscape, with scheme trustees now required to retender for services more regularly, which has favoured medium-sized challengers such as XPS, over the large incumbents,” he said.

“This has already begun to manifest in earnings delivery consistently ahead of the market’s expectations, alongside several hikes in the dividend.”

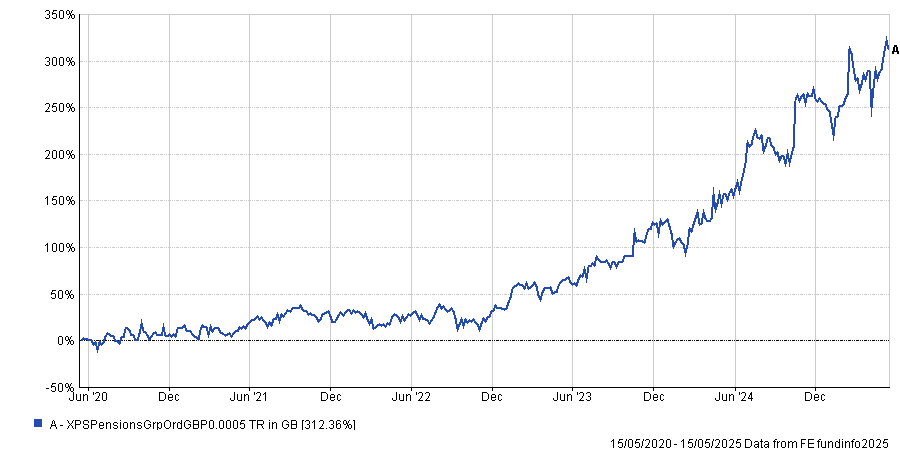

Total return of stock over 5yrs

Source: FE Analytics

Like Galliford Try, the share price has been strong, up 58.1% over the past year and more than tripling over five years, with a total return of 312.4% in the past half a decade.

Again, Lynch is not alone, with five analysts rating the fund suggesting an average target price of 461.25p, 14.8% higher than its current level, according to Tipranks. The highest estimates suggest a target price of 485p, while the lowest is 435p. Four of the analysts have a ‘Buy’ recommendation, while one suggests investors ‘Hold’ the stock.

Intermediate Capital Group

Last but not least is Intermediate Capital Group, the alternative asset manager focused on private markets, which Lynch said has a “very strong track record” for fundraising.

The company has become a bit of a specialist at attracting investors to recently seeded strategies and has successfully scaled up follow-up portfolios of well-established strategies.

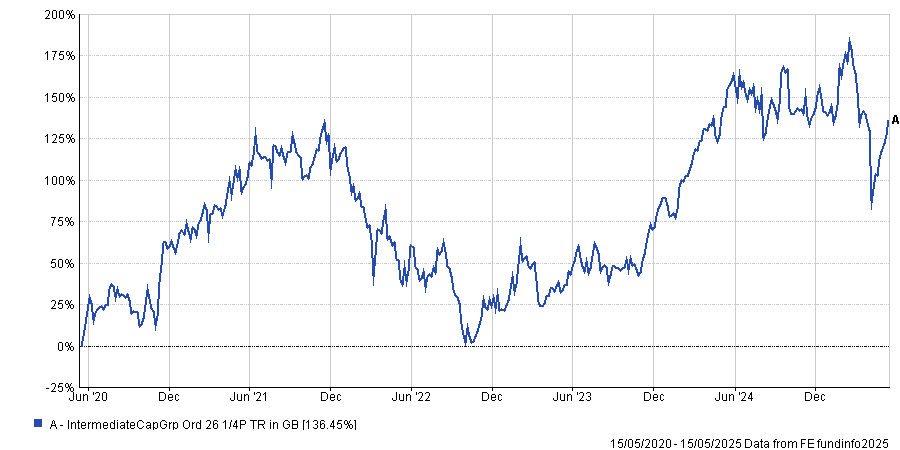

Unlike others on this list, the share price has dropped 9.5% over the past year, although it has almost doubled in value over the past half a decade. From a total-return perspective, the company has made investors 136.5% over five years, as the below chart shows.

Total return of stock over 5yrs

Source: FE Analytics

“With the fundraising now more broadly spread across a greater range of strategies, we are confident that this momentum can be maintained, as evidenced by its continued strong performance in the more difficult fundraising environment seen since 2022,” said Lynch.

“We believe that the market underappreciates the duration of its management fees, with investors committing capital on a multi-year basis, and we see the potential for significant operating leverage, which feeds through to attractive levels of dividend growth.”

This is the most heavily backed stock of the three among analysts, Tipranks data suggests. There are 11 ‘Buy’ recommendations on the stock including experts from JP Morgan, Citi, Deutsche Bank and Goldman Sachs.

Looking at those that have updated their guidance in the past three months, on average five analysts have a target price of £23.70, around 14.6% higher than the current price, although the upside ranges from 3.7% to 26.2%.