Multi-asset funds often attempt to be ‘one-stop-shops’ for investors, holding a variety of alternative assets such as gold, infrastructure, cash or derivatives.

But funds that claim to be the “only thing you need to own” are often far too complex for their own good, according to Jacob De Tusch-Lec and Jack Holmes, managers of Artemis Monthly Distribution fund.

“The reality is that a lot of these complex multi-asset funds get in their own way,” Holmes said. “They tend to do things that unexpectedly double up on each other, or even directly offset each other.”

De Tusch-Lec added that when a multi-asset fund starts using alternatives, both investors and managers can get confused and misunderstand exactly what they are holding.

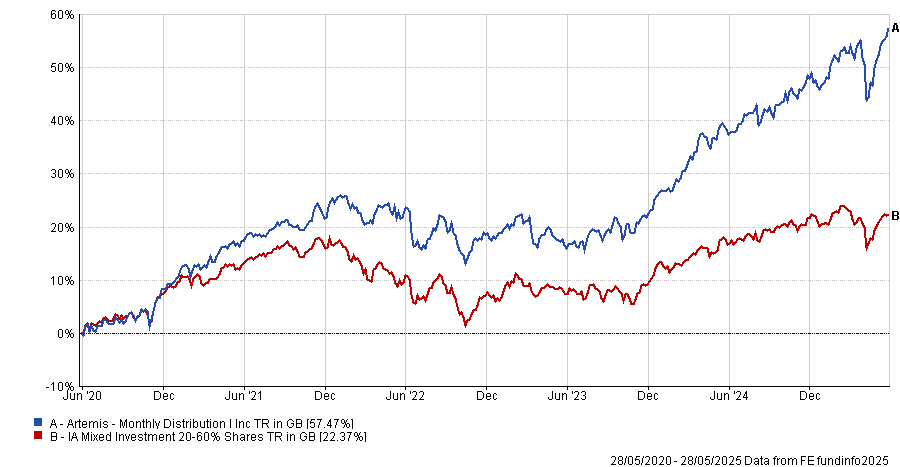

By contrast, Holmes and De Tusch-Lec described their approach of combining equity positions from the Artemis Global Income and bonds from the Artemis High Income fund as “relatively straightforward”, claiming it has been key in making Monthly Distribution the top performer in the IA Mixed Investment 20-65% sector over the past one, three and five years, and the second best over 10 years.

Performance of the fund vs the sector and benchmark over 5yrs

Source: FE Analytics

Below, the managers explain how simplicity guides asset allocation, why investors have developed a distorted view of the world, and why their biggest recent mistake was not sticking harder to their convictions.

What is your investment process?

De Tusch-Lec: The fund tries to find good value and good income and combine them into a single, relatively straightforward solution.

Holmes: Ultimately, what we’re trying to do is take our independent income funds and get the best of both worlds from them. For example, we’re both trying to produce a high level of income, but I could do that alone, what I can’t do is grow that income like Jacob can.

Why is simplicity so important?

It allows us to move quickly. In fixed income, I might buy a bond that’s trading at relative discount of 100 basis points, and it could close that gap in a month, so you need to find something new. Simplicity helps with that.

At other firms running multi-asset strategies, the funds can be so complex you need to explain your asset allocation in very generic terms to someone who does not understand the asset class. That’s not really a great way of approaching asset allocation, but it’s a great way of having arguments.

De Tusch-Lec: People are often surprised by how static our asset allocation is, but because the fund is simple, we can make a lot of changes under the bonnet that don’t appear in the asset allocation.

We could have 50% in equities at two different points, but it’s going to be massively different if we own a high-beta bank at one point or a high-risk equity at another.

What’s your view on global markets?

On the equity side, the period after the financial crisis including the pandemic was an exception that investors have taken as the new normal. I don’t think we’ll ever be going back to a period of 0% rates or quantitative easing.

This ‘regime change’ means that different types of assets will perform well. For example, we like companies benefitting from government spending, such as defence companies, and we’ve been underweighting our exposure to tech.

Within our respective universes, everything is now in flux, and so investors can’t assume ‘rules of thumb’ about asset classes that worked for the past 10-15 years will continue.

Holmes: On the bond side, the fundamental issue is with governments. For the first time in 70 years, consumers and corporates look healthy, but government debt doesn’t.

The natural thing a competitor might do in a multi-asset fund is own a lot of long-duration assets to hedge the equity exposure. We are not really doing that because that’s not a great hedge anymore in this new regime.

What were your best and worst calls in the past year?

Holmes: On the fixed income side, the worst call was probably hanging onto inflation-linked bonds. I thought longer-term inflation would have been more of a concern, but it’s just not played out like that.

The best thing was owning a lot of short-dated high-yield bonds. In hindsight, I should have just committed to my convictions harder and owned more of them.

De Tusch-Lec: On the equity side, our best call was buying defence and our worst call was not owning enough of It. Defence has been a main driver of returns for years, but in this fund we did not own as much. Defence companies have done much better than expected.

In a world in flux, you should be willing put a decent amount of capital behind your ideas and commit to them, perhaps more than you otherwise would.

What are your hobbies?

De Tusch-Lec: I have three kids and if I need to hide from them, I play online chess.

Holmes: I read a lot, both non-fiction and some more nonsensical stuff.