Despite emerging markets having a reputation as an attractive market for stockpickers, active funds have not been the best way to invest since 2020. In fact, most active funds would have underperformed a tracker and not a single active fund would have outperformed the small-cap part of the market, according to Trustnet research.

Emerging markets can be a challenging place to make money. Despite being referred to under the same umbrella, the trends that drive a market such as China can be significantly different to those in Latin America or India. This has made investing in the region complicated.

Add in the fact that investors have managed to make strong returns in the US and global markets, many investors have not needed to look toward the region.

However, interest seems to be rising, with asset managers such as St James’s Place stating that investors should consider rotating into the region. For those struggling to decide where to start, knowing what has performed well in the past could be helpful.

This is part of an ongoing series where Trustnet examines different markets based on market capitalisation and investment style, as well as looking at the difference between active and passive funds, to determine what has been the best way to invest since 2020.

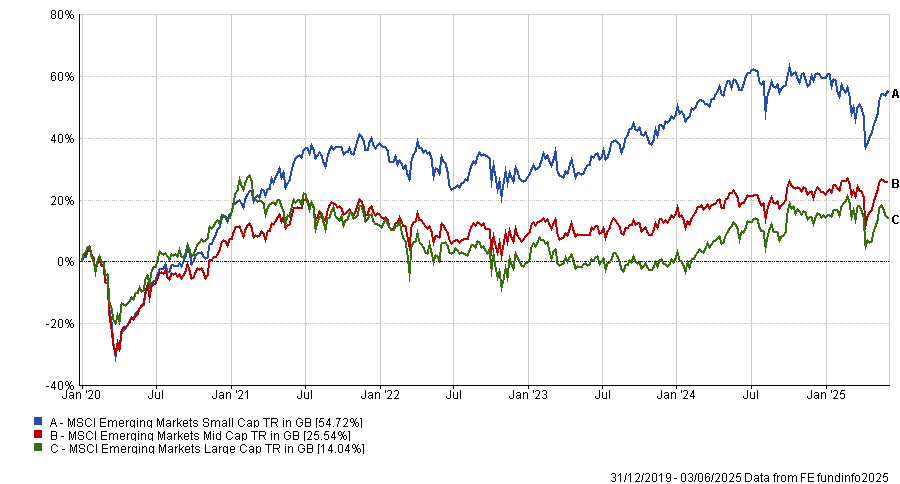

To begin with, we consider market capitalisation. Since 2020, the MSCI Emerging Markets Small Cap index trounced the MSCI Emerging Markets Mid and Large Cap indices, delivering almost double the returns, as demonstrated by the chart below.

Performance of indices since 2020

Source: FE Analytics

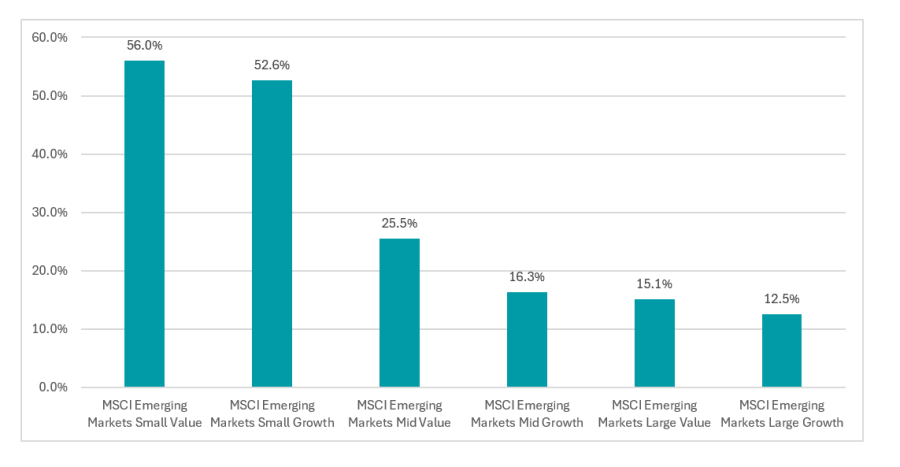

This trend continues when we examine investment styles. The MSCI Emerging Market small-cap value and growth indices have surged by 56% and 52.3% over this period, beating the next closest index by more than 25 percentage points.

While value outperformed growth across the market cap spectrum, the dominance of the small-cap indices suggests that market capitalisation mattered more than investment style on performance during this period.

Performance of indices since 2020

Source: FE Analytics

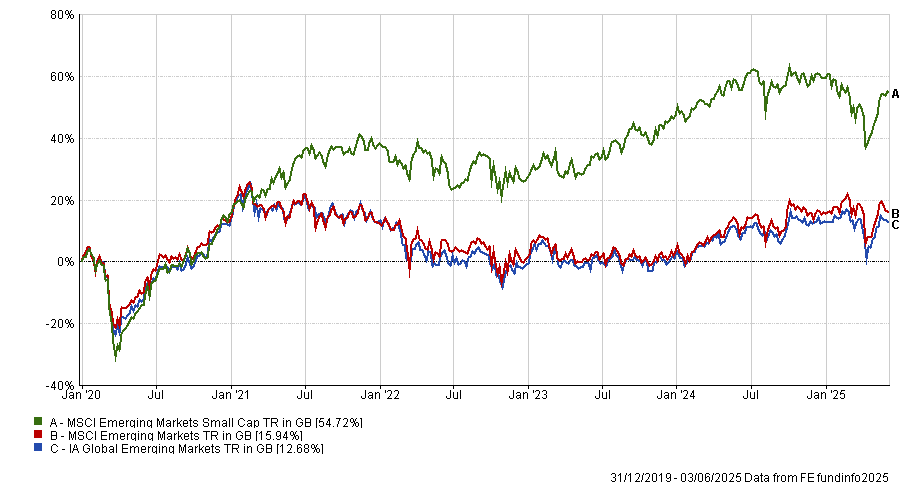

Turning to the age-old active versus passive debate, with small-caps performing best some might suggest active managers should win in this arena, as smaller stocks tend to be less well researched and therefore a happier hunting ground for those doing their own research.

Yet most active funds failed to beat the most common benchmark in the sector – the MSCI Emerging Markets.

When compared to the small-cap index, the results are even worse, with the average fund underperforming by almost 42 percentage points. In the 139-strong sector, not a single active fund delivered a better result than the small-cap index, with the top fund in the peer group up 53.1%, lagging by just over a percentage point.

Performance of sector vs index since 2020

Source: FE Analytics

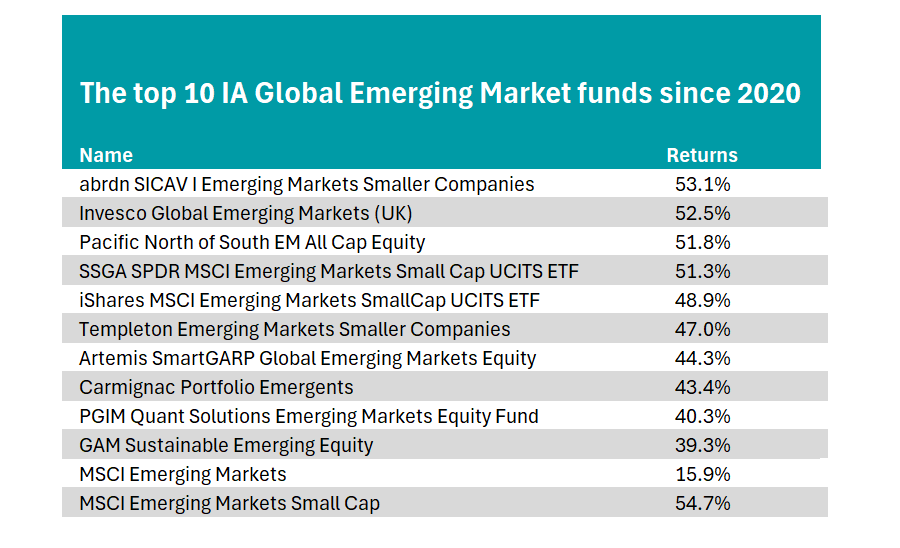

Indeed, two of the best performing emerging market funds during this period tracked the small-cap index. The SSGA SPDR MSCI Emerging Markets Small Cap UCITS ETF is up 51.3% over this period, making it the fourth best-performing strategy in the sector overall. It is followed by the iShares Emerging Market Small Cap UCITS ETF, which trails just behind with a performance of 48.9%.

However, while an active fund could not outperform the small-cap index, 63 funds in the peer group had a better return than the all-cap index. The chart below shows the 10 best-performing emerging funds in this period, which included eight active strategies.

Source: FE Analytics

Top of the chart is the Aberdeen SICAV Emerging Markets Smaller Companies fund, which aims to outperform the MSCI Emerging Markets Small Cap Index using an environmental, social and governance (ESG) approach. While it has not achieved this over the period, it has climbed by 53.1%, the best return in the sector.

Following just 20 basis points behind is the Invesco Global Emerging Markets fund managed by FE fundinfo Alpha Manager William Lam, who works alongside co-managers Ian Hargreaves, Charles Bond and Matthew Pigott. Its top 10 includes some of the biggest names in the emerging market index, such as TSMC, Alibaba and Tencent, which have all performed well.

Indeed, analysts at FE Investments said recent outperformance was due to “favourable stock selection” and a bottom-up focus since 2020, with very few underperforming holdings.

The Templeton Emerging Markets Smaller Companies fund also qualified, surging 47% since 2020, the sixth-best result in the sector. Managed by Alpha Manager Vika Chiranewal and Chetan Sehgal, it aims to invest primarily in companies with a market capitalisation of less than $2bn.

The other funds in the top 10 include: Pacific North of South EM All Cap Equity, Artemis SmartGARP Global Emerging Markets Equity, Carmignac Portfolio Emergents, PGIM Quant Solutions Emerging Markets and GAM Sustainable Emerging Markets.

Previously in this series, we have looked at the UK, European, global and US markets.